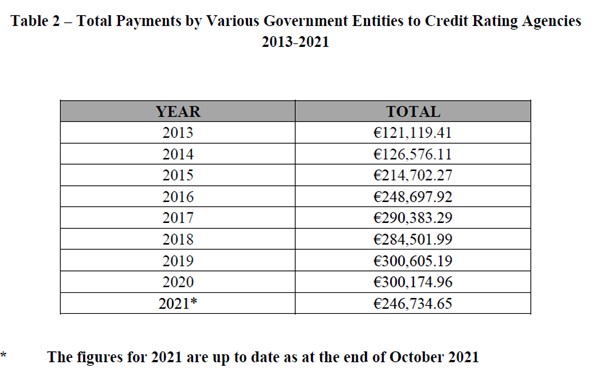

Payments by the Government of Malta to credit rating agencies have continued their upward trend, almost tripling since 2013, with €246,734 paid this year up to October.

Meanwhile, payments by the Ministry for Finance have decreased, with other entities contracting credit rating agencies of international renown to rate Malta’s sovereign debt.

In response to a parliamentary question asked by Opposition MP Jason Azzopardi back in January 2019, then-Minister for Finance Edward Scicluna tabled an annual breakdown of the total amount Government was paying to credit rating agencies.

Two years later, in January 2021, Opposition MP Ryan Callus asked the same question to current Finance Minister Clyde Caruana, then still at the very start of his term. However, Minister Caruana’s reply deviated from the format and figures previously seen.

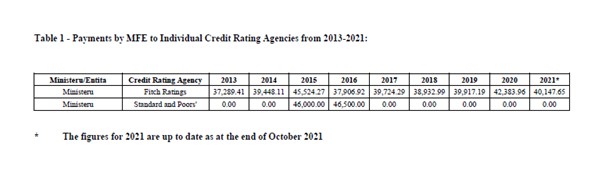

His reply only included payments made to Fitch Ratings and Standard and Poor’s.

Replying to questions sent by this newsroom, the Ministry clarified that the figures presented by Minister Scicluna in 2019 showed the total sum paid by the Ministry for Finance and other entities to the various credit rating agencies, whereas the figures tabled by Minister Caruana in January 2021 reflected the amounts paid by the Ministry for Finance alone.

Along with the Ministry for Finance, the Central Bank of Malta and Malta Government Investments Ltd also carried out payments to credit rating agencies. Therefore, while the Ministry only paid €39,724 in 2017, to Fitch Ratings, the total sum paid by all three entities reached its highest level up to that point – €290,383.

The figures tabled by Minister Caruana, being limited to only one entity, did not reflect the actual total, leaving the actual total amount paid unpublished since 2018.

BusinessNow.mt can now for the first time reveal the total amounts paid in 2019, 2020, and up to October of this year.

The updated figures, received from the Ministry for Finance, show that the amounts Government paid to the various credit rating agencies continued increasing since the last time the figures were published in 2018.

While 2018 saw a minor reduction from the preceding year in the cost of such ratings – €284,501 – both 2019 and 2020 saw the total sum top €300,000 for the first time.

Meanwhile, the sums paid to individual agencies by the Ministry for Finance in 2021 can also be revealed, with Fitch Ratings remaining the only agency contracted directly by the Ministry, receiving €40,147 this year, down from the €42,383 received in 2020.

Ratings agency Standard & Poor’s has not been paid by the Ministry since 2016, though a recent grading indicates that its services are still being contracted.

Former Minister Scicluna has stated that Malta has been making payments to credit rating agencies since 2000.

What are credit rating agencies and why are they important?

Credit rating agencies are firms that rate the riskiness of debt, whether corporate or sovereign. These ratings serve as vital indicators to investors, and essentially answer the question – “How likely is it that this entity will default on its debt obligations?”

The Big Three are Standard and Poor’s (S&P), Fitch Ratings and Moody’s, although others exist, and the Government of Malta has used all of the Big Three along with others like DBRS.

Credit rating agencies came under fire during the Great Recession of 2008 and the European Sovereign Debt Crisis of the early 2010s, and when questioned in front of the United States’ Congressional Committee, they defended their actions by saying that rather than making researched and informed ratings for investors, they were merely providers of “opinions”.

This was not enough to convince legislators, and the agencies were more tightly regulated through the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 in the US and the CRA Regulation of 2009 in the EU, which was subsequently amended to bring it in line with the creation of the European Securities and Markets Authority (ESMA).

In a communication from 2013, the European Commission explained that the “quasi-institutional role” of credit ratings, their lack of transparency and lack of independence from the entity that contracts them to provide a service, and the absence of liability required increased regulatory oversight.

Malta’s inflation edges up to 2.7% in October as food and services lead price pressures

The October RPI reading indicates some re-acceleration in consumer-facing sectors after a period of summer stabilisation

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion

Celebrating success: stories from the team behind Finco Trust

The stories of Lee-Anne Abela, Kris Vella, and Maria Mamo reflect the values that continue to guide the firm forward