The 2024 National Productivity Report by Malta’s National Productivity Board (NPB) focuses on the ‘twin transition’, the simultaneous advancement of green and digital transformations, as a strategic pathway to enhance productivity, sustainability, and resilience in Malta’s economy.

Productivity is a crucial driver of economic growth, impacting both labour efficiency and capital utilisation.

Malta’s productivity has shown stable trends in recent years. In 2023, real labour productivity per person was 109.8, slightly up from 109.5 in 2022, and higher than the EU27 and Euro Area averages. Similarly, labour productivity per hour worked remained strong at 109.0, surpassing the EU27 and Euro Area figures. However, Malta’s unit labour costs (ULC) increased to 101.3 in 2023, reflecting post-pandemic wage pressures, though still below the EU27 and Euro Area averages.

In terms of capital investment, Malta’s Gross Fixed Capital Formation (GFCF) peaked at 134.2 in 2022 but dropped to 111.2 in 2023, indicating a slowdown in investment growth. Despite this decline, Malta’s investment performance remains above the EU27 average.

The country’s investment intensity as a percentage of GDP was 19 per cent in 2023, a decrease from 24.2 per cent in 2022, and below the EU average of 22 per cent. This suggests that while Malta has seen high investment growth, it allocates a lower proportion of GDP to fixed capital compared to its EU counterparts.

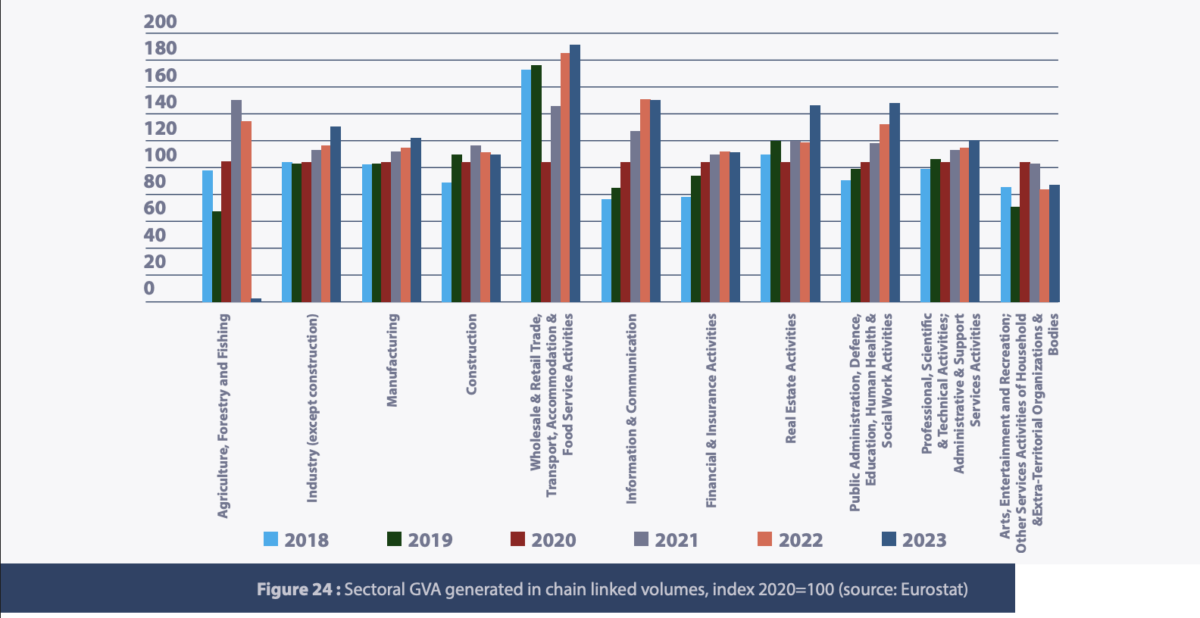

The report also shows that Malta’s economy has diversified over the years, transitioning towards a service-based economy, though sectoral disparities persist. While sectors like ICT, financial services, and professional services have flourished, traditional sectors such as manufacturing, agriculture, and construction face productivity challenges.

ICT and professional services, notably in fintech and iGaming, have driven significant growth, with ICT’s GVA share rising from 6.9 per cent in 2018 to 10.4 per cent in 2023. Meanwhile, manufacturing and construction have seen slowdowns, with agriculture struggling with structural issues, including high production costs and limited land.

Despite strong recovery post-pandemic in sectors like tourism, wholesale, retail, and accommodation, agriculture’s contribution has diminished significantly. Public administration, education, and health services, though important, have also seen reduced relative significance. The private sector, particularly in knowledge-based industries, is becoming a larger driver of economic growth.

On the other hand, sectoral productivity shows significant variation. The industry and manufacturing sectors have improved productivity, while construction has seen a decline. ICT, with its digital transformation, has notably increased labour productivity per hour.

In capital productivity, sectors like financial and insurance activities and information and communication have shown high returns on capital investments, reflecting technological advancements.

In contrast, sectors like construction and agriculture demonstrate mixed results, with capital investments not always translating to higher productivity. This suggests that while capital plays a role, labour efficiency, technology adoption, and structural factors are equally crucial for boosting productivity.

Productivity challenges and obstacles

The report highlights some of the primary drivers and obstacles to productivity in Malta, as outlined in recent policy initiatives and strategic plans.

Human capital and skills gap

Malta faces a skills gap, particularly in digital and high-skill service sectors. Addressing this gap involves enhancing technical education and attracting skilled expatriates, with initiatives like AI training and STEM development playing a central role in bridging the divide.

Technological adoption and innovation

Malta’s “Vision 2030” strategy focuses on digital transformation and innovation to boost productivity. National research and development strategies, aligned with EU programs like Horizon Europe, emphasise technological adoption across sectors.

Infrastructure and investment

Investments in digital and physical infrastructure, including green energy projects and improved internet connectivity, are key drivers of productivity. Ongoing investments in sustainable energy and transport are essential, particularly given Malta’s vulnerability to external economic shocks.

Regulatory environment and business climate

Malta’s regulatory framework has become more business-friendly, with incentives for sustainable investments and streamlined processes to attract foreign investment. Reducing administrative burdens, especially for SMEs, helps foster productivity and investment.

The 2024 National Productivity Report highlights the importance of Malta’s ‘twin transition’ towards green and digital transformations to boost productivity and address existing economic challenges. While sectors like ICT and financial services have flourished, traditional industries face ongoing structural issues that hinder growth.

By investing in human capital, technological innovation, and infrastructure, Malta can enhance productivity and resilience, positioning itself for sustainable future growth.

Andaria first EMI in Malta to secure principal membership with three major card schemes

CEO Kurt Azzopardi describes this as a milestone that elevates the entire FinTech ecosystem

US exits global tax deal targeting large multinational profits

US withdraws from OECD agreement on a 15% global minimum tax rate on large multinationals

Late payment interest rate in commercial transactions stays level

The 10.15% interest rate was first announced in July 2025