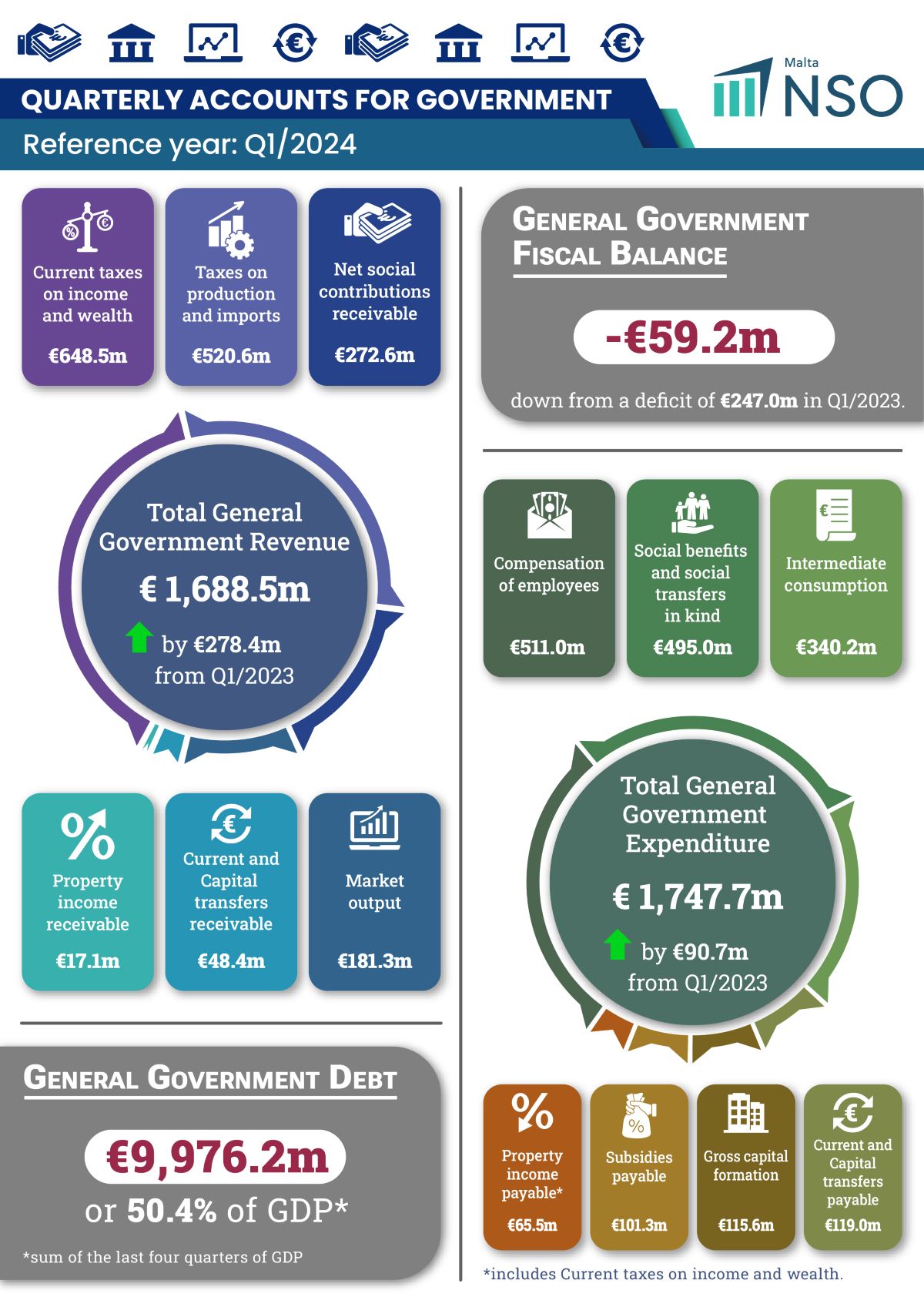

The national debt continues to edge towards the €10 billion mark after the Government posted its accounts for the first quarter of 2024, where it registered a deficit of €59.2 million.

During the period January to March 2024, total revenue stood at €1,688.5 million, an increase of €278.4 million when compared to the corresponding quarter in 2023.

This was mainly brought about by increases in current taxes on income and wealth (€151.6 million), taxes on production and imports (€71.3 million) and market output (€39.6 million), partially offset by decreases in capital transfers receivable (€14.6 million).

Total expenditure in the first quarter of 2024 amounted to €1,747.7 million, an increase of €90.7 million over the corresponding quarter in 2023.

The largest increase was recorded in social benefits and social transfers in kind (€52.9 million), followed by compensation of employees (€30.9 million) and property income payable (€18.4 million).

Adjustments were implemented to the Government’s Consolidated Fund data to transition to accrual-based accounting, aligning with the requirements of ESA 2010.

During the first quarter of 2024, these adjustments resulted in a decrease of €100.8 million to the Consolidated Fund surplus, which stood at €41.6 million.

In relation to financial transactions in assets, during the first quarter of 2024, increases were recorded in equity and investment fund shares (€173.2 million) and short-term debt securities (€10 million).

Conversely, currency and deposits and other accounts receivable decreased by €129.4 million and €79.1 million, respectively.

Considering the financial transactions in liabilities, the highest increase was recorded in long-term debt securities (€345.0 million). In contrast, decreases were registered in other accounts payable (€178.9 million), short-term debt securities (€122.3 million) and currency and deposits (€22.0 million).

At the end of March, general government debt stood at €9,976.2 million, or 50.4 per cent of GDP.

This equates to an increase of €726.3 million over the corresponding quarter in 2023, largely reflected in Central Government Debt, which amounted to €9,974.3 million.

Currency and deposits stood at €432.8 million, a decrease of €39.7 million over March of 2023.

This includes euro coins issued in the name of the Treasury, considered a liability of Central Government, and the 62+ Malta Government Savings Bond, the latter amounting to €329.9 million.

Long-term debt securities increased by €955.6 million, while short-term debt securities decreased by €271.2 million, respectively. In addition, long-term loans increased by €81.3 million. Local Government debt stood at €1.9 million.

General Government guaranteed debt amounted to €1,069.7 million at the end of March 2024, equivalent to 5.4 per cent of GDP1. There was a decrease of €89.0 million when compared to the first quarter of 2023.

Malta’s inflation edges up to 2.7% in October as food and services lead price pressures

The October RPI reading indicates some re-acceleration in consumer-facing sectors after a period of summer stabilisation

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion

Celebrating success: stories from the team behind Finco Trust

The stories of Lee-Anne Abela, Kris Vella, and Maria Mamo reflect the values that continue to guide the firm forward