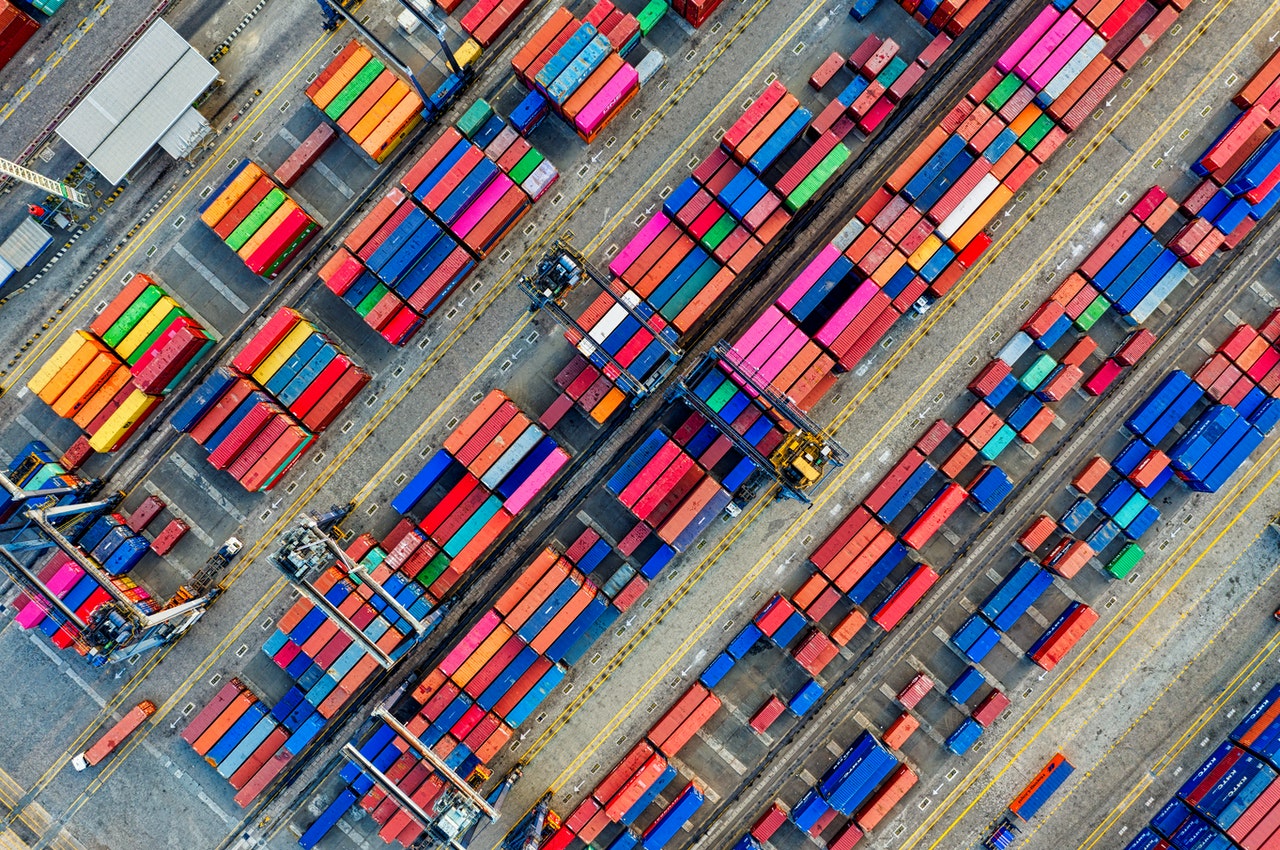

As the UK prepares to exit the EU on 31st December, and the chances of both sides striking a deal become increasingly slim, MaltaPost has published a presentation for how the UK’s changes to its import/export rules are likely to impact your business.

In order to prepare for full border controls on imports from the EU, the UK will introduce three key changes in the tax regime between the two sides.

It will become mandatory to provide electronic customs data, the low value consignment relief will be removed on commercial goods and a new VAT scheme will apply for commercial items valued between £0 and £135.

With regards to buying goods from the UK, from 1st January 2021, the UK will be considered a third-country and therefore, full customs controls will apply when purchasing goods from the region.

Check out MaltaPost’s full presentation here.

General fear of travelling doesn’t justify free holiday cancellation, MCCAA warns

Malta Competition and Consumer Affairs Authority clarifies rights for travellers amidst concern over the Middle East war

Malta to host first Mediterranean forum on accessible hospitality

One panel will examine Malta’s potential role as a regional focal point for promoting accessibility in the hospitality sector

Merchant Shipping Directorate ‘providing full support’ to Malta-flagged vessels in Middle East

Malta committed to ensuring that its flag continues to represent safety and stability ‘even in challenging circumstances’