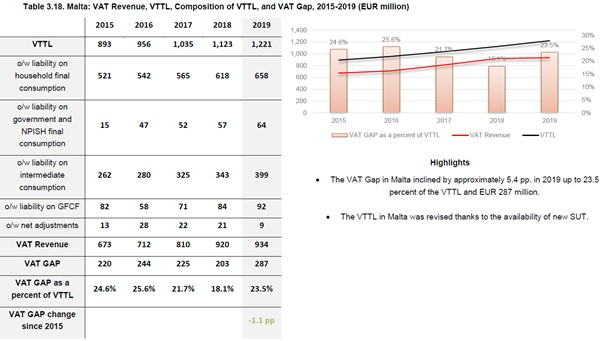

The Maltese Government failed to collect an estimated €287 million of VAT payments in 2019, according to the European Commission, which noted that this makes up close to a quarter of all VAT due.

The difference between the VAT due and that collected, known as the VAT gap, increased by 5.4 percentage points in Malta – the highest increase in the EU – to reach 23.5 per cent.

This means Malta has the third largest VAT gap in Malta, behind Romania, with 34.9 per cent of the VAT due going uncollected, and Greece, with 25.8 per cent.

The European Commission calculated that the maximum VAT revenue Malta could have recouped in 2019 was €1,221 billion. Actual revenues, however, stood at €934 million.

This gap of €287 million represents VAT fraud and evasion, VAT avoidance, bankruptcies, and financial insolvencies, as well as miscalculations and administrative errors.

The increase in Malta’s VAT gap comes even as the EU’s overall VAT gap decreased from €141 billion in 2018 to €134 billion in 2019.

In a statement, the European Commission said that lost VAT revenues have an extremely negative impact on Government spending on things like schools, hospitals and transport.

Missing VAT could also prove beneficial as member states strive to cover debt incurred during the initial recovery from the COVID-19 pandemic, or raise their climate financing ambitions.

Commissioner for the economy Paolo Gentiloni said, “This year’s figures correspond to a loss of more than €4,000 per second. These are unacceptable losses for national budgets, and mean that ordinary people and businesses are left to pick up the shortfall through other taxes to pay for vital public services.

“We need to make a joint effort to crack down on VAT fraud, a serious crime that takes money out of consumers’ pockets, undermines our welfare systems and depletes government coffers.”

Wolt Market unveils refreshed identity in Malta

Expanded partnerships with Maltese producers, upgraded fresh food categories, all in vibrant green – Wolt Market marks a new milestone

Irrestawra Darek grants for Reġjun Nofsinhar oversubscribed within days

Demand for the scheme surged immediately upon opening

Clyde Caruana pledges energy subsidies to remain amid Iran war oil price volatility

Finance Minister says it is too early to assess the additional cost arising from developments in the Middle East