Malta International Airport plc (MIA) was among the four companies that published their half-yearly financial results last week.

Given the monthly announcements of the traffic movements by the airport operator and the strong growth recorded in each of the first six months of the year, it was natural to expect the company to report another record financial performance.

MIA announced last week that as a result of the 11.7 per cent growth in passenger movements between January and June 2025 to 4.54 million (a reflection of the higher seat capacity and representing an additional 475,000 passengers), total revenue also jumped by 11.9 per cent to a record of €71.9 million.

Revenue from the ‘Aviation’ segment registered an increase of 11.1% to €49.2 million whilst revenue from the ‘Retail and Property’ segment grew by 11.9 per cent to €22.4 million. During a financial analyst presentation held last Friday, CEO Alan Borg noted that the non-aviation segment (retail and property) registered a slightly faster growth in revenue compared to aviation income. In terms of overall revenue contribution, it is worth highlighting that although aviation income remains the largest contributor, the retail and property segment has improved its share to almost 32 per cent of total income.

On his part, the outgoing CFO Karl Dandler explained that the stronger income from the retail and property segment is not only a reflection of the upturn in passenger growth but in particular, this reflects the increased expenditure at certain concessionaires within the terminal which positively contributes to the company’s revenue. Moreover, the CFO remarked about the consistent upturn in revenue from the airport lounge and other VIP services.

Given the predominantly fixed cost base of the company, the higher revenue flowed through to the bottom line with EBITDA reaching €45.7 million (+11.4 per cent), profit before tax of €37.8 million (+10.5 per cent) and profit after tax of €24.5 million (+10.7 per cent). The annualised return on average equity remains elevated at 23.5 per cent.

In line with the resumption of its semi-annual dividend policy following the COVID disruptions, the interim dividend was left unchanged from last year at €0.06 per share. Over the past three financial years, MIA distributed higher annual dividends to shareholders to a record of €0.18 per share in 2024. Given the dividend payout ratio of its parent company Flughafen Wien AG (Vienna Airport) at 60 per cent, one could expect a further slight upturn in the final dividend to be announced in the first quarter of 2026 also taking into consideration the very positive financial performance of MIA and the strength of its balance sheet.

MIA continues to invest significant sums in various parts of the business without the need to take on any borrowings. Moreover, as at 30 June 2025, despite the heavy capital expenditure, the company had cash and cash equivalents of over €50 million.

As I had reported in mid-May following the publication of the Q1 financial statements and the April traffic results, given the very strong start to the year, the company should easily surpass its initial target for 2005 of 9.3 million passengers (+3.7 per cent growth).

In fact, last week, MIA upgraded its passenger and financial forecasts for 2025. The company now expects an additional 400,000 passengers from its January forecast to a total of 9.7 million (which would represent growth of 8.3 per cent from the record level of 2024).

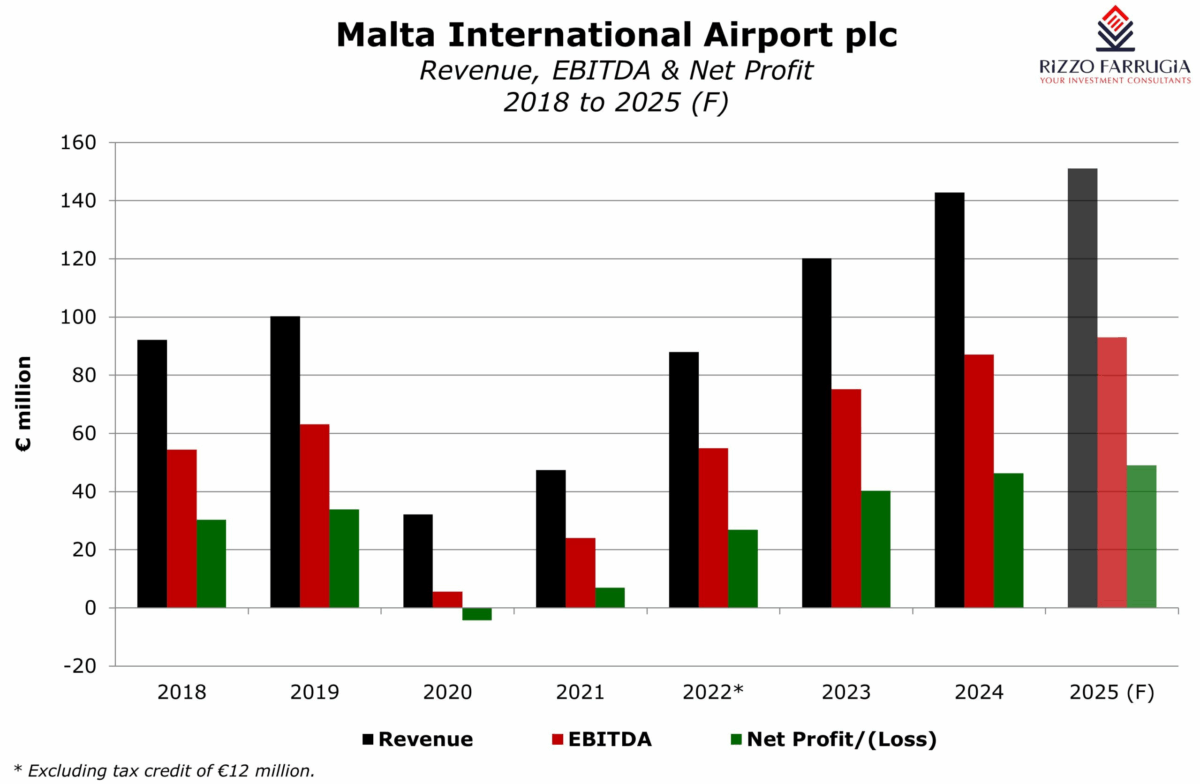

Likewise, revenue is expected to rise to €151 million (previous forecast: €147 million), EBITDA to €93 million (previous forecast: €91 million) and a net profit of €49 million (previous forecast: €48 million).

Also last week, MIA published its July traffic results showing a very strong growth in seat capacity of 8.8 per cent in one of the key months for the company. The CEO attributed this strong growth rate to the high demand from travellers to destinations across Southern Europe. The interim financial report published last week made reference to statistics across the Southern European region indicating that Malta emerged as the best-performing destination within its peer group as it outperformed six comparable destinations.

Another important observation that emerged last week was the continued strength of Ryanair’s market share as it accounted for 52 per cent of all passenger movements while the market share of KM Malta Airlines decreased to 18 per cent as it suffered a drop of 11 per cent in passenger movements in the first half of 2025.

Investors may not appreciate the strong growth in passenger traffic over the past decade with just over 5 million passengers in 2016 and now fast approaching the 10 million level this year. One must also take into consideration the brutal impact from the COVID-19 pandemic between 2020 and 2022.

The very strong growth in passenger movements led to an equally remarkable improvement in the company’s financial performance over recent years. Assuming the company achieves its targets for 2025, revenue would have more than doubled since 2016 from €73 million to €151 million with profit after tax rising by 133% from €21 million in 2016 to an estimated €49 million in 2025.

MIA is embarking on a major capital expenditure programme over the next 5 years which will lead to a sizeable increase in the retail and property segment. With the company’s EBITDA already approaching €100 million annually, the company should consider taking on some long-term debt similar to the capital structure of several other European airports. This will enhance shareholder returns and provide capacity for higher cash dividends in the future once the terminal expansion and SkyParks two project are fully operational.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

A Liquidity Provider for the corporate bond market

Edward Rizzo suggests the Malta Development Bank could play an important role in revitalising the secondary market for corporate bonds

What if we blend iTunes, Uber & Netflix into banking?

Instant payments, T+1, and AI. Like iTunes, Uber and Netflix for finance!

Devising an Equity Market Development Programme

The equity market suffers from chronically thin trading volumes especially in the aftermath of the pandemic