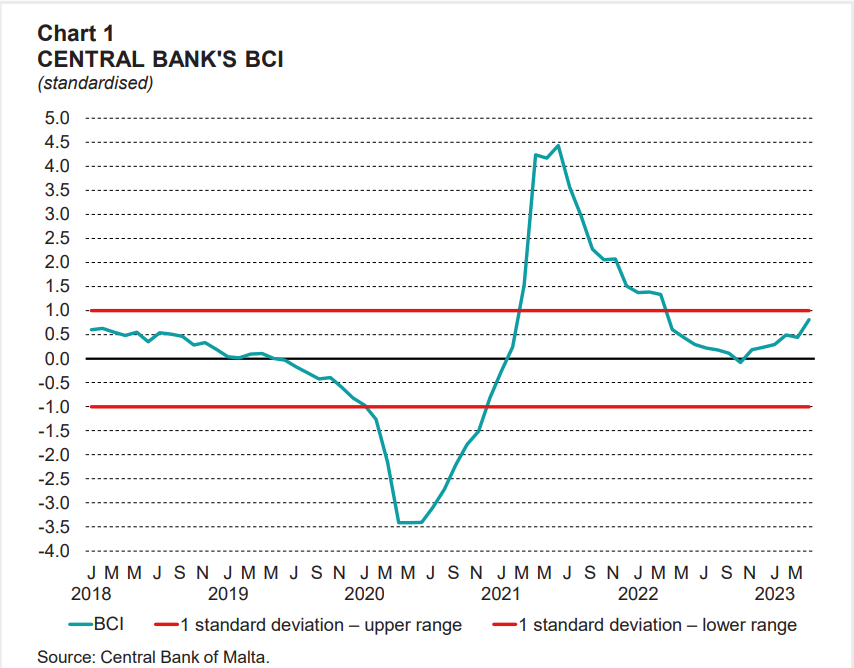

The Central Bank of Malta’s (CBM) Business Conditions Index indicates that in April, annual growth in business activity rose above its long-term average, driven by the number of tourist arrivals, industrial production, tax revenue, and growth in Gross Domestic Product (GDP) in recent months.

The information was provided through the CBM’s May Economic Update.

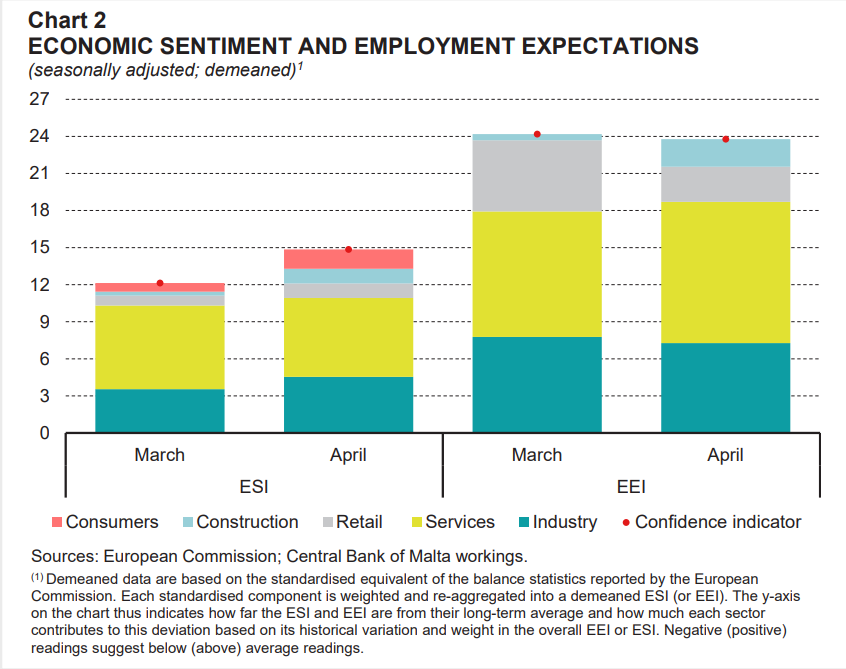

The European Commission’s Economic Sentiment Indicator (ESI) for Malta reached a 14-month high of 114.9, up from 112.2 in March. It is also well above the euro average of 99.3.

On a month-on-month basis, sentiment increased strongly in the construction sector, and to a lower extent, among retailers, industry, and consumers.

By contrast, sentiment eased in the services sector, however remained elevated from a historical perspective

Compared to March, uncertainty in Malta increased, according to the EU Commission’s Uncertainty Indicatory, however, it is still lower on a year-on-year basis, and below the eurozone average.

An increase in uncertainty was largely driven by developments in industry, with respondents reporting difficulty in assessing their future business situation.

On a year-on-year basis, both industrial production and retail trade grew by 12.5 per cent in March, which was preceded by 18.5 per cent growth in February.

Industrial production is a measure of economic activity involving quarrying, manufacturing, and energy sectors.

The most significant increases were recorded among firms that manufacture machinery and equipment, those producing computer, electronic and optical products, as well as those involved in printing and reproduction of reported media.

Strong increases in output were also registered among firms manufacturing basic pharmaceuticals products, medical and dental instruments.

By contrast, firms producing textiles and certain non-metallic mineral products and metals, motor vehicles, trailers and semi-trailers reported a decrease in production.

The unemployment rate stood at 2.9 per cent in March, marginally lower than the rate of three per cent registered in the previous month, and in March 2022.

Furthermore, the annual inflation rate based on the Harmonised Index of Consumer Prices (HICP) stood at 6.4 per cent in April, down from 7.1 per cent in the previous month.

In March, the deficit on the Consolidated Fund narrowed to €249.7 million, an improvement of f €41.2 million when compared to the deficit registered a year earlier.

These developments reflect a rise in Government revenue, which outweighed a smaller rise in Government expenditure.

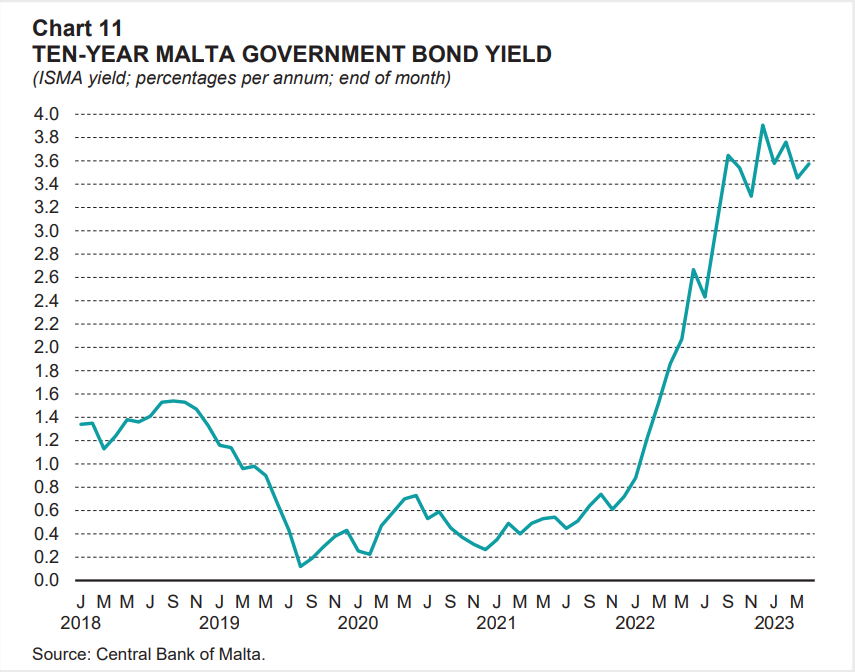

On the capital market, yield on ten-year Maltese Government bonds increased to 3.58 per cent at the end of April, 12 basis points higher than at the end of March. It also stood 172 basis points above its year-ago level (see Chart 11). This reflects the transmission of recent increases in ECB policy rates to Government bond yields.

Meanwhile, the Malta Stock Exchange (MSE) Equity Price Index rose by 2.3 per cent when compared with March. Similar movements were recorded in the MSE Total Return Index, which accounts for dividends as well as changes in equity prices.

Malta Maritime Forum warns EU ‘green’ law driving business to North Africa

Malta Maritime Forum warns southern EU ports risk becoming feeder hubs playing a secondary role to extra-EU ports

Hotel bedspace increases by 27% since 2022

The sector is steadily expanding its accommodation supply

General fear of travelling doesn’t justify free holiday cancellation, MCCAA warns

Malta Competition and Consumer Affairs Authority clarifies rights for travellers amidst concern over the Middle East war