European Commission President Ursula von der Leyen has unveiled a sweeping €1.816 trillion budget proposal for the European Union, covering the 2028-2034 period – a significant increase from the current €1.21 trillion framework.

The plan, touted as “more strategic, more flexible, more transparent,” seeks to reallocate funds toward competitiveness, defence, and crisis resilience while introducing new EU-wide taxes to reduce reliance on member states.

However, the proposal has already sparked fierce backlash from lawmakers, farmers, and cohesion-dependent nations.

The budget is called the Multiannual Financial Framework (MFF), European Union’s long-term budget, setting spending limits and priorities for a period of seven years. It determines how much money the EU can spend and on what, from agriculture and regional development to defense, climate action, and crisis response.

The new Multiannual Financial Framework (MFF) restructures spending into three main pillars:

- €865 billion for agriculture, fisheries, cohesion, and social policies (down from over 60 per cent of the current budget).

- €410 billion for competitiveness, research, and innovation.

- €200 billion for external action, including €100 billion in support for Ukraine.

Dr Von der Leyen emphasised the need for flexibility, proposing a €400 billion crisis loan mechanism for unforeseen emergencies, a lesson learned from the pandemic and Ukraine war.

Additionally, the Commission plans to streamline 52 existing programs into just 16, with some funds left unallocated for rapid reallocation.

The most contentious change is the merger of the Common Agricultural Policy (CAP) and cohesion funds – traditionally the EU’s largest spending areas – into a single pillar. Southern nations like France and Italy, with strong farming lobbies, and Eastern countries reliant on cohesion funds, are expected to fiercly resist the cuts.

Meanwhile, Western and Northern states, which have long pushed for a shift toward defence and green innovation, may welcome the reallocation. But critics argue the cuts undermine the EU’s traditional support structures.

Kata Tüttő, president of the Committee of the Regions, slammed the plan as a “MONSTER” that “cracks the backbone of cohesion policy by nationalizing and centralising.”

To help repay the EU’s COVID-19 recovery debt, the proposal introduces three new levies:

- A tax on electronic waste.

- A tax on tobacco products.

- A levy on large corporate revenues.

Combined with existing customs duties and emissions trading revenues, the Commission expects to raise €58.5 billion annually. However, Germany and France, both facing domestic fiscal pressures, have already signaled opposition to increasing EU contributions.

The proposal faces an uphill battle in negotiations with member states and the European Parliament. MEPs criticised the Commission for lacking transparency, with Budget Committee Chair Johan Van Overtveldt complaining that journalists received more details than lawmakers.

Siegfried Mureșan (EPP), a key budget negotiator, dismissed claims of a “historic” increase, arguing the rise merely accounts for inflation and Next Generation EU debt repayments.

With unanimity required among the EU’s 27 governments, Dr von der Leyen’s plan is far from guaranteed. As Europe grapples with rising populism and economic strain, the budget debate will test the bloc’s ability to balance old subsidies with new priorities, without fracturing unity further.

The coming months will reveal whether Brussels can secure a deal or if backlash forces a major rewrite.

Debunking the gender pay gap in the EU

Around 24 per cent of the gender pay gap is due to over-representation of women in relatively low-paid sectors

EU to tax small parcels from China in new crackdown

The decision to remove the exemption on small parcels is part of a broader overhaul of EU customs rules

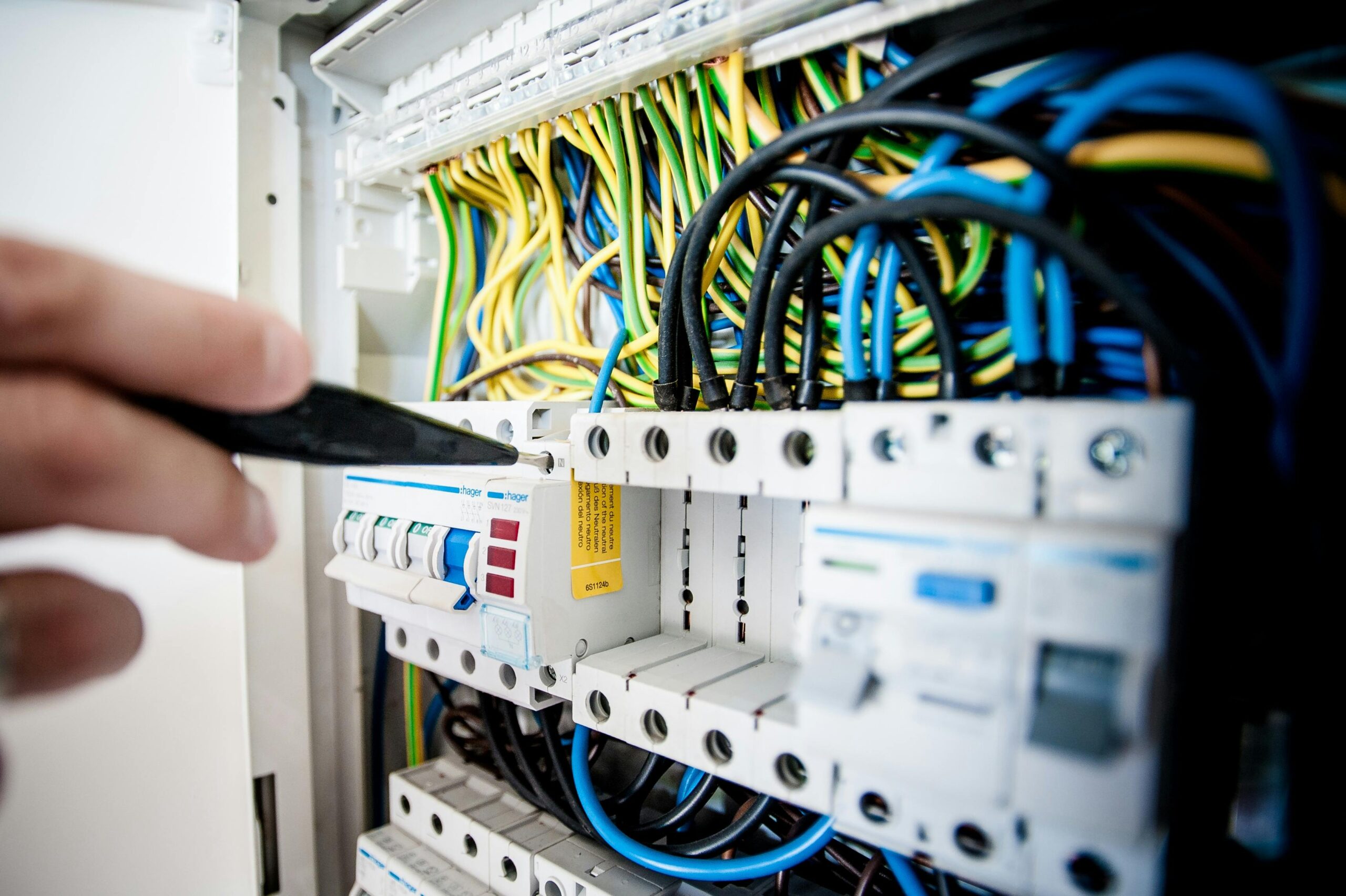

Malta enjoys second lowest electricity prices in the EU

The cost of 100 kWh of electricity ranges from €38.4 in Germany to a low of €6.2 in Turkey