Central Bank of Malta Governor Edward Scicluna singled out Malta’s dynamic economy, buoyed to some extent by its energy subsidies, together with a weak pass-through of tighter monetary policy on bank deposit and lending rates in Malta as the two main factors delaying the return of inflation to target.

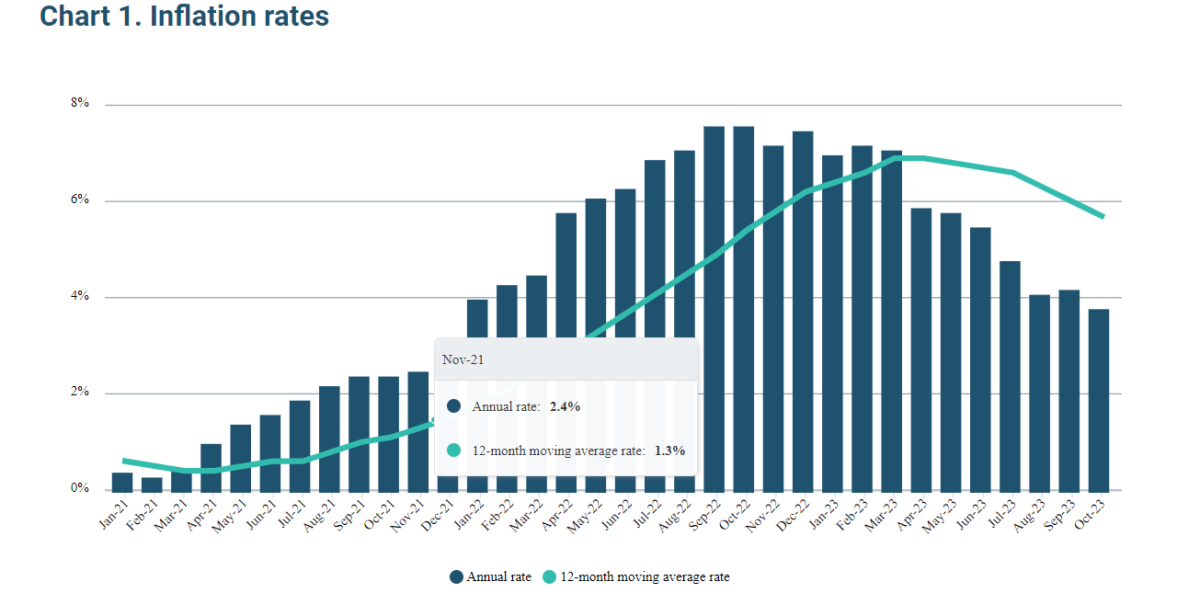

In October 2023, Malta’s annual inflation, as indicated by the Retail Price Index (RPI), stood at 3.7 per cent, a decrease from September’s 4.1 per cent, the National Statistics Office reported. This is a steep decrease from the staggering highs of 2022, which saw the RPI reach 7.5 per cent in August and September 2022. The high rates of inflation persisted until March 2023, before starting to come down steadily – but has not yet reached the target two per cent.

The country has employed a policy of electricity and fuel price freezing through subsidies, as well as a flour and animal feed subsidy, costing the island some €608 million in 2023, while €320 million has been allocation for 2024. The country has faced criticism, most recently from the International Monetary Fund, which called for the Government to phase out the energy subsidies to encourage a green transition and energy conservation, however the Government has repeatedly stood by its decision, crediting it with creating an environment for economic growth at a time when global economies are stalling.

During a traditional address at the Institute of Financial Services Malta’s annual dinner on 27th November, Prof Scicluna also said it would be a mistake to assume that European Central Bank (ECB) rate cuts are imminent, considering international tensions and the prevalence of uncertainty on the world stage.

The Governor stated that the previous sudden rise in inflationary pressures prompted the ECB to withdraw monetary policy accommodation and initiate a steep rate-hiking cycle, raising ECB key policy rates by 4.5 percentage points as of November 2023. The ECB raised interest rates on 10 occasions between July 2022 and November 2023.

“Monetary conditions are now firmly in restrictive territory”, the Governor said, emphasising the importance of price stability, which preserves purchasing power and rewards productive work. Stable prices are a necessary condition for sustainable and inclusive economic growth.

The effects of the monetary policy tightening are already evident, with euro area inflation falling to 2.9 per cent in October 2023. Prof Scicluna argued that, barring exogenous shocks to the global economy, the ECB is on target to achieve its two per cent inflation target over the medium term.

Despite the sharp monetary policy tightening, the euro area economy has been relatively resilient, with unemployment rates at historical lows. However, Governor Scicluna noted that a short technical recession within the euro area remains a possibility.

While the decline in inflation is supported by the resolution of supply chain bottlenecks and the impact of restrictive monetary policy on imported goods and services, Governor Scicluna warned that several domestic factors are pushing in the opposite direction, as described above.

The weak monetary policy pass-through in Malta implies that other policy areas leading to growth become more relevant. Lifting the supply potential of the economy through the efficient allocation of NextGenerationEU funds is key, as is the alignment between monetary and fiscal policies. Macroprudential tools could also be deployed to correct imbalances and reduce risks in banks’ portfolios.

Prof Scicluna concluded his intervention by stating that it would be a mistake to assume that a rate cut is imminent, as international tensions persist and uncertainty prevails. The ECB Governing Council will, nevertheless, ensure that inflation returns to its two per cent medium-term target in a timely manner.

Featured Image:

Central Bank Governor Edward Scicluna / Photo by Jonathan Borg

Government introduces mandatory physical inspection for vintage vehicle classification

From 1st September 2025, vehicles seeking vintage status must undergo a physical inspection by the official classification committee

Local filmmakers paid just €250 to screen at Mediterrane Film

The figure stands in stark contrast to the estimated €5 million total spend

Malta International Airport closes in on one million passengers in June

Meanwhile, aircraft traffic movement rose by 4.5 per cent year on year