Minister for Finance and Employment Clyde Caruana today unveiled a sweeping reform of Malta’s tax collection regime, saying it “marks the beginning of a much-needed culture change”.

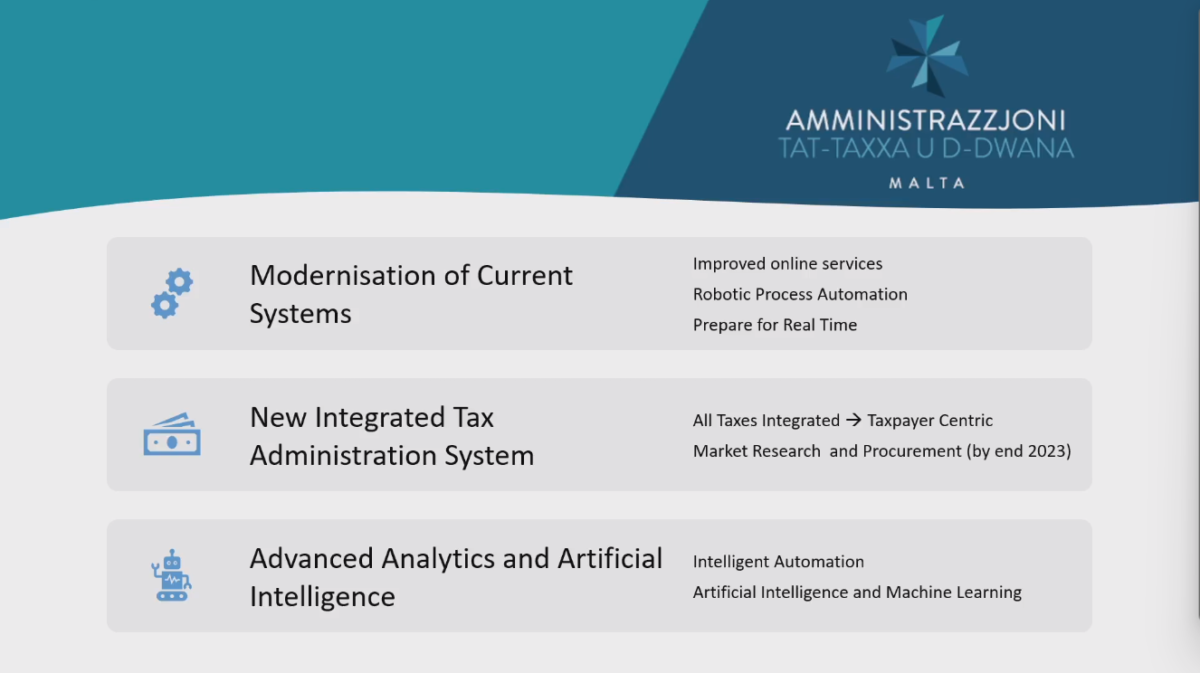

The reform is the result of “two years of intensive work”, and will see the Income Tax, Value Added Tax and Customs Department merge to become the Malta Tax and Customs Administration, bringing the Government’s major revenue collection systems under one roof.

“The strategy will transform the Commissioner for Revenue into an administration suited for an evolving economy whilst reaping the benefits of modern technology,” he said.

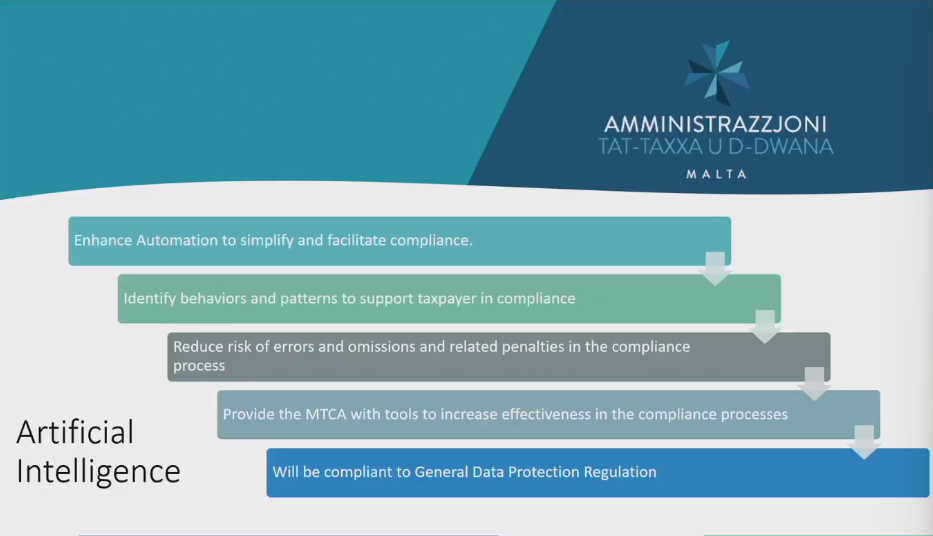

The new entity will be introducing a high-end artificial intelligence (AI) system to catch tax cheats.

“If someone has land worth a million euros, to justify the purchase of the land, there needs to be substantial income. It can’t be income of €20,000 or €10,000. So this new programme will pull the information of liquid assets, such as deposits, illiquid assets, such as land, buildings, cars. We have registries of everything. All this would be compared with what is declared.”

It will be analysing VAT returns by the end of this year and all other forms of taxes within the next three years, he said.

The system is currently used in several countries, including the UK, the Netherlands, Ireland, Canada and New Zealand, and is expected to help the newly reformed tax department to monitor and calculate income and tax dues far more quickly and efficiently by running daily analyses of the wealth owned by people and companies and matching it with their declared income.

It will also automatically alert authorities when a person or business’s declared income does not tally with their accumulated wealth, according to Minister Caruana.

The Minister has long spoken of the need for Government to collect its dues, and has often criticised elements of the business community for under-declaring income.

Late last year, he revealed that a specialised team from the International Monetary Fund were in Malta to advise the relevant authorities on how Malta can achieve “better compliance” by local companies with regards financial reporting

“It’s difficult to achieve the desired results when the corporate revenue we get arises from just 30 per cent of local firms. The other 70 per cent declare either break even or register a loss,” he said at the time.

On Tuesday, the Minister continued in much the same vein, arguing that the singular AI-powered revenue collection administration “marks the beginning of a much-needed culture change and will alter the way tax investigations are done.”

He said the time when people would be investigated based on an anonymous tip-off, or as a result of a random probe, is gone.

“Rather, the software will run a quick, daily analysis of the population and will conduct work that usually takes weeks and months in just a few minutes.”

The reform is a major part of the Officer of the Commissioner for Revenue’s three-year strategic plan, launched today and covering the period 2023 to 2025, titled Delivering Transformation.

“The strategy is intended to ensure that our country does more with less by making better use of existing revenue, and that all taxes due are collected,” said Minister Caruana.

“Indeed, the mindset of delayed payments and systematic non-compliance needs to change for the sake of good governance and fairness. An increase in compliance and efficiency would also allow Malta’s tax burden to remain relatively low in comparison to European counterparts thus sustaining economic development and labour market growth.”

He said he understands that “some will not appreciate this effort – they will even say it is an attack on business, that I have a grudge against business people, or that I am attempting to stifle economic growth.”

Minister Caruana pushed back vociferously against such suggestions, making the case that he “could never” be against economic growth, “because it’s what drives employment and wealth”.

“But I am not in favour of crony capitalism, in which business people feel that paying taxes is a burden, instead of a duty,” he said.

“I want to foster an economy that awards creativity over the individual’s connections. I want a country in which perseverance prevails over established power, inclusivity over exclusivity, and in which we strengthen equity and reduce inequality, and push people who work honestly over people who attempt to engage in illicit influence for their gain.

“I want to see a system that leads to progress that everyone can enjoy, not just the few. These are the concepts over which we are building the strategy we are announcing today because the people deserve better.”

He touted the Government’s track record in supporting the Maltese economy through troubled times, and highlighted the importance of strong public finances in order that it may do so: “When the moment of truth arrived, whether it was COVID, whether it was the Ukraine war – everyone turned to the Government. But if taxes were not collected, it would not have been possible to distribute hundreds of millions of euro to save families and businesses.”

Pointing out that taxes make up 85 per cent of the Government’s revenue, the Minister noted with satisfaction a 42 per cent increase in the number of people calling in to regularise their tax position last year, and said it “was no coincidence” that 2022 saw the collection of €240 million more in VAT.

While acknowledging that the increase revenue is partly the result of a growing economy, he stressed that “it is also because tax administration is strengthening its efforts to collect everything that it’s due.”

From €1,000 apologies to €2,600 proposals: Malta’s most dramatic bouquets

Yes, those numbers are correct

Veracloud recognised as winner of 2025 Microsoft Malta Partner of the Year

Veracloud has been named Microsoft Malta Partner of the Year 2025, recognised for its outstanding innovation and cloud-driven customer solutions

The Remarkable Collective appoints Alan Caruana to its Strategy Partners Collective

His EU funding and advisory expertise strengthens TRC’s consultancy offer and creates new opportunities for Maltese SMEs