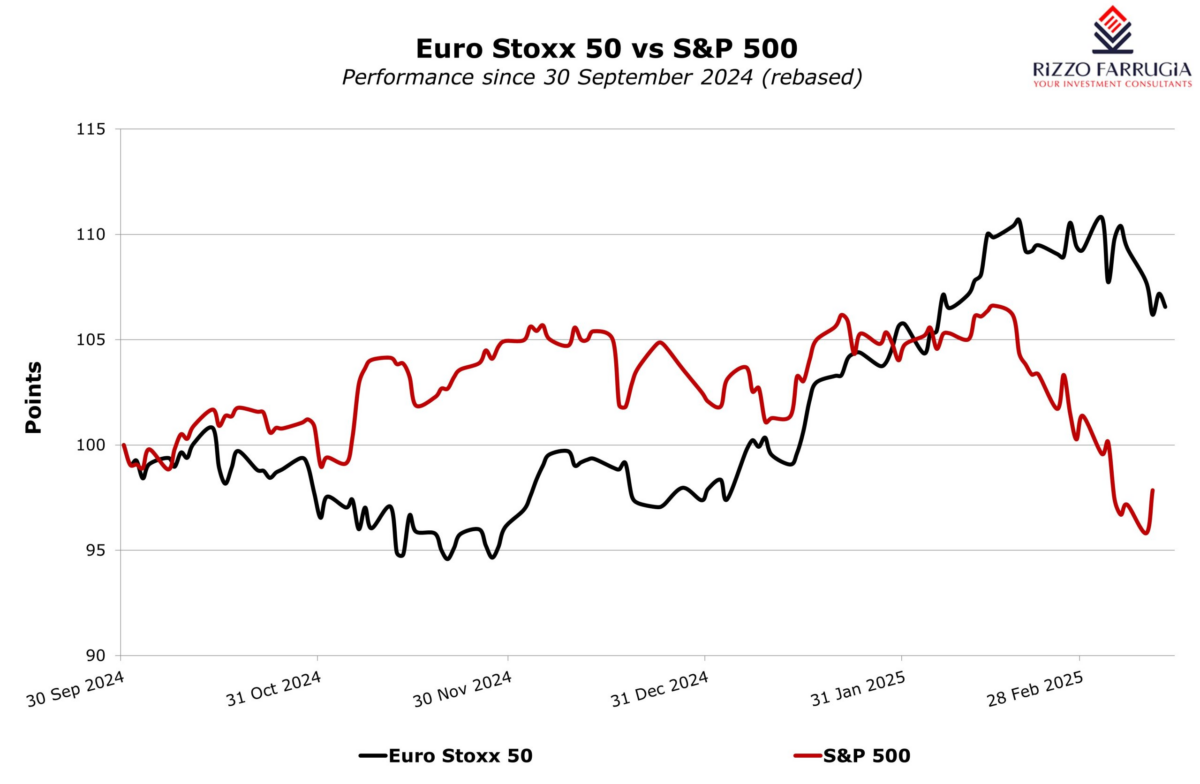

In last week’s article I mentioned that during the fourth quarter of last year and in early 2025, the consensus view among most financial analysts was that the US stock market (driven by the continued AI investment theme and boosted by the promised tax cuts and deregulation of the new US President Donald Trump) will continue to outperform the European markets in view of the very weak economic performance across the eurozone.

This was precisely the case during the last few weeks of the year following the confirmation of the election victory in the US by Donald Trump in early November as he secured a second term in office.

However, since then, US equities have seen all their gains wiped out as investors become increasingly concerned about the damaging economic impact of President Trump’s trade tariffs. On the other hand, European equity markets climbed following several years of underperformance which is indeed surprising given the tough stance on European trade (including fresh tariffs on several European goods) by the US President.

Although the US equity markets performed positively between early November and mid-February when they hit fresh all-time highs, they have since dropped into ‘correction’ territory after dropping by more than 10 per cent since their high on 19th February. In fact, the S&P 500 index has fallen by 1.3 per cent from its level in early November at the time of the Presidential election.

On the other hand, the Euro Stoxx 50 index has gained by over 11 per cent since November, with Germany’s DAX showing an upturn of 20 per cent.

So why have equity markets surprised so many investors and analysts?

Essentially, Trump’s trade strategy has dented investor confidence towards the US equity market. Furthermore, in the first few weeks of the year, the latest economic data indicated that the Federal Reserve is unlikely to cut interest rates (also due to expected stronger inflation caused by import tariffs), while in Europe, there was a clear path for monetary policy easing which is another important tailwind from an investor’s perspective. Moreover, European markets have more encouraging earnings prospects and are benefitting from an upsurge in share buybacks, as well as trading on cheaper valuations.

Moreover, towards the end of January, there was a meaningful impact on the US technology sector following the news that the Chinese AI developer DeepSeek released its latest AI-powered chatbot DeepSeek R1 which was reportedly produced for a fraction of the cost of its major US rivals, the most popular being ChatGPT. The S&P 500 index has an allocation of over 30 per cent to the technology sector and the downturn in the major tech companies in recent weeks has a material impact on the overall performance of the US equity market.

On the other hand, in early March, Germany announced an unprecedented fiscal package aimed at bolstering defence and infrastructure spending, which consists of (i) a €500 billion budget infrastructure fund over the next decade; (ii) exemption of defence expenditures exceeding 1 per cent of GDP from the constitutional debt brake; and (iii) an increase in the allowable structural deficit. The historic German economic policy U-turn coupled with the accommodative monetary policy after the European Central Bank continued to lower interest rates on 6th March to 2.5 per cent is very positive news for German economic growth over the medium-term which led the DAX index rally to fresh record levels.

Finally, recent weak economic data in the US has caused concerns among investors on a possible economic recession. In a recent televised interview, President Trump did not rule out the possibility of a US recession this year and acknowledged the short-term economic turbulence from his trade and fiscal agenda.

These various developments led to the S&P 500 index dropping into ‘correction’ territory for the first time since late 2023 with European equity indices moving higher.

Interestingly, the latest market downturn in the US took place on the 5th anniversary of one of the worst days for the US equity market. In fact, in mid-March 2020, the S&P 500 had tumbled by just under 12 per cent ranking as the 3rd worst day in its history at the start of the COVID-19 pandemic. Moreover, statistics indicate that since 1929, this was the seventh-fastest correction for the S&P 500 as it took only 16 trading days for the index to drop by 10 per cent from the high of 19th February. Also interesting is the fact that three of the seven fastest drawdowns happened under President Donald Trump – in 2018, 2020 and again in recent weeks.

The Magnificent Seven comprising Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla, saw their combined market value decline by over $3.3 trillion from their recent peaks. These companies accounted for 87 per cent of the S&P 500’s total market cap decline of over USD3.7 trillion during this period showing the dominance of these companies in the index and where the major sell-off took place. The worst performer was Tesla as it dropped by over 50 per cent (Tesla shares had surged following Donald Trump’s election victory) followed by Nvidia at -24.0 per cent.

Meanwhile, across Europe, shares of defence companies such as Rheinmetall, Leonardo, Hensoldt, Dassault Aviation, Thales and Saab have soared amid expectations of increased European military budgets in response to geopolitical uncertainty and the latest US policy shift. The share prices of most of these companies have experienced increased demand since Russia’s invasion of Ukraine in 2022. The anticipated economic boost from infrastructure and defence spending also translated in higher yields across euro area sovereign bonds which led to a surge across several insurance and banking equities due to better long-term business prospects.

The recent downturn across the US equity market prompted a number of market strategists and financial analysts to lower their targets for the S&P 500 for this year following the consensus bullish views until some weeks ago. Most of these analysts argue that tariffs function as taxes on consumers and businesses, with the potential to fuel inflation while slowing economic growth. In fact, a number of the major US investment banks have also revised lower their economic forecasts for the US economy for 2025.

Meanwhile, earlier this week, German lawmakers formally approved to reform the country’s debt brake rule to enable a rise in public borrowing in order to fund a hike in defence spending. The motion required backing from two-thirds of parliamentarians since a change to the German Constitution is necessary. Following this approval, Europe’s largest economy will be embarking on the fiscal policy stance that capital markets have long been requesting. This should help European equity markets to continue to narrow the outperformance against the US in the coming years following a period of more than a decade where US equities performed significantly better than those in Europe.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

More than 70,000 active rental contracts with the Housing Authority in the first half of 2025

This figure marks an increase of 7.5% compared to the same period in 2024

Unprecedented issuance in Q4

Malta’s bond market is seeing record issuance in the final quarter of the year

A new era of growth for db Group

db Group is a family-owned business that traces its origins back to 1984