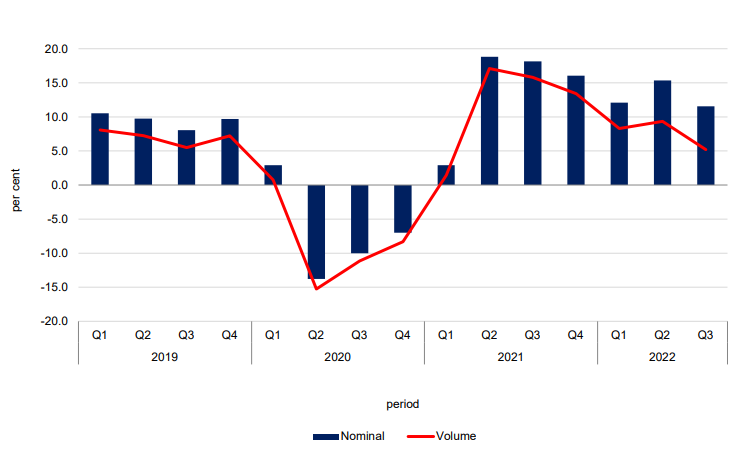

Provisional estimates indicate that the Gross Domestic Product (GDP) for the third quarter of 2022 amounted to €4,402.2 million, registering an increase of €456.1 million, or 5.2 per cent in volume terms.

In terms of production (output), 2022’s third quarter GDP increased by 11.6 per cent when compared to the same quarter in 2021.

The figures emerge from a periodic update issued by the National Statistics Office.

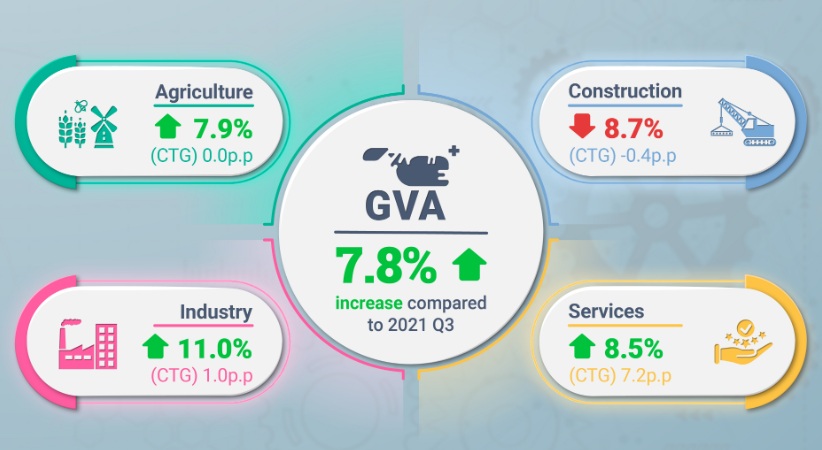

Malta’s economy is expressing resilience despite high inflation (7.4 per cent) and rising eurozone interest rates (up two per cent this year), with indicators showing that growth between July to September 2022 was primarily driven by dynamic activity in services followed by improvements in both industry and agricultural activities, with a slowdown in construction.

In this period Gross Value Added (GVA) rose by 14.4 per cent in nominal terms and 7.8 per cent in volume terms relative to 2021. Meanwhile services activities increased by 8.5 per cent, industry by 11 per cent and 7.9 per cent in agriculture. Notably a drop of 8.7 per cent of activity was recorded in the construction sector.

The continued strong performance of services can be seen as the sectors ongoing recovery from the COVID-19 pandemic with growth mainly being attributed to accommodation and food service activities (40.6 per cent) followed by administrative & support services (22.7 per cent), wholesale and retail trade; repair of motor vehicles and motorcycles (9.2 per cent), transportation and storage (15 per cent) and Information and communication (eight per cent).

Net taxes on products contributed negatively towards GDP growth, with a decrease of 25.4 per cent in volume terms.

The expenditure approach

The expenditure approach is another method used to calculate GDP and is derived by adding final consumption expenditure of households, general government, and non-profit Institutions serving households (NPISHs), gross capital formation and net exports.

The contribution of domestic demand to the year-on-year GDP growth rate in volume terms was 2.9 percentage points, with final consumption expenditure having a positive contribution of three percentage points and gross capital formation contributing negatively by 0.1 percentage points. External demand also registered a positive contribution of 2.3 percentage points, with 17.4 percentage points attributable to exports and 15.1 percentage points explained by imports.

In the third quarter of 2022, final consumption expenditure witnessed an increase of 4.8 per cent in volume terms. This was the result of an increase in the expenditure of households and NPISHs of 7.6 and 1.8 per cent, respectively. General government expenditure decreased by 1.2 per cent.

Gross fixed capital formation declined by 0.9 per cent in volume terms. This decrease was mainly attributable to investment in other buildings and structures.

Exports and imports of goods and services in volume terms rose by 10.4 per cent and 10.1 per cent, respective

The income approach

The third approach to measure economic activity is the income approach, which shows how GDP is distributed among compensation of employees, operating surplus of enterprises and taxes on production and imports net of subsidies.

Compared to the third quarter of 2021, the €456.1 million increase in nominal GDP was the result of a €130.6 million increase in compensation of employees, a €323.5 million rise in gross operating surplus and mixed income, and an increase of €2 million in net taxation on production and imports.

Gross National Income (GNI)

GNI differs from the GDP measure in terms of net compensation receipts, net property income receivable and net taxes receivable on production and imports from abroad.

Considering the effects of income and taxation paid and received by residents to and from the rest of the world, GNI at market prices for the third quarter of 2022 was estimated at €4,050 million.

New EIB and BOV partnership channels ‘fresh financing to Maltese businesses’

The banks say this initiative is designed to enhance the working capital and investment capacity of Maltese mid-sized firms

Africa Select Equity Fund – Providing investors with access to Africa’s economic expansion

Mediterrania Capital Partners’ Africa Select Equity Fund offers investors access to one of the world’s most promising emerging markets

Self-employed, employees and companies contribute €2.1 billion in 2023

Parliamentary data reveals five-year growth trends in fiscal contributions