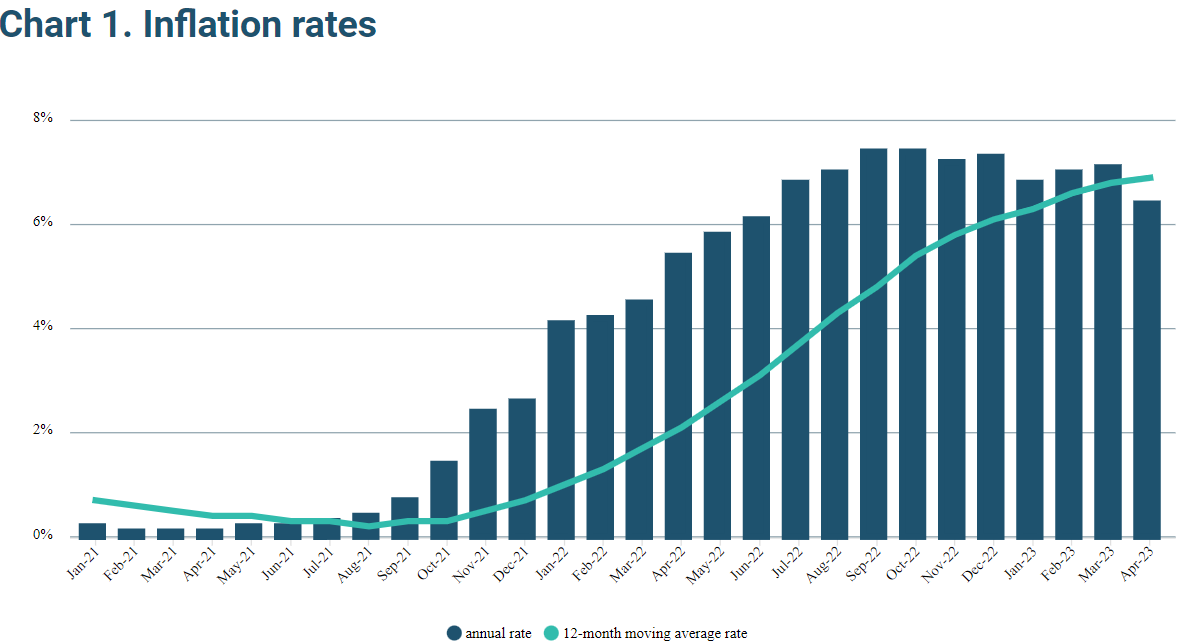

Malta’s rate of inflation registered a drop of 0.7 per cent in April 2023, returning well below the seven per cent level following three months of consecutive increases.

The 12-month moving average for inflation stood at 6.9 per cent, up 0.1 per cent from the previous month.

Food and non-alcoholic beverages maintained the top spot as the main drivers of inflation (11.4 per cent) followed by furnishing, household equipment and routine household maintenance (8.3 per cent) and restaurants and hotels (5.6 per cent).

Meanwhile, clothing and footwear registered the lowest annual inflation rate (0.5 per cent) followed by communication (1.3 per cent).

By making use of the European Classification of Individual Consumption according to Purpose (ECOICOP), it is possible to measure the impact of different categories through the inclusion of an index, which takes into account both the weight and the annual rate of inflation of each category.

According to the NSO, higher prices of milk, cheese and eggs were largely responsible for inflation in the food and non-alcoholic index, which was the main contributor to inflation.

This was followed by the restaurants and hotels index, and the housing, water, electricity, gas and other fuels index, which attribute their rate of inflation to higher prices of restaurant services and house maintenance services, respectively.

The drop in inflation also denotes Malta's rate of inflation return below the eurozone (seven per cent).

Malta’s public debt ‘very much in line’ with Eurozone rules – BOV Chair

The chairperson of Malta’s largest bank shrugged off the doubling in Maltese Government debt since 2019

Malta’s public debt tops €11 billion

The debt-to-GDP ratio remains well within EU limits

New EIB and BOV partnership channels ‘fresh financing to Maltese businesses’

The banks say this initiative is designed to enhance the working capital and investment capacity of Maltese mid-sized firms