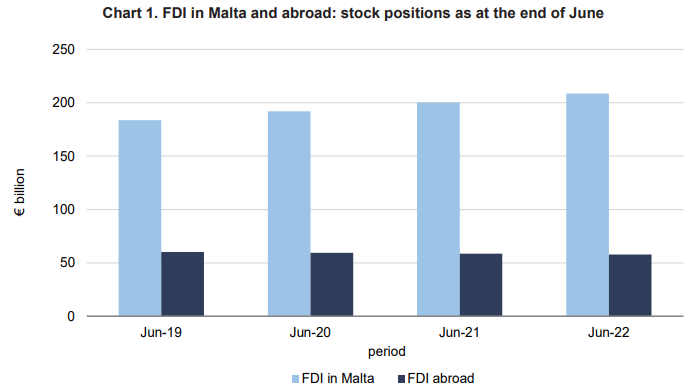

Foreign Direct Investment (FDI) flows in Malta increased by two billion euros during the first half of 2022 as the overall stock position increased to €208.6 billion, according to data released by the National Statistics Office.

The main contributors to this increase in total FDI flows were financial and insurance activities, with a total contribution of 97.6 per cent.

In June 2022, the stock position of FDI amounted to €8.3 billion more than the corresponding period a year earlier.

In terms of direct investment abroad (referring to investments made by Maltese investors in foreign economies), the stock position stood at €57.8 billion in June 2022, down by €0.748 billion compared to June 2021.

Financial and insurance activities made up 98.9 per cent of total FDI abroad, as flows totalled €3.2 billion, mainly in the form of claims by direct investors.

According to the OECD, FDI has continued its upward trend that started in 2021 after a significant low in 2020.

Malta, along with the rest of the European Union, is expected to avoid a recession, with inflation expected to continue declining to 5.6 per cent and 2.5 per cent in the Eurozone in 2023 and 2024 respectively, there are signs of a challenging but positive economic outlook.

MFSA concludes review of Crypto-Asset Service Providers following MiCA implementation

The Authority provided clear expectations and guidance to address certain concerns.

Malta Development Bank to launch schemes supporting sustainable development and creative sector

In 2024, the MDB launched the SME Guarantee Scheme and the Guaranteed Co-Lending Scheme

Euro surges as Trump slaps 20% tariff on Europe, EU vows to retaliate

The sweeping reciprocal tariffs has sparked fears of an all-out global trade war