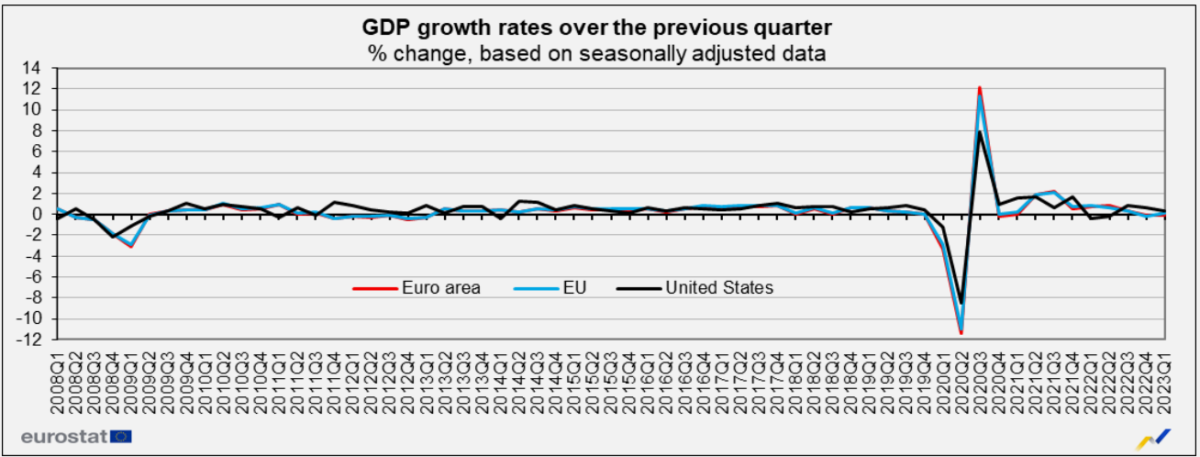

The eurozone has entered a shallow recession as the collective GDP of the single currency’s members shrank for two consecutive quarters amid persistently high rate of inflation and rising interest rates.

The monetary union’s GDP fell by 0.1 per cent for the second quarter in a row, entering what’s known as a technical recession (two successive quarters of economic contractions).

While Malta itself has not yet entered a recession, the national GDP contracted by 0.5 per cent during the first quarter of 2023.

Eight EU countries recorded an economic contraction during the reporting period, with Ireland experiencing a significant contraction of 4.6 per cent.

Despite clear signs of an economic slowdown, the European Central Bank Governing Council is expected to hike interest rates once again on 15th June in order to further suppress inflation.

On Monday (this week) President of the European Central Bank (ECB), Christine Lagarde told the European Parliament, “our future decisions will ensure that the policy rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to our two per cent medium-term target and will be kept at those levels for as long as necessary.’

The eurozone inflation rate declined to 6.1 per cent in May, however, food inflation remained elevated at 12.5 per cent.

Conversely, the eurozone recorded positive employment rate growth of 0.6 per cent during the first quarter of the year. Estonia and Malta led, registering 4.4 per cent and 2.9 per cent growth in employment respectively.

Malta introduces new 15% tax regime for highly skilled professionals

Qualifying individuals are taxed at a flat 15% rate for an initial five-year period

Malta’s inflation edges up to 2.7% in October as food and services lead price pressures

The October RPI reading indicates some re-acceleration in consumer-facing sectors after a period of summer stabilisation

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion