The Central Bank of Malta (CBM) Business Conditions Index indicates that in May, annual growth in business activity was broadly unchanged compared to the previous month and stood above its long-term average, leading to a drop in economic uncertainty. However, economic sentiment in May is significantly below that of the previous month.

The information was provided through the CBM’s June Economic Update.

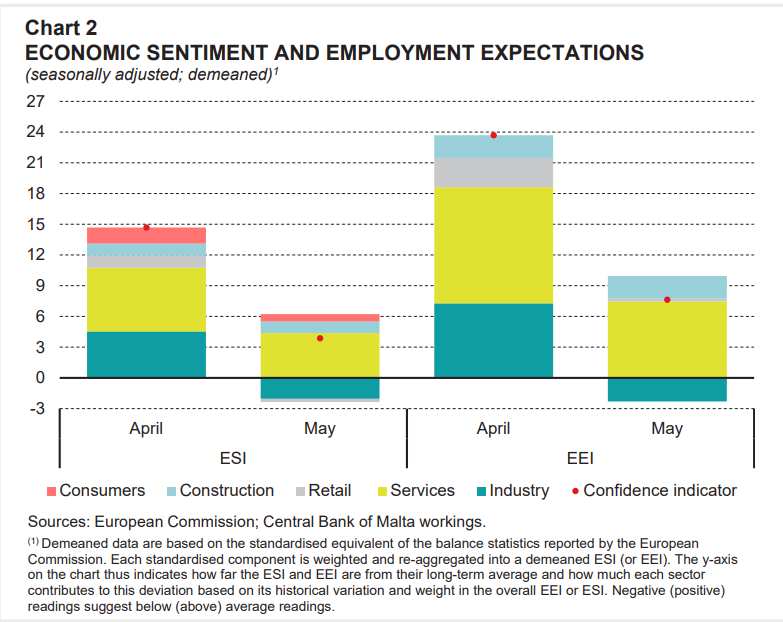

The European Commission’s Economic Sentiment Indicator (ESI) for Malta fell down a notch to 103.9 in May from its 15-month high rating of 114.7 recorded in the previous month.

Notwithstanding this decline, the ESI remained above its long-term average of around 100 and stood above the euro area average of 96.5.

On a month-on-month basis, sentiment dropped across all sectors, with the retail sector experiencing the largest drop, followed by industry.

In fact, the confidence indicator for retail decreased to -9 from 36.2 in April. The report said that the decline in confidence reflected a sharp deterioration in retailers’ expectations of business activity over the next three months, and their assessment of sales in recent months.

Furthermore, the share of respondents assessing their stock levels to be above normal increased month-on-month.

Confidence in industry also turned negative at -11.4 down from 8.5 month-on-month as production expectation for the months ahead decreased strongly from very high levels recorded in April.

Firms also assessed their stocks of finished products to be above normal.

Lastly, consumer confidence edged down further to -9.9 from -6.9 in April. While still above its long-term average of -10.2, consumer expectations of the general economic situation over the next 12 months dropped.

Nevertheless, respondents had a less negative assessment of their personal financial situation of the last 12 months and the next 12 months.

On a positive note, uncertainty in Malta turned negative, meaning in May 2023, businesses were better able to predict their situation with ease.

According to the European Commission’s Economic Uncertainty Indicator, in Malta it stood at -3.2, down from 19.4 in April. This marks a significantly lower score than the euro area, and notable year-on-year drop from May 2022 when the score stood at 35.2

Uncertainty declined across all sectors except for the retail sector.

On a year-on-year basis, industrial production in April grew by 14.2 per cent year-on-year, largely driven by strong increases among firms manufacturing pharmaceutical products as well as machinery and equipment.

Production in the energy sector also grew at a faster pace of 31.9 per cent, compared to 2.7 per cent in the previous month.

The tourism sector also continued registering strong gains, as tourism arrivals, expenditure and nights spent in Malta were all above pre-pandemic levels.

Seasonally adjusted unemployment returned to its historic low of 2.8 per cent in April with the number of persons registered as unemployed being 966.

Furthermore, the annual inflation rate based on the Harmonised Index of Consumer Prices (HICP) stood at 6.3 per cent in May, down from 6.4 per cent in the previous month.

In April, the deficit on the Consolidated Fund increased to €57.0 million, a deterioration of €39.5 million from the deficit registered a year earlier.

These developments mainly reflect a rise in government expenditure, which more than outweighed a rise in government revenue. In turn, the primary balance registered a deficit of €36.4 million, compared with a small primary surplus registered in April 2022.

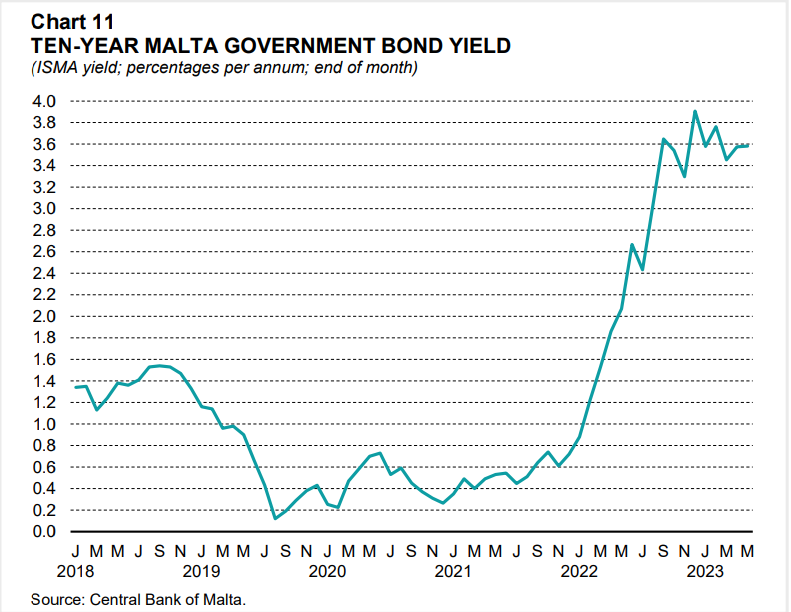

On the capital market, yield on ten-year Maltese Government bonds stood at 3.58 per cent at the end of May, broadly unchanged from the previous month. It also stood 151 basis points above its year-ago level. This reflects the transmission of recent increases in ECB policy rates to Government bond yields.

Meanwhile, the Malta Stock Exchange (MSE) Equity Price Index rose by 3.4 per cent when compared with April. Similar movements were recorded in the MSE Total Return Index, which accounts for dividends as well as changes in equity prices.

Self-employed, employees and companies contribute €2.1 billion in 2023

Parliamentary data reveals five-year growth trends in fiscal contributions

MFSA concludes review of Crypto-Asset Service Providers following MiCA implementation

The Authority provided clear expectations and guidance to address certain concerns.

Malta Development Bank to launch schemes supporting sustainable development and creative sector

In 2024, the MDB launched the SME Guarantee Scheme and the Guaranteed Co-Lending Scheme