One of the most highly sought-after metals that has become instrumental to the green economic transition, has finally started getting cheaper after its price blew up over the past two years.

Lithium is a soft, silvery metal that has been dubbed “white gold” in recent years due to its integral use in battery cells of mobile phones, laptops and most of all, electric vehicles (EVs), due to its ability to store energy efficiently and recharge.

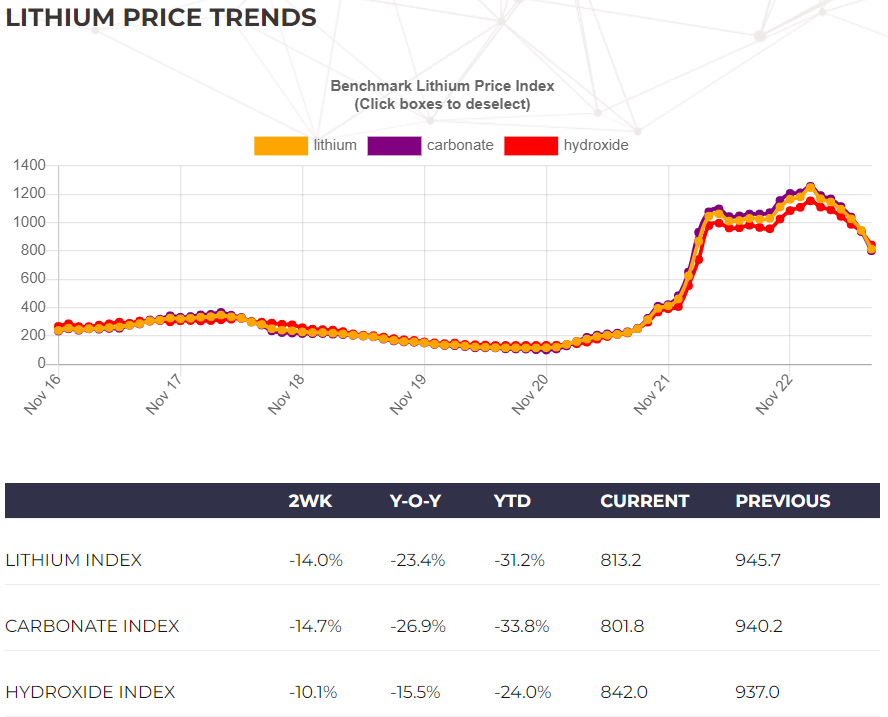

Tech companies, especially EV manufacturers, can finally breathe a little easier, after the price of Lithium by more than 30 per cent since its peak in January 2023. While today it is still almost six times as expensive as it was in 2021, a downward trend is beneficial to a number of firms who’ve witnessed their cost of production increase in light of soaring rates of inflation around the world.

According to Sifted.eu, there are over 400 startups using or manufacturing lithium-ion batteries in Europe, with the price of the battery making up around 30-40 per cent of the cost of an EV. Dropping lithium prices will then lead to cheaper EV facilitating consumer demand.

There is, however, a risk that, if Lithium prices continue dropping, the metal producers might reduce output, since it would discourage investment.

However, it is unlikely that demand for the metal will subside any time soon. The European Union has effectively agreed to require all cars sold in the European Union to emit zero emissions by 2035, which will inevitably boost EV sales.

Self-employed, employees and companies contribute €2.1 billion in 2023

Parliamentary data reveals five-year growth trends in fiscal contributions

MFSA concludes review of Crypto-Asset Service Providers following MiCA implementation

The Authority provided clear expectations and guidance to address certain concerns.

Malta Development Bank to launch schemes supporting sustainable development and creative sector

In 2024, the MDB launched the SME Guarantee Scheme and the Guaranteed Co-Lending Scheme