Loans subject to a moratorium declined for the fourth consecutive time since March 2020, suggesting that some businesses and households have recommenced regular loan repayments, signalling a recovery in income flows.

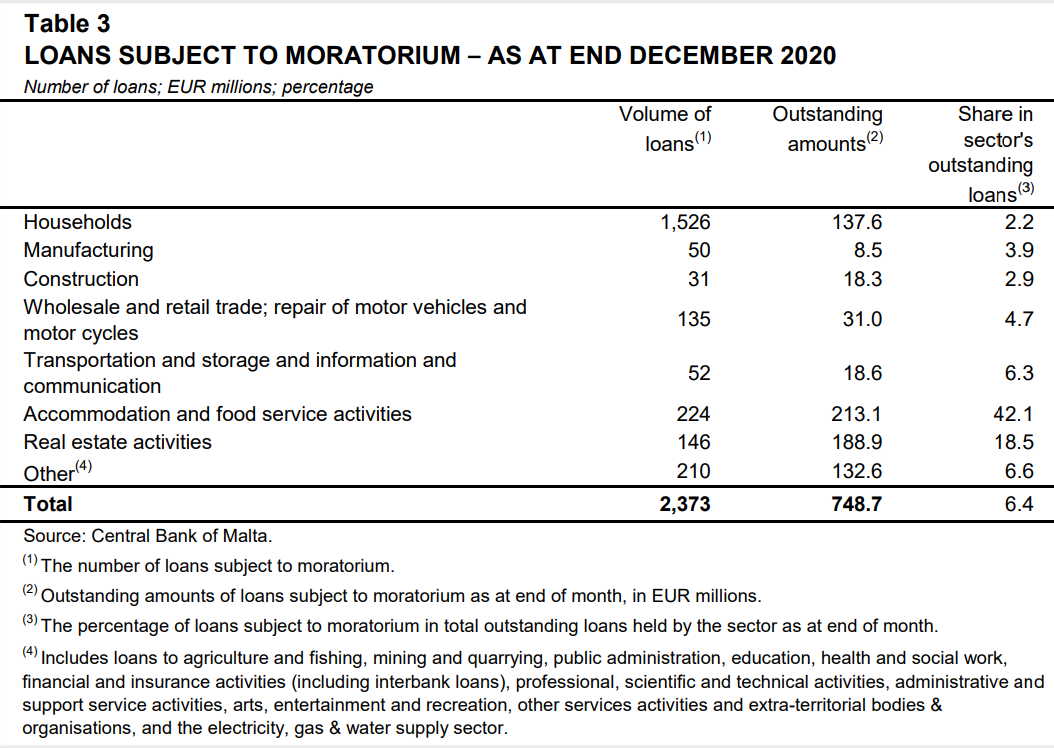

As at end-December, there were 2,373 loans subject to a moratorium on repayments, the Central Bank of Malta (CBM) reported in its Economic Update for December 2020.

In response to the outbreak of COVID-19 and the subsequent containment measures, several businesses and households were faced with liquidity challenges, and thus applied with monetary financial institutions in Malta for a moratorium on loan repayments.

The total value of loans subject to a moratorium in December edged down when compared with November, the CBM noted.

These declined by around €185 million and stood at €748.7 million, or 6.4 per cent of total outstanding loans to Maltese residents.

When compared with a month earlier, the largest declines in euro and volume terms were observed in the household, wholesale and retail as well as real estate sectors.

The largest number of loans covered by moratoria was held by households, with the sector accounting for 64.3 per cent of the total volume of loans subject to a moratorium.

Maltese households held €137.6 million, or 18.4 per cent, of the total value of loans subject to a moratorium, equivalent to 2.2 per cent of outstanding household loans.

Meanwhile, the accommodation and food services activities sector held €213.1 million in loans subject to a moratorium.

This is the sector most affected by the containment measures and, indeed, 42.1 per cent of the loans held by this sector were subject to a moratorium by the end of December.

The real estate sector held €188.9 million in loans subject to a moratorium, or around 25.2 per cent of such loans – equivalent to slightly less than a fifth of the sector’s outstanding loans.

Moreover, as of end-December, the wholesale and retail trade sector held €31.0 million in loans subject to a moratorium, making up 4.1 per cent of loans subject to a moratorium, or 4.7 per cent of loans held by the sector.

In addition, the CBM reported that in terms of the number of facilities, the sector comprising wholesale and retail activities applied for the largest number, and had the largest value of sanctioned loans, at €95.1 million.

This was followed by accommodation and food services activities, with 122 facilities making up a total of €93.1 million in sanctioned loans, and the sector comprising transportation and ICT, which had a total sanctioned amount of €39.4 million.

Celebrating success: stories from the team behind Finco Trust

The stories of Lee-Anne Abela, Kris Vella, and Maria Mamo reflect the values that continue to guide the firm forward

Malta’s public debt ‘very much in line’ with Eurozone rules – BOV Chair

The chairperson of Malta’s largest bank shrugged off the doubling in Maltese Government debt since 2019

Malta’s public debt tops €11 billion

The debt-to-GDP ratio remains well within EU limits