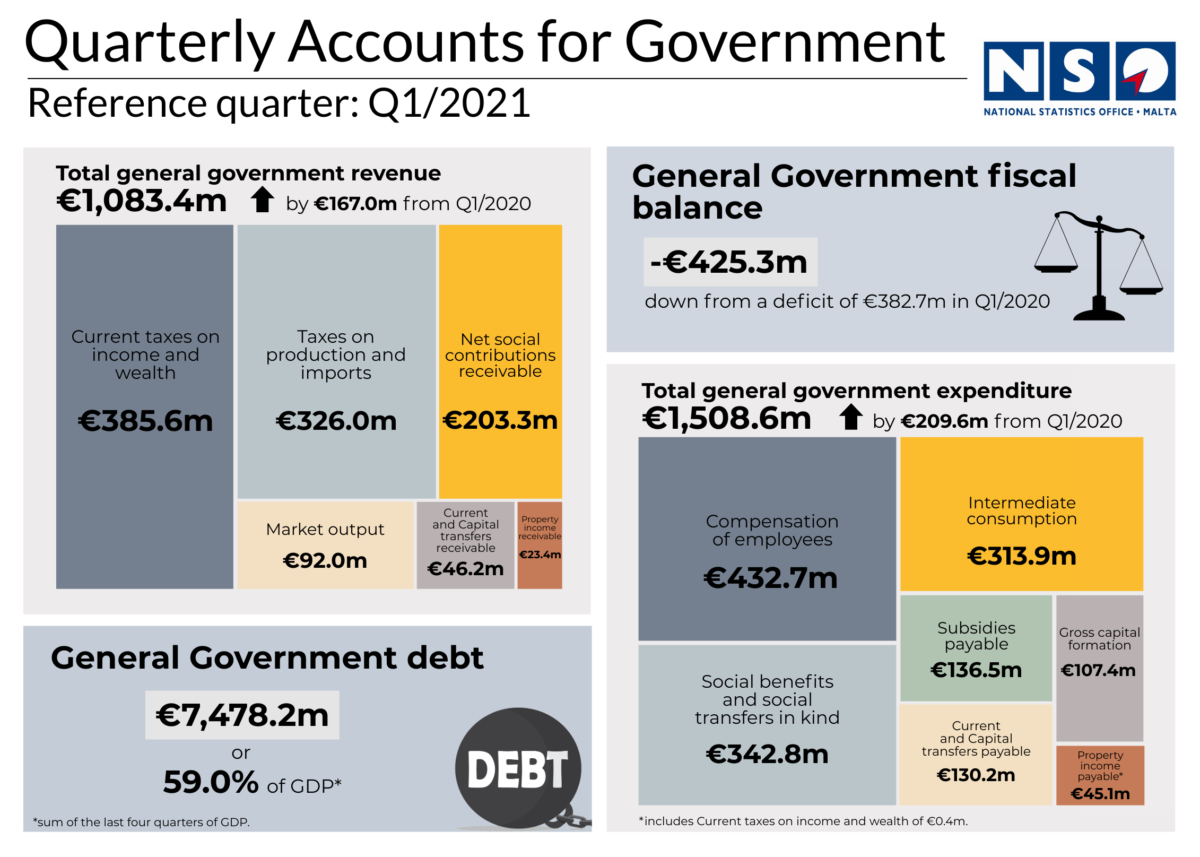

The Government recorded a deficit of €425.3 million between January and March of this year, notwithstanding an increase of €167 million in revenue when compared to the corresponding quarter in 2020.

The deficit was fuelled by an increase of €209.6 million in Government expenditure over Q1 2020 to reach €1,508.6 million, with intermediate consumption registering the largest rise of €118.7 million.

This was followed by subsidies payable (€53.6 million), mostly in relation to the COVID-19 Business Assistance programme.

Notably, compensation of employees increased by €46.8 million, or over 12 per cent, over the corresponding quarter of 2020.

Other increases were recorded in social benefits and social transfers in kind (€20.2 million), property income payable (€2.7 million), current transfers payable (€2.3 million) and current taxes on income and wealth (€0.1 million).

Meanwhile, total revenue stood at €1,083.4 million, an increase of €167 million when compared to the corresponding quarter in 2020.

The largest increase in revenue was recorded in current taxes on income and wealth (€112.5 million), followed by net social contributions (€40.9 million), market output (€19.8 million) and capital transfers receivable (€10.3 million).

These increases in revenue were partially offset by decreases in taxes on production and imports (€9.0 million), property income receivable (€5.6 million) and current transfers receivable (€1.9 million).

In relation to financial transactions in assets, during the first quarter, other accounts receivable and currency and deposits registered an increase of €189.4 million and €85.7 million, respectively.

Long-term debt securities increased by €1 million, while equity and investment fund shares increased by €0.9 million.

On the other hand, long-term loans recorded a decrease of €0.3 million.

Considering the financial transactions in liabilities, the highest increase was recorded in long-term debt securities (€275.1 million), followed by long-term loans (€126.9 million), short-term debt securities (€124.5 million) and other accounts payable (€95.6 million).

In contrast, currency and deposits decreased by €3.2 million.

Government Debt

At the end of March, General Government debt stood at €7,478.2 million, or 59 per cent of GDP.

This equates to an increase of €1,544.8 million over the corresponding quarter in 2020, largely reflected in Central Government Debt which amounted to €7,474.8 million.

Short-term and Long-term debt securities increased by €283.3 million and €920.9 million, respectively.

Currency and deposits stood at €469.2 million, an increase of €90.7 million over March of 2020. This includes the euro coins issued in the name of the Treasury, considered a liability of Central Government, and the 62+ Malta Government Savings Bond, the latter amounting to €379.5 million.

Additionally, Long-term loans registered an increase of €250.2 million, while Short-term loans declined by €0.4 million. Local Government debt stood at €3.4 million.

General Government guaranteed debt amounted to €1,185.8 million at the end of March 2021, equivalent to 9.3 per cent of GDP. There was an increase of €175.1 million when compared to the first quarter of 2020.

Malta’s inbound tourism surges by 14.6% in April 2025

194,126 tourists visited the sister islands

Childcare centres raise alarm over delayed service agreement

Discussions with the Government have yet to result in any concrete proposals, said CCPA President Simon Zammit

Built differently – CLA Malta offers custom solutions in a cookie-cutter landscape of tax advisory and business

Their client-centric philosophy extends far beyond conventional consultancy.