Malta punches above its weight in high-tech and construction industries compared to its European Union counterparts, and is home to a vibrant retail trade sector bolstered by a strong inflow of tourists, according to a Eurostat report.

A 2023 report on key business figures in the EU assessed the state of European businesses in the aftermath of the COVID-19 pandemic and amidst the Russian invasion of Ukraine.

The two events have triggered a series of crises since 2020, ranging from supply chain issues, elevated levels of inflation and also trade restrictions due to sanctions.

Within the EU, there were a total of 23.4 million enterprises, employing 127.6 million people who contributed €6,496 billion to the economy as measured by value added at factor cost.

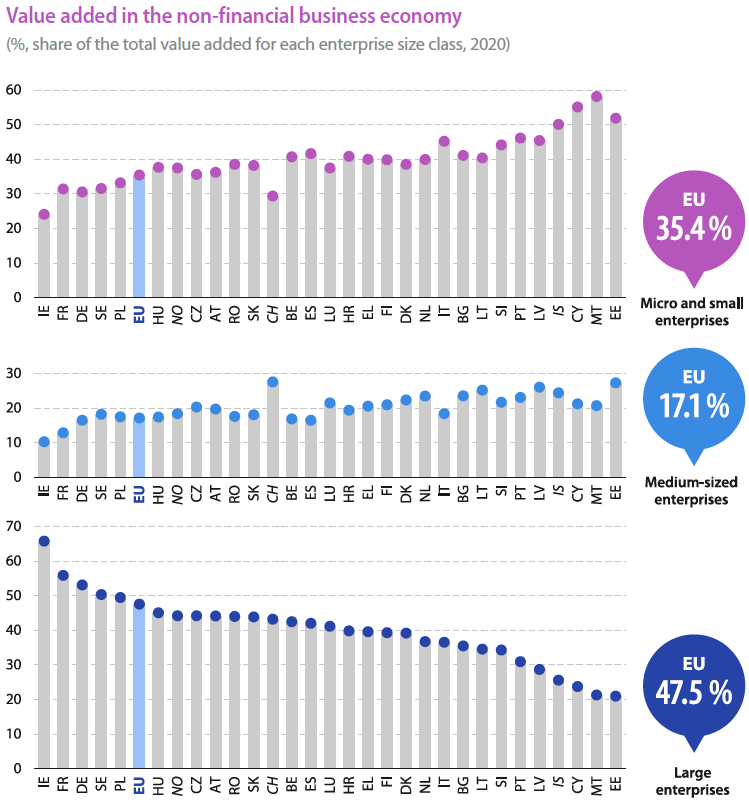

Roughly 99 per cent of businesses were micro and small enterprises (0-49 employees), and employed the largest bulk of workers (48.5 per cent), who contributed over a third of all generated economic value (35.4 per cent).

Meanwhile, large enterprises (250 or more employees) only made up 0.2 per cent of all businesses however they held the largest share of value added to the economy (47.5 per cent) and employed over a third of all workers (35.7 per cent).

This is a significant contrast to Malta, where almost 60 per cent of value added to the economy was from micro and small enterprises, and just over 20 per cent came from large enterprises.

This indicates that, while the EU’s economy is mostly driven by SMEs, large enterprises hold significantly more economic leverage across the union than they do in Malta.

Malta also had one of the widest gaps between enterprise birth and death rates.

Enterprise birth rates represent the number of new businesses, and deaths represent permanent closures. The data excludes mergers, take-overs, break-ups, or other forms of restructuring.

The report noted that enterprise birth rate were over 14 per cent in Malta, while death were just over four per cent.

This is the widest gap by a significant margin in the EU, and was followed by France, which had an enterprise birth rate of just under 12 per cent, and death rate of roughly 4 per cent.

Meanwhile, the EU average enterprise birth rate was 8.9 per cent, while the death rate was 7.2 per cent.

Enterprise death rates outpaced births in 10 EU countries, with the starkest gap being in Bulgaria, where enterprise death was just under 15 per cent, while birth rate were roughly nine per cent.

As a share of total businesses, high-growth enterprises (i.e., have the potential to have a considerable impact on employment, such as ICT, construction, manufacturing etc), represented over 12 per cent of businesses in Malta, the fifth highest share in the EU.

While Malta lagged in R&D spending per capita (just over €100 per inhabitant, compared to the EU average of €485), it was home to one of the highest shares of high-tech industry activity as a share the value the manufacturing sector added to the economy, coming in third at just under 20 per cent.

High-tech industries refer to manufacturing activities involved in pharmaceuticals, electronics, optical products, and advanced machinery. Recently, the local pharmaceutical industry has been experiencing fairly strong growth in output, even in light of a shortage of raw materials.

Construction and trade

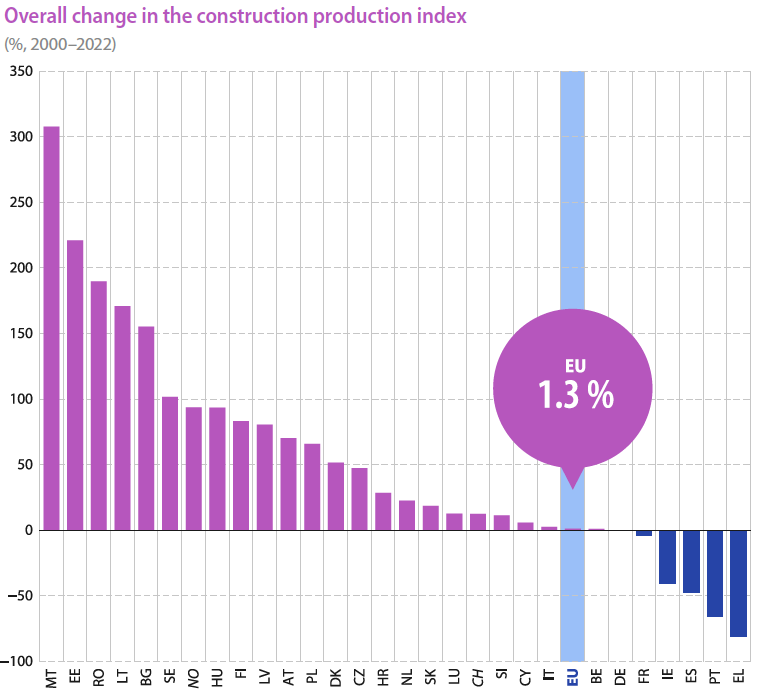

Malta excelled in the construction sector, with output having quadrupled between 2000 and 2022. This is significantly above the EU average where output only increased by 1.3 per cent, and even higher than the country with the second largest increase in production, Estonia, where output tripled.

Despite the spike in output, Malta maintained below EU average personnel costs.

The report also explored distributive trade within the EU, which encompasses activities involving motor, wholesale, and retail trade.

In Malta, retail trade was responsible for 51.4 per cent of all distributive trade value added in 2022, the highest share in the EU. The report attributed this to the large number of tourists the country receives.

MFSA flags ‘misalignment’ between objectives and public expectations of green loans

Green investment is nonetheless expected to balloon over the coming years

Super rare Ferrari Daytona SP3 spotted cruising along Malta’s roads

The car is currently being traded for a whopping €4 million

Mandatory skills pass for Maltese and EU nationals deferred for a year

The skills pass remains obligatory for third country nationals