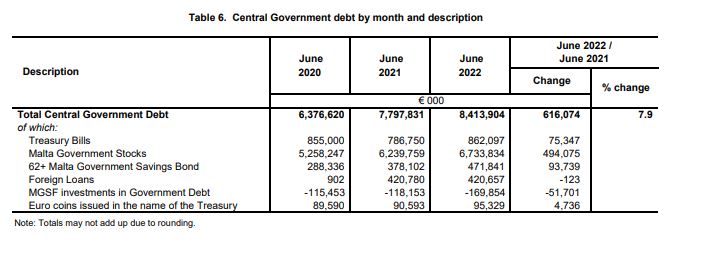

At the end of June 2022, Central Government debt stood at €8,413.9 million, a €616.1 million rise from the same period in 2021, according to the National Statistics Office

The main driver of debt was reported under Malta Government Stocks, at €491.1 million, and the 62+ Malta Government Savings Bond at €93.7 million. As Government’s need for cash ballooned in the first six months of the year, for instance due to cushioning the global increase in energy prices to keep them stable domestically, it is not uncommon for the state to issue stocks and bonds to the public as a form of financing.

In addition, the state is coming off two years of providing widespread COVID relief in the form of wage supplements and other pandemic related measures.

Higher debt was also recorded under Treasury Bills (€75.3 million) and Euro coins issued in the name of the Treasury (€4.7 million). This increase in debt was partially offset by a decrease in Foreign Loans (€0.1 million). Finally, higher holdings by government funds in Malta Government Stocks resulted in a decrease in debt of €51.7 million

Government Deficit

As for the deficit, by the end of June 2022, Government registered a drop in the state’s consolidated fund deficit to reach €462.6 million. During the same period last year, the deficit was recorded at €823.6 million.

Recurrent Revenue was 17.2 per cent higher than in the first half of 2021, when the vaccine was being rolled out and restrictive measures – meaning sections of the economy being closed – remained in effect.

Recurrent revenue for the first half of 2022 amounted to €2.6 billion, with the largest increase recorded under income tax at €142.6 million. This chimes with the easing of restrictions and the return to work of all economic sectors.

The next biggest increase in revenue was recorded under VAT at €125.3 million, social security at €59.8 million, grants at €51.9 million, licences, taxes and fines at €9.8 million, rents at €2.9 million, reimbursements at €2.5 million, Central Bank of Malta at €2.2 million and Dividends on Investment at €1.1 million. The rise in revenue was partially offset by decreases under ‘Fees of Office’ at €18.2 million, miscellaneous receipts at €1.8 million and customs and excise duties at €1 million.

By the end of June 2022, total expenditure stood at €3,028.8 million, 0.5 per cent higher than the previous year. During the reference period, recurrent expenditure totalled €2.7 billion, an increase of €18.4 million in comparison the first six months of 2021.

The main contributor to this increase was a €43.3 million increase reported under Programmes and Initiatives. Furthermore, an increase was also witnessed under Personal Emoluments at €6.4 million.

This rise in expenditure outweighed decreases under operational and maintenance expenses at €16.7 million and contributions to Government entities at €14.6 million. The main developments in the Programmes and Initiatives category involved added outlays towards Economic stimulus payments worth €48.1 million, social security benefits at €30.7 million, tax relief measures at €25.8 million, Extension of school transport network at €7.5 million, Residential care in private homes at €7.3 million, Gas stabilisation fund at €7.1 million, Carer allowances at €5.7 million and Electoral commission activities at €5.4 million. This rise in programmes and initiatives was partly offset by a decrease under the Pandemic assistance schemes by 91.4 million.

MFSA concludes review of Crypto-Asset Service Providers following MiCA implementation

The Authority provided clear expectations and guidance to address certain concerns.

Malta Development Bank to launch schemes supporting sustainable development and creative sector

In 2024, the MDB launched the SME Guarantee Scheme and the Guaranteed Co-Lending Scheme

Euro surges as Trump slaps 20% tariff on Europe, EU vows to retaliate

The sweeping reciprocal tariffs has sparked fears of an all-out global trade war