In a major development that has sent ripples through global markets, the United States and China have agreed to temporarily slash tariffs on each other’s imports, easing tensions in the ongoing trade war between the world’s two largest economies.

The announcement, which followed high-level trade negotiations held over the weekend in Geneva, Switzerland, marks the first concrete breakthrough since US President Donald Trump imposed sweeping tariffs on Chinese goods entering the US in January.

Under the new agreement, the US will lower its tariffs on Chinese imports from a staggering 145 per cent to 30 per cent for a 90-day period, effective 14th May. In parallel, China will reduce its tariffs on American goods from 125 per cent to 10 per cent for the same duration.

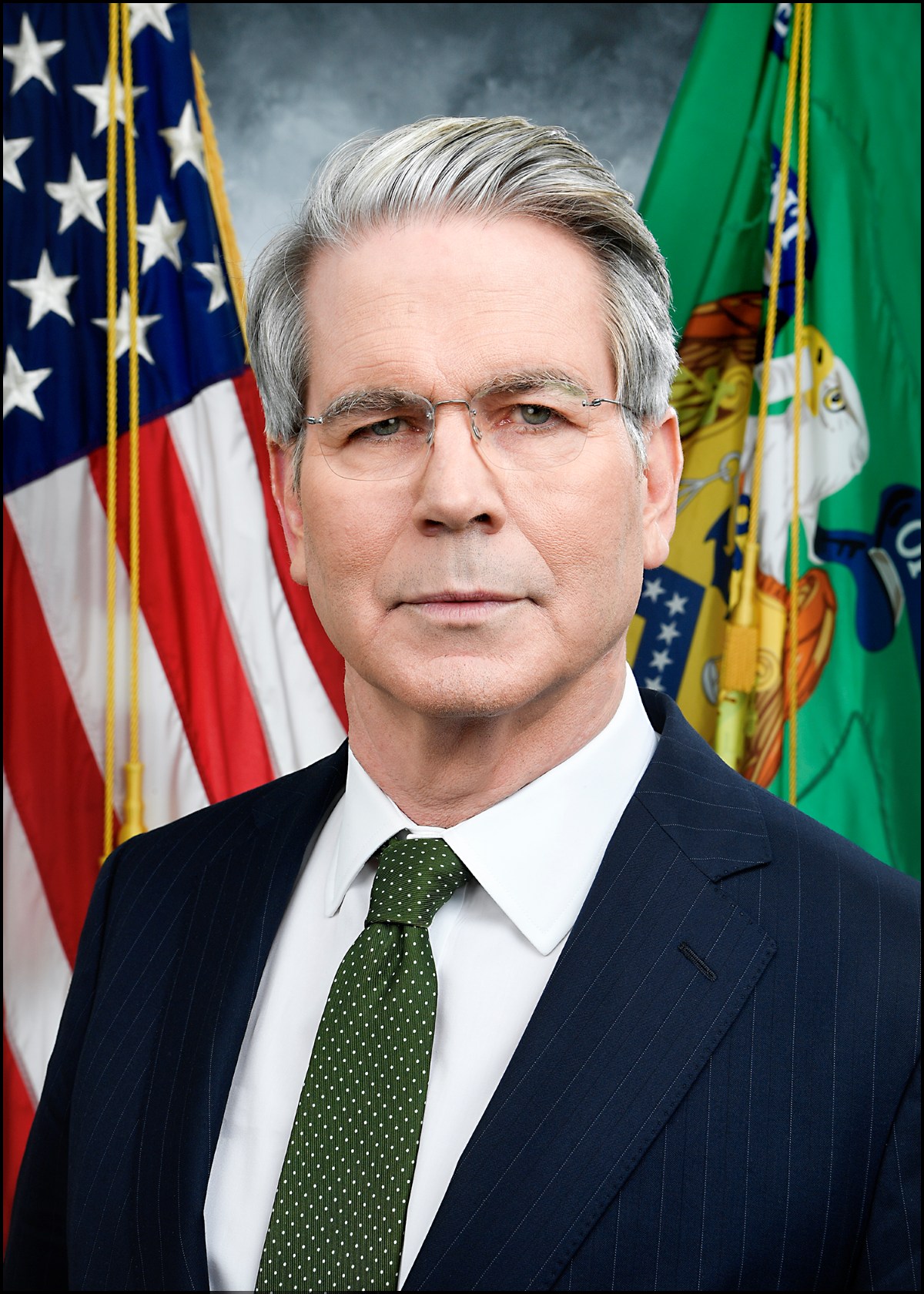

US Treasury Secretary Scott Bessent hailed the negotiations as “productive and constructive”, noting that the two sides had made “substantial progress” on de-escalating trade tensions. Chinese Vice Premier He Lifeng echoed the sentiment, describing the discussions as “in-depth” and “of great significance” not only for the two nations but for the global economy at large.

While details remain limited, a joint statement confirmed that both countries have agreed to establish a bilateral mechanism to continue trade and economic consultations. The framework will be co-led by Bessent, US Trade Representative Jamieson Greer, and Vice Premier He.

The easing of tariffs comes after months of economic strain and political brinkmanship, which saw the imposition of record-high duties and retaliatory levies that rattled financial markets and heightened fears of a global recession.

The trade standoff has weighed heavily on both economies: Chinese exporters have faced mounting stockpiles of unsold goods, while the US economy contracted by 0.3 per cent in the first quarter of the year.

Markets responded positively to the announcement. Mainland Chinese and Hong Kong stocks rallied on Monday, while the Chinese yuan gained strength against the US dollar. US stock futures also pointed to a higher open, suggesting renewed investor optimism.

Ngozi Okonjo-Iweala, Director-General of the World Trade Organization, called the breakthrough “a significant step forward” and urged both nations to build on the momentum.

However, observers caution that the 90-day reprieve is only a temporary fix. Frank Lavin, former undersecretary for international trade at the US Department of Commerce, said the lowered tariffs remain “well above historical norms.” Andrew Wilson, deputy secretary general of the International Chamber of Commerce, noted that anything above 20 per cent remains “severely disruptive” to international trade.

President Trump, in a social media post following the talks, described the developments as “very good” and said the negotiations had ushered in a “total reset” of the US-China relationship. He expressed hope that the truce would lead to greater market access for American businesses in China.

Yet despite the positive tone, both sides signalled that there are still substantial hurdles to overcome. White House officials stressed that the US would not make unilateral concessions, while Chinese state media underscored the decision to engage was made in light of global expectations and appeals from international businesses.

As part of a broader shift in US trade policy, the Trump administration recently introduced a universal baseline tariff on all imports, targeting countries it deemed “worst offenders” – a list that includes China and the European Union. Additionally, separate deals are being negotiated with other trading partners, including a new arrangement with the UK to ease car import duties.

For now, the US-China agreement provides a welcome pause in what has been a rapidly escalating trade conflict. But with only 90 days on the clock, all eyes will be on the next round of negotiations – and whether this truce can evolve into a more lasting resolution.

Event tourism is the standout travel trend for 2026 – How will Malta fare?

The global tourism market is booming, and events are leading the way

EU Parliament agrees on common system to calculate corporations’ taxable income

The reform is designed to replace today’s patchwork of national tax rule

60,000 people have three times as much as poorest half of humanity – report

The third edition of the World Inequality Report 2026 shows inequality is made by design