The Central Bank of Malta (CBM) has published its first climate-related financial disclosures report for its euro and foreign currency-denominated non-monetary policy portfolio (NMPPs).

Publication of the report is in line with the recommendations made by the Task Force on Climate-related Financial Disclosures (TCFD) adopted by the European Central Bank (ECB) and Eurosystem national banks. It seeks to demonstrate the risks the investments have coming from the transition to lower carbon-intensive economies and their impact on the environment.

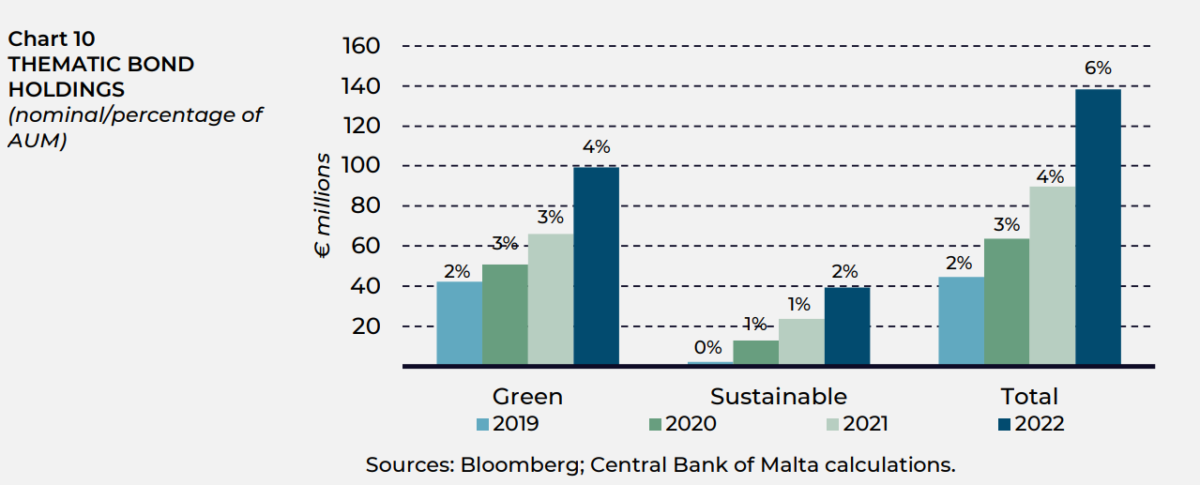

The report shows that the share of green and sustainable bond holding in its NMPP grew from 2 per cent in 2019 to six per cent in 2022, with a majority of being investments being in green bonds.

Green and sustainable bonds are debt instruments issued by firms or other entities looking to raise funds for new or existing projects focused on environmental benefits and economic sustainability.

The report does note that, investment in green and sustainable bonds for the NMPPs does not necessarily directly imply lower emissions because the underlying projects do not automatically translate into comparatively low or falling carbon emissions at the issuer firm level. However, the climate mitigation projects financed by the capital raised by the issuer firm, result in “avoided emissions” that would have otherwise occurred.

The CBM aims to align its NMPPs with the EU’s target of achieving carbon neutrality by 2050 and will therefore seek to intensify its efforts to ensure gradual progress is made towards this target while maintaining traditional investment objectives of capital preservation, liquidity and return.

“Climate change is the greatest challenge humankind is facing this century, and its impact is becoming increasingly evident. To secure a liveable future, urgent decisions need to be taken. They need to be taken now,” said CBM Governor Edward Scicluna, in the report’s foreword.

In addition to its mandatory Eurosystem disclosures, the CBM has also published additional metrics to improve its assessment of the climate-related profiles of their NMPPs.

As a member of the Central Banks and Supervisors Network for Greening the Financial System (NGFS), the CBM will continue to actively participate in its meetings and work streams and the Eurosystem network covering climate-related climate risks and disclosures.

Malta introduces new 15% tax regime for highly skilled professionals

Qualifying individuals are taxed at a flat 15% rate for an initial five-year period

Malta’s inflation edges up to 2.7% in October as food and services lead price pressures

The October RPI reading indicates some re-acceleration in consumer-facing sectors after a period of summer stabilisation

db Group reports turnover of almost €100 million and record profit as it opens bond issue to public investors

This coincides with the launch of a €60 million bond programme to support the Group’s continued expansion