Last week, Simonds Farsons Cisk published its Annual Report & Financial Statements for the 2024/25 financial year which came to an end on 31st January 2025.

It was yet another record financial year for the Group with revenue from the beverage businesses growing by 5.5 per cent to €101.8 million while revenue from the food businesses increased by 6 per cent to €39.7 million. As such, the Group’s total revenue amounted to a new all-time high of €141.5 million compared to €132.9 million in the previous year.

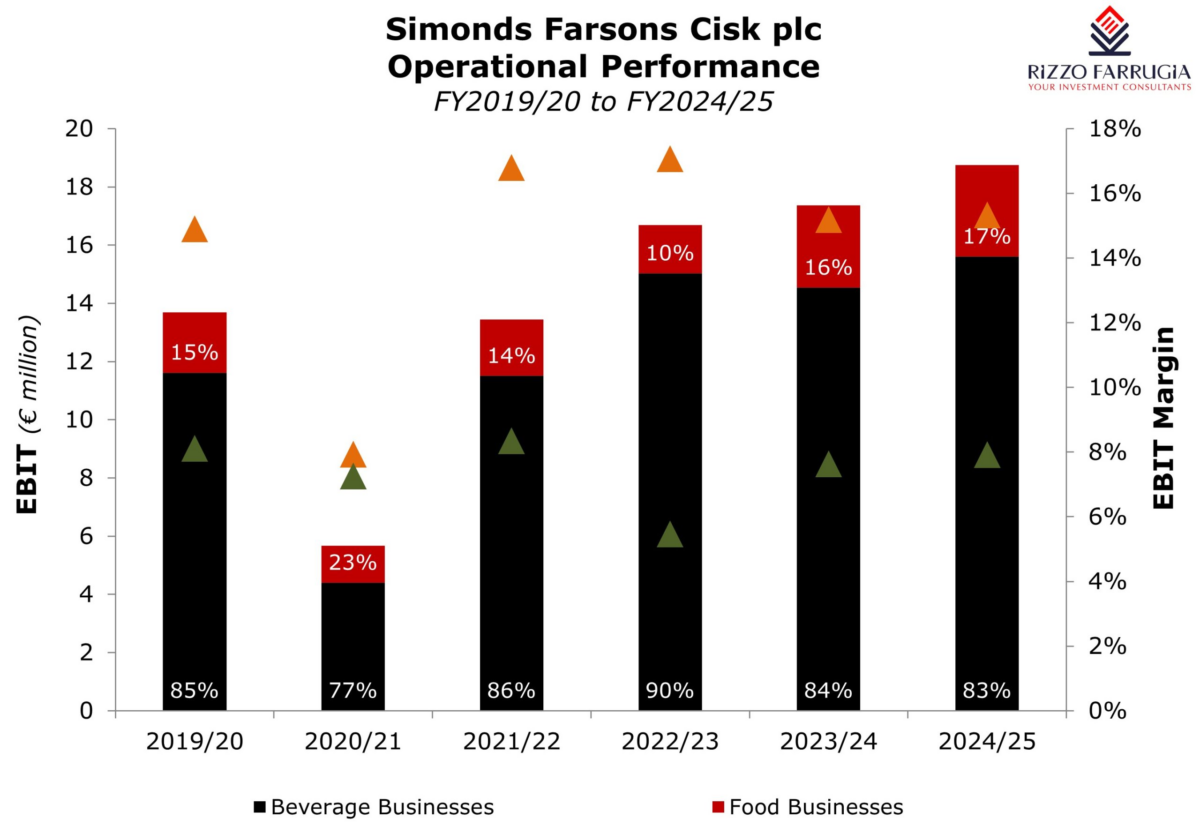

The operating profit of the beverage businesses climbed by 9 per cent to €15.6 million while the operating profit of the food businesses amounted to €3.1 million. Overall, the Group’s operating profit increased by 7.9 per cent also to a fresh record of €18.8 million (FY2023/24: €17.4 million). The Group’s operating profit margin remained virtually unchanged at 13.2 per cent. Excluding depreciation and amortisation charges, EBITDA increased by 8.8 per cent to €28.7 million translating into an EBITDA margin of 20.3 per cent (FY2023/24: 21.0 per cent).

Farsons reported a profit after tax of €17.0 million (+23.7 per cent) from the beverage businesses and a profit after tax of €1.66 million (+5.8 per cent) from the food businesses. Overall, the Group’s net profit reached a record of €18.6 million, which is 22 per cent higher than the previous year and translates into a return on average equity of 11.9 per cent (FY2023/24: 10.6 per cent).

Last week, in conjunction with the publication of the Annual Report, the Directors of Farsons resolved to recommend a final net dividend (out of tax-exempt profits) of €0.14 per share representing an increase of 27.3 per cent compared to the final net dividend of €0.11 per share last year. When including the net interim dividend of €0.06 per share paid in October 2024 (Oct 2023: €0.05), the total net dividend attributable to FY2024/25 amounts to €0.20 per share, which is 25 per cent higher than the total net dividend attributable to the previous financial year and represents a conservative payout ratio of 39 per cent.

In his address to shareholders within the Annual Report Chairman Louis A. Farrugia described the past financial year as a “year of strategic importance”. Mr Farrugia explained that following a strategic review concluded in 2024, the Board has determined that the food business is now well-positioned for further expansion as an independent, focused entity. The review concluded that this reorganisation intends to maximise value for shareholders and stakeholders, driving both organic and inorganic growth, while maintaining alignment with the Farsons’ Group long-term vision.

At the upcoming Annual General Meeting being held on 26th June, shareholders will be asked to approve a resolution for the spin-off of the food businesses, namely Quintano Foods Limited and Food Chain Limited, into a separately publicly listed company which will be called Quinco Holdings plc and whose shares will also be listed on the Malta Stock Exchange. The spin-off and eventual listing of Quinco Holdings plc is expected to be concluded by 31st December 2025.

Quinco Holdings plc will have the same number of shares as those in Simonds Farsons Cisk plc (i.e 36 million) and the spin-off will take place as a ‘dividend-in-kind’ to the shareholders of Simonds Farsons Cisk plc, proportionate to the number of shares which they hold. This is similar to the property spin-off into Trident Estates plc that took place in 2018.

Earlier this week, Farsons published an Explanatory Circular with further details on the proposed spin-off, including a detailed vision for the Quinco Group and the basis for determining the value of the ‘dividend-in-kind’.

This is being determined by reference to the net asset value per shares on the record date of the distribution. Based on the pro forma financial statements as at 31st January 2025, the net asset value amounts to €1.30 per share. Although this may change until the record date is established in due course ahead of the listing, this should not be material and therefore a ‘dividend-in-kind’ of circa €1.30 per share should be attributable to all shareholders of Farsons in the months ahead.

The Chairman of Farsons clearly stated that the first decision for the newly formed Board of Directors of Quinco Holdings plc is to devise an ambitious growth plan for the business.

Meanwhile, in the 2024/25 Annual Report, CEO Norman Aquilina explains that “the food category remains excessively fragmented with growing signs of expected market consolidation, many recognising this inevitability to hold on to a competitive position”. Mr Aquilina also noted that “Quintano Foods is working towards strengthening its brand portfolio in anticipation of the move to the new distribution centre.” Indeed, in the 2023/24 Annual Report, the CEO had highlighted that through the Group’s investment in a new warehouse and logistics centre in Ħandaq, the company will more than triple its current storage capabilities.

In the Explanatory Circular it is clearly stated that the Quinco Group aims “to unlock significant growth potential (both organic and inorganic) to drive long-term value for stakeholders”.

The upcoming addition of Quinco Holdings plc to the MSE should be an interesting development not only for the shareholders of Farsons who would be receiving their shares in the new entity in due course, but also for the wider investing community in Malta. It could prove to be a precursor to some M&A activity as Quinco’s stated vision is to consolidate the food importation segment as well as the restaurant franchising business.

Meanwhile, the Farsons Group maintains a positive outlook for the current financial year ending in January 2026 “supported by ongoing investments in infrastructure, a dynamic tourism sector, and prudent financial management”. The publication of the Financial Analysis Summary due by the end of July should give a clear indication of the anticipated growth in the beverage segment which remains the key profitability driver.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

What if we blend iTunes, Uber & Netflix into banking?

Instant payments, T+1, and AI. Like iTunes, Uber and Netflix for finance!

Devising an Equity Market Development Programme

The equity market suffers from chronically thin trading volumes especially in the aftermath of the pandemic

Funding national projects

How can capital markets be used to diversify the funding sources of long-term national development projects