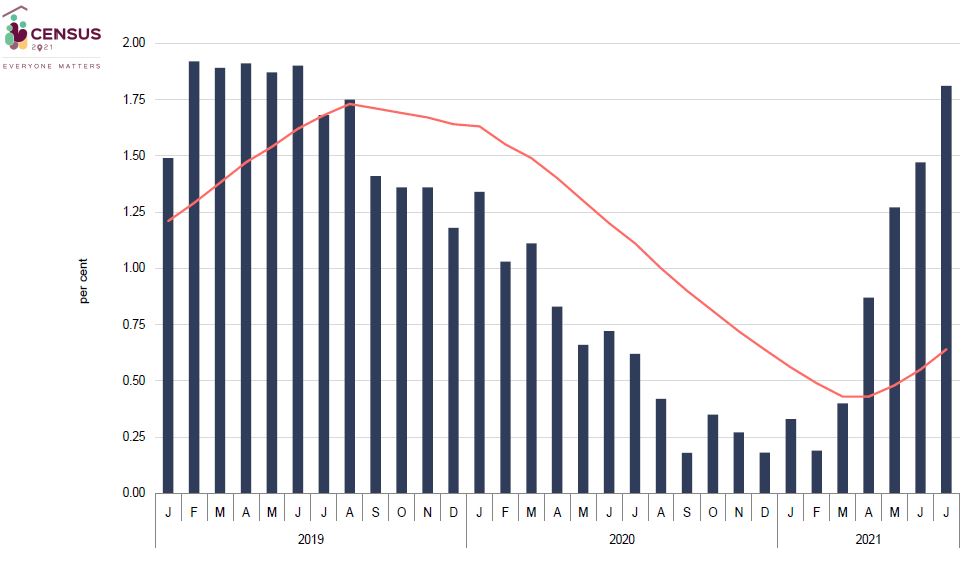

Inflation in Malta reached an annual rate of 1.81 per cent in July as it continues the steady upward climb started in March, thanks to higher prices reported for food, including restaurant service and takeaways, and recreation and culture.

July’s rate is higher than the annual rate of 1.47 per cent in June, which was in turn higher than the 1.27 per cent recorded in May.

This places the 12-month moving average, which is less vulnerable to volatile prices, at 0.64 per cent, still far below the revised European Central Bank target of a “symmetric” two per cent inflation target over the medium term.

The figures emerge from a statement released by the National Statistics Office (NSO) on the latest measure of the Retail Price Index (RPI), which revealed that prices for water, electricity, gas and fuels did not rise at all, while prices for beverages and tobacco increased only slightly (0.37 per cent) when compared to the same month a year prior.

However, the monthly rate, which compares price changes between the reference month and the previous month, decreased, with prices in July 2021 slightly cheaper (-0.13 per cent) than those registered in June, largely driven by a large drop in clothing and footwear, possibly linked to summer sales promoted by retail fashion outlets.

Food prices, which exerted the largest contribution to the annual inflation rate, increased by 2.95 per cent over July 2020 prices, and by 0.16 per cent when compared to June 2021 prices.

The largest upward impact on annual inflation was in fact registered in the food index (+0.63 percentage points), largely due to higher prices of vegetables.

The second and third largest impacts were measured in the recreation and culture index (+0.47 percentage points) and the housing index (+0.18 percentage points), mainly on account of higher private school fees and higher prices of house maintenance services respectively

The RPI for recreation and culture increased considerably, by 4.7 per cent when compared to July 2020 and by 1.3 per cent when compared to June 2021.

Within recreation and culture, sports-related equipment registered an annual rate of 0.72 per cent, while educational fees and related expenses registered an annual rate of 21.96 per cent and other recreational articles and services registered an annual rate of 0.94 per cent.

Bank of Valletta: Pioneering the future of digital payments in Malta

Chris Degabriele, Head of eBanking, reflects on the bank’s exciting digital transformation journey, which is closely linked to his own.

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns