Last Monday 30th October was an important day on many counts. One of the notable developments was the presentation of the 2024 Budget Speech together with the publication of the Government’s Financial Estimates over the next three years.

These detailed reports provide the necessary information to undertake an analysis of the finances of the Government of Malta which is rarely available across the local media. A regular review of Government finances is important for the investing public given the ongoing need for the Government to rely on institutional and retail investors to raise its annual borrowing requirements through the issuance of Malta Government Stocks and Treasury Bills.

The overall government deficit for 2023 is anticipated to be marginally lower than originally expected at this time last year. The revised estimates for 2023 indicate a deficit of €936 million compared to a forecasted figure of €972 million. The GDP in nominal terms for 2023 is also expected to grow much higher than anticipated to €18.9 billion compared to last year’s forecast for 2023 of €17.5 billion. As a result, the deficit for 2023 will account for five per cent of GDP compared to earlier projections of 5.5 per cent.

The anticipated deficit of €936 million for this year shows an improvement compared to the deficit of €982 million in 2022 (5.7 per cent of GDP) and the much higher levels in the prior two years as the economy was severely hit by the pandemic. In fact, the Malta Government’s deficit amounted to €1.27 billion in 2020 (9.7 per cent of GDP) and €1.14 billion in 2021 (7.8 per cent of GDP).

In the next three years until 2026, the Government’s estimates indicate that although the budget deficit will decline, it will remain elevated reflecting the higher levels of recurrent expenditure as well as higher interest costs in view of the rising levels of debt. Interest costs on outstanding Government debt are expected to rise to €348.7 million in 2026 compared to €173.6 million in 2022. This surge in costs is both as a result of the rising levels of debt as well as the higher interest rate environment as from the second half of 2022.

The budget deficit for 2024 is expected to amount to €920 million (4.5 per cent of GDP) easing to €873 million in 2025 and €817 million in 2026. Since the economy is projected to continue to grow rapidly in future years with an estimated GDP of €23 billion in 2026, the deficit in three years’ time would equate to 3.5 per cent of GDP which is considered to be a manageable level.

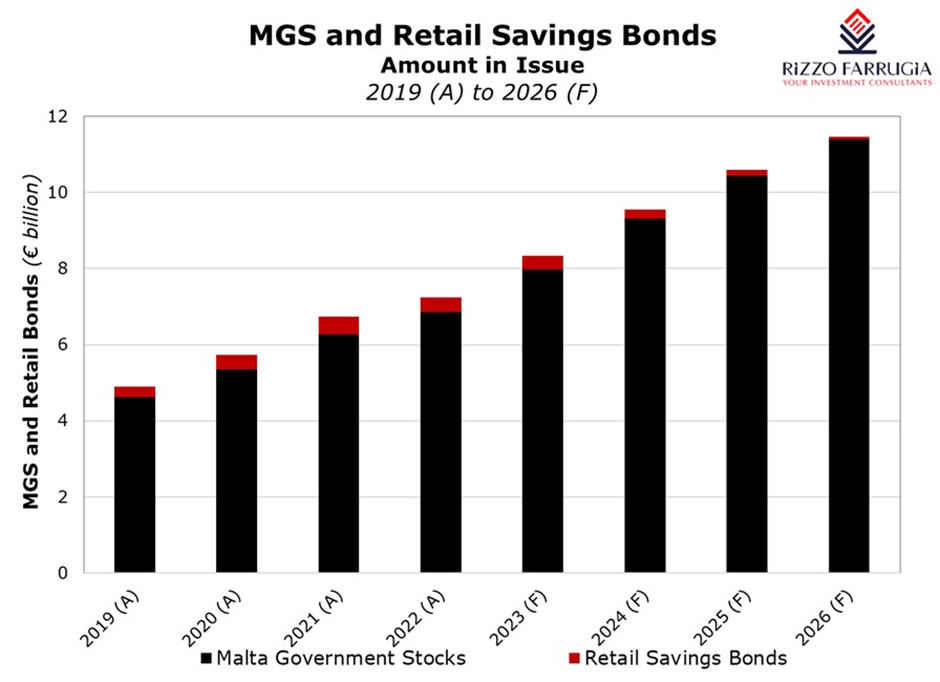

However, in view of the continuing budget deficits in the years ahead and the maturing MGS’s on an annual basis, new MGS issuance will remain elevated over the coming years. The latest Government’s Financial Estimates published last week indicate that the Government will require to raise €1.7 billion in 2024 (primarily through issuance of MGS), a further €1.5 billion in 2025 and an additional €1.8 billion in 2026.

In order to place this into perspective, the Government issued €1.4 billion in MGS so far this year. However, from the latest information published last week, it transpires that an additional €135 million in new MGS’s are required by the end of 2023. Since this is not a large sum within the context of general MGS issuance, it is very likely that this will take place via an offering to retail investors only and not to institutional investors.

It is envisaged that by the end of 2026, total Government debt would increase to €13.1 billion compared to €9 billion as at the end of 2022 and only €5.7 billion at the end of 2019 prior to the pandemic. While these figures are very high indeed and may alarm certain readers, this must be placed within the context of the extremely challenging circumstances over recent years.

Moreover, while the absolute debt level is important to monitor, the debt to GDP ratio is the correct indicator in order to gauge the overall indebtedness. In fact, this is among the most commonly-used indicators by credit rating agencies. Should Malta’s GDP grow in line with expectations, the debt to GDP ratio will rise to just under 57 per cent which is still a very comforting measure when compared to several other countries across the world some of which have debt to GDP levels of over 100 per cent.

As indicated in several of my articles over recent years, there is an abundance of liquidity across the local financial system. In fact, despite the sharp rise in Government debt since the onset of the pandemic in early 2020 with total MGS issuance of €5.23 billion over the past four years (apart from an additional €500 million in Malta Government Savings bonds to selected individuals), this was all absorbed by institutional and retail investors.

The latest data from the NSO indicates that as at the end of 2022 just over 60 per cent of Government debt was held by local financial corporations (commercial banks and insurance companies). Local credit institutions were among the main buyers of MGS during the course of this year too which is very reassuring indeed since the large majority of Government debt is held by local institutions and private investors. In turn, this also implies that the debt servicing requirements of the Government also end up in the hands of local institutions and investors thus continuing to strengthen the local economy.

However, naturally, there are limits as to the overall level of sovereign debt that each credit institution or insurance company can indeed hold within their portfolios. In view of the expected MGS issuance totalling €5 billion until 2026, it is worth highlighting this possible limitation so as to ensure that future issuance is structured in a manner that maximises participation by local investors.

While the rising level of debt is not a major concern when compared to the overall size of the economy, the borrowing requirements of the Government in future years remain very sizeable. In this context, we cannot remain complacent of this reality and need to understand the overall implications across the capital market and the wider financial system.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Banks dominate the headlines

A pre-tax profit figure of €302.4 million represents an absolute record in the BOV's 50 years

Quarter of first-time buyer homes cost over €300,000

Single buyers spend on average €212,454 on their properties

Liquidity across Malta’s bond market

During the past five years, average annual activity across the bond market amounted to €100 million