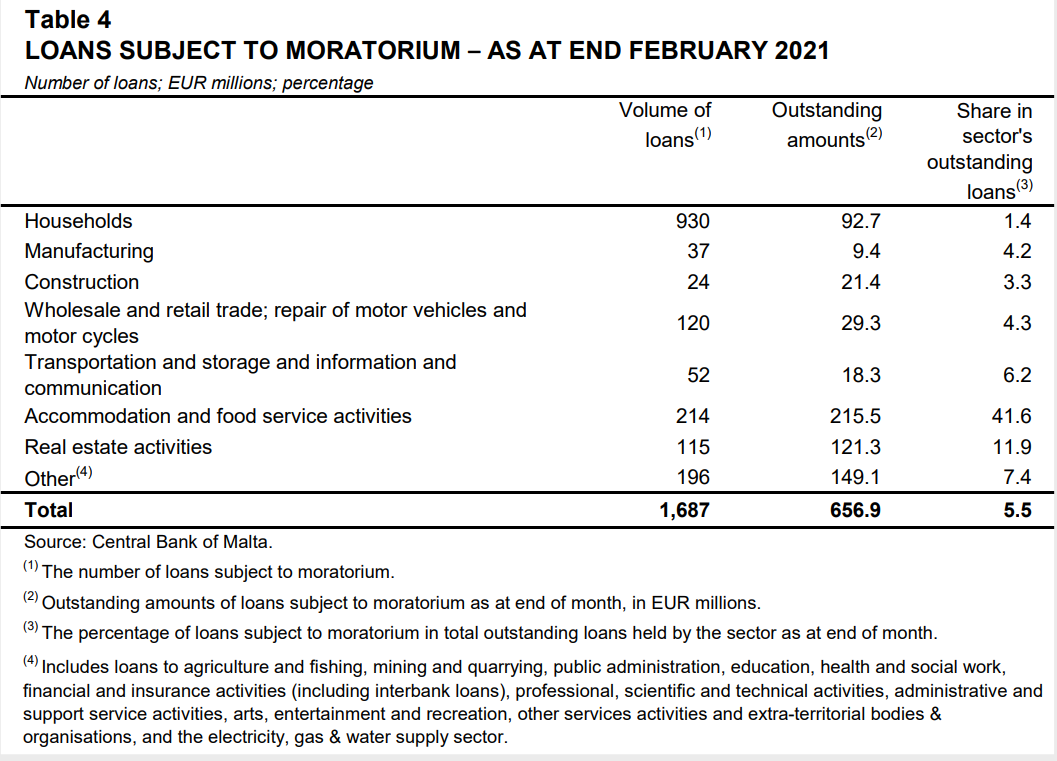

As at end-February, there were 1,687 loans subject to a moratorium on repayments. The total value of loans subject to a moratorium in February edged down further when compared with January, the Central Bank of Malta said in its latest economic update.

In response to the outbreak of COVID-19 and the subsequent containment measures, several businesses and households were faced with liquidity challenges, and thus applied with financial institutions in Malta for a moratorium on loan repayments.

Of the 1,687 loans still subject to moratorium on repayments, a decline by around €34 million was observed in February, reaching a value of €656.9 million, or 5.5 per cent of total outstanding loans to Maltese residents.

Such moratoria declined for the seventh consecutive time since March 2020, in addition, in February, the drop was larger than that observed in the preceding month when the smallest decline was recorded.

When compared with a month earlier, declines in value terms were observed in the real estate, wholesale and retail, and information and communication sectors, as well as ‘other’ categories’. These were partly offset by an increase in the value of loans extended to households, and the manufacturing, construction, transportation and accommodation sectors.

The largest number of loans covered by moratoria was held by households, with the sector accounting for 55.1 per cent of the total volume of loans subject to a moratorium. The outstanding value of loans subject to a moratorium of Maltese households rose to €92.7 million, or 14.1 per cent, of the total value of loans subject to a moratorium, equivalent to 1.4% of outstanding household loans.

Meanwhile, the accommodation and food services activities sector held €215.5 million in loans subject to a moratorium. This is the sector most affected by the containment measures and, indeed, 41.6 per cent of the loans held by this sector were subject to a moratorium by the end of February. The real estate sector held €121.3 million in loans subject to a moratorium, or around 18.5 per cent of such loans – equivalent to 11.9 per cent of the sector’s outstanding loans. Moreover, as at end February, the wholesale and retail trade sector held €29.3 million in loans subject to a moratorium, making up 4.5 per cent of loans subject to a moratorium, or 4.3 per cent of loans held by the sector.

To further alleviate liquidity challenges, the Government launched the Malta Development Bank (MDB) COVID-19 Guarantee Scheme (CGS) for the purpose of guaranteeing new loans granted by commercial banks for working capital purposes to businesses facing liquidity shortfalls as a result of the pandemic. The scheme enables credit institutions to leverage government guarantees up to a total portfolio volume of €777.8 million.

New €15 million scheme to support small businesses and self-employed seeking industrial space

'This scheme addresses three key needs for business success – stability, peace of mind, and reduced bureaucracy'

Kebab Factory’s 10% student discount for language school Study Squad

Kebab Factory celebrates Malta’s language school community with a 10% discount for students, educators, and staff across all seven locations

‘It’s still about creating a meaningful connection with customers’: Matthew Fenech, Motors Inc.

The CEO explains how Motors Inc. keeps the customer experience at the centre of its growth trajectory