The EU has managed to delay a looming 50 per cent tariff on all goods by the US, surging stock futures for the bloc and leaving the US dollar waning under pressure due to a lack of investor confidence in US assets.

This comes after US President Donald Trump announced that he has agreed to delay the implementation of a 50 per cent tariffs on EU imports to 9th July instead of 1st June, pushing the euro into a one-month high.

The announcement also sparked a surge in US stock futures and major stock benchmarks in Europe are predicted to open higher on Monday (today).

According to futures pricing, the Euro Stoxx 600 jumped 1.54 per cent, and the DAX surged 1.35 per cent as of 3:30 am CEST.

Trump had originally announced 20 per cent “reciprocal tariffs” on the EU on 2nd April before reducing them to 10 per cent for 90 days. However, he then threatened to impose a 50 per cent tariff from 1st June, citing a lack of progress in negotiations due to disagreements among EU member states.

According to the bloc’s trade chief, Maroš Šefčovič, the EU submitted a revised trade proposal to the US last week.

In a social media post on Friday, Trump criticised the EU’s non-tariff barriers, including VAT regimes, “ridiculous corporate penalties,” non-monetary trade restrictions, and “unjustified lawsuits against American companies,” which he claimed contributed to an annual trade deficit of over $250 billion (€219 billion). “Our discussions with them are going nowhere!” he wrote, justifying his move to raise import levies.

It seems negotiations are moving, with Trump following up on Sunday saying “I agreed to the extension – 9th July, 2025 – It was my privilege to do so.”

If an agreement isn’t reached by the new deadline and the tariff is imposed, the increase would dramatically raise Washington’s current tariff baseline levy of 10 per cent to 50 per cent, and fuel simmering tensions between two of the world’s economic heavyweights.

The latest threat of a June hike sent stock markets into a tailspin on Friday, amid fears of renewed global economic disruption, with the US dollar also falling in value.

Image: Unsplash

Malta’s olive oil cooperative predicts good harvest, but future remains bleak

Malta's olive oil farmers face a number of financial and environmental hurdles

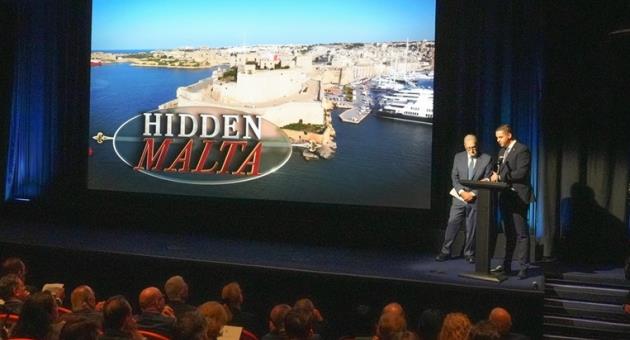

Award-winning travel host Peter Greenberg’s Hidden Malta premieres in US

The event was one of three major developments unveiled to boost tourism from the region

5,000 sacks of flour from Malta are currently feeding Gaza

Another batch of 5,000 sacks of flour is being prepared to send to Gaza