The International Monetary Fund (IMF) has released an assessment on Malta’s economy which focused on the effects of the Russian invasion of Ukraine and the subsidy of energy prices among other issues.

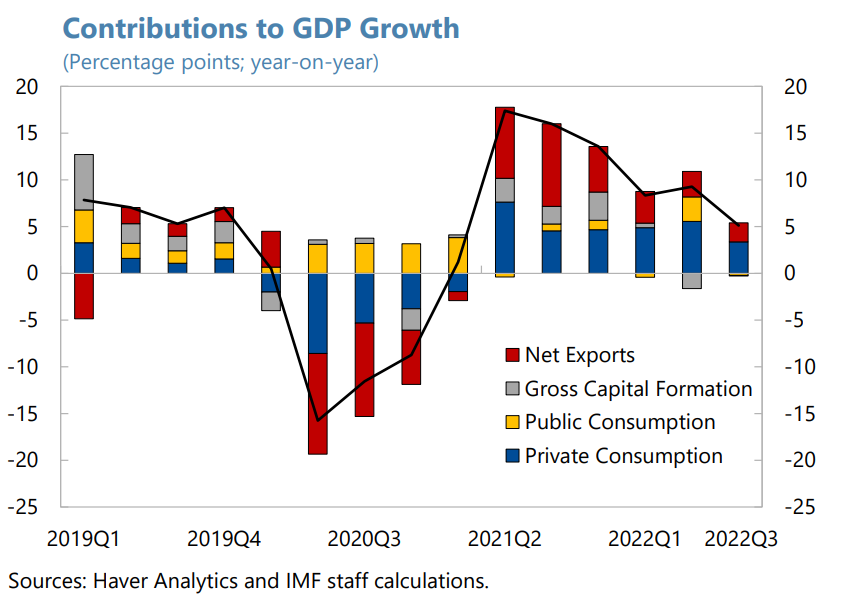

The IMF said that Malta’s economy recovered strongly after the worst economic decline ever as a result of the COVID-19 pandemic. They noted that economic growth picked up and inflation remained among the lowest in the eurozone, in large part due to the Government freezing energy prices.

Economic growth is expected to slow down to 3.25 per cent in 2023 due to weaker consumer purchasing power leading to a reduction in demand for goods. Inflation is expected to drop to 3.25 per cent by the end of 2023.

Malta is also expected to avoid both a recession and a deep slowdown in economic growth due to a strong rebound in tourism and the fast-growing, recession-resilient igaming sector.

Assessment of the energy-subsidy policy and possible ways forward

Malta’s energy sector was described as ‘unique’ within the European context by the IMF.

This is due to the energy sector not being fully liberalised, with Enemed and Enemalta being the sole petroleum product and electricity companies in the country. This allowed the country to enact rapid direct intervention in the market as the war erupted.

Since 2014, only gasoline and diesel prices have fluctuated, otherwise energy prices were kept stable, even during the energy crisis triggered by the Russian invasion of Ukraine.

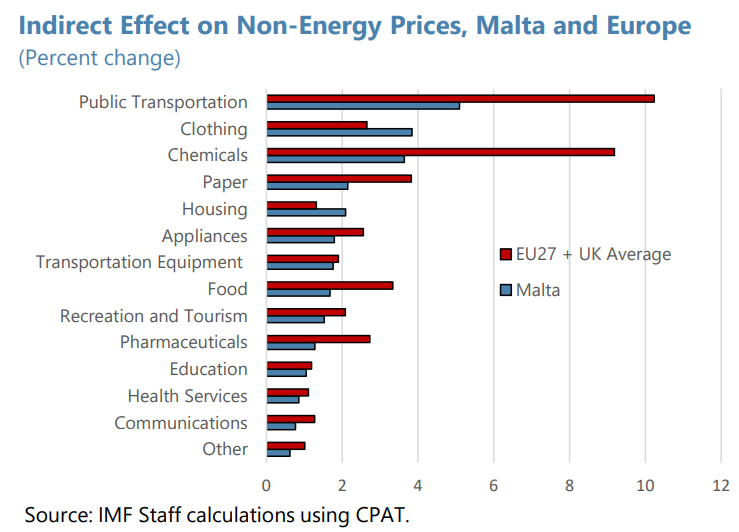

The IMF noted that the energy crisis threatened the country’s post-pandemic recovery, however, Malta’s decision to freeze energy prices kept inflation well below the EU average.

Freezing energy prices also resulted in higher consumer confidence, better real wages and stronger economic activity, according to the IMF.

However, the IMF cautioned that energy subsidies were expected to add up to 3.5 per cent of national GDP in 2023, mainly driven by the energy-intensive industrial sector.

It was pointed out that the subsidies were not coupled with any incentives for businesses and households to save energy or invest in renewables, indicating a missed opportunity and an adverse effect.

Malta was encouraged to prepare an exit-strategy for the energy subsidy policy since high energy costs were expected to persist for a prolonged period of time. The IMF presented a couple of possible scenarios.

First Scenario – Full passthrough, no more energy subsidies

Under this scenario, energy subsidies would be removed completely. This would lead to a significant impact on household consumption, in line with other European countries, especially for low-income households.

When it came to the effects on industry, the IMF highlighted that it would limited. The greatest risk would be that the energy-intensive industrial sector would become less competitive but not significantly so.

Second Scenario – Full passthrough, no energy subsidies, but subsidising low and middle-income households

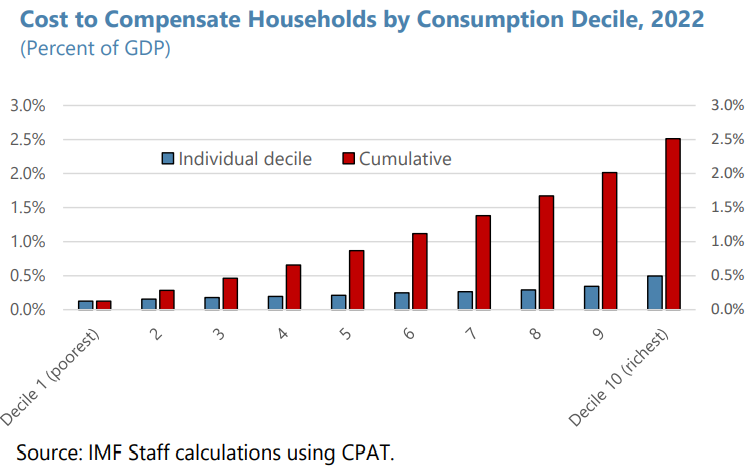

Under this scenario, energy subsidies would be removed, but vulnerable households would receive targeted subsidies. The IMF noted that higher-income households are more energy intensive, and as a result, are more expensive to maintain.

This would benefit public funds and the general public overall, since low-income households spend a larger share of their purchasing power on energy bills, while consuming far less energy than high-income households.

BNF Bank and Mastercard partner to bring added value to Maltese customers

Collaboration enhances everyday banking through exclusive experiences, rewards, and innovative payment solutions

ĠEMMA launches new podcast series to make financial literacy accessible for all

New episodes will be released every two weeks and will be available across multiple platforms

Malta introduces new 15% tax regime for highly skilled professionals

Qualifying individuals are taxed at a flat 15% rate for an initial five-year period