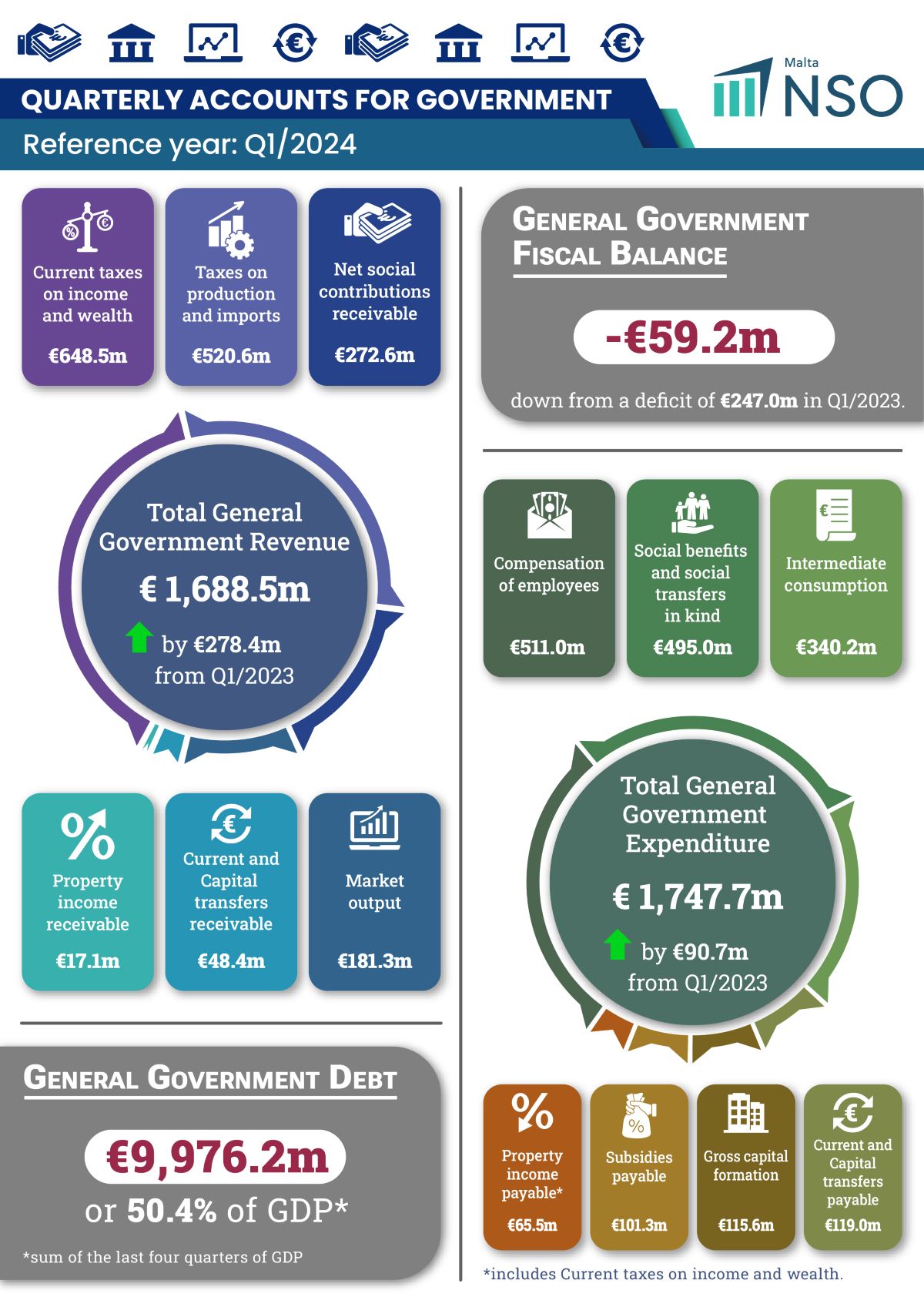

The national debt continues to edge towards the €10 billion mark after the Government posted its accounts for the first quarter of 2024, where it registered a deficit of €59.2 million.

During the period January to March 2024, total revenue stood at €1,688.5 million, an increase of €278.4 million when compared to the corresponding quarter in 2023.

This was mainly brought about by increases in current taxes on income and wealth (€151.6 million), taxes on production and imports (€71.3 million) and market output (€39.6 million), partially offset by decreases in capital transfers receivable (€14.6 million).

Total expenditure in the first quarter of 2024 amounted to €1,747.7 million, an increase of €90.7 million over the corresponding quarter in 2023.

The largest increase was recorded in social benefits and social transfers in kind (€52.9 million), followed by compensation of employees (€30.9 million) and property income payable (€18.4 million).

Adjustments were implemented to the Government’s Consolidated Fund data to transition to accrual-based accounting, aligning with the requirements of ESA 2010.

During the first quarter of 2024, these adjustments resulted in a decrease of €100.8 million to the Consolidated Fund surplus, which stood at €41.6 million.

In relation to financial transactions in assets, during the first quarter of 2024, increases were recorded in equity and investment fund shares (€173.2 million) and short-term debt securities (€10 million).

Conversely, currency and deposits and other accounts receivable decreased by €129.4 million and €79.1 million, respectively.

Considering the financial transactions in liabilities, the highest increase was recorded in long-term debt securities (€345.0 million). In contrast, decreases were registered in other accounts payable (€178.9 million), short-term debt securities (€122.3 million) and currency and deposits (€22.0 million).

At the end of March, general government debt stood at €9,976.2 million, or 50.4 per cent of GDP.

This equates to an increase of €726.3 million over the corresponding quarter in 2023, largely reflected in Central Government Debt, which amounted to €9,974.3 million.

Currency and deposits stood at €432.8 million, a decrease of €39.7 million over March of 2023.

This includes euro coins issued in the name of the Treasury, considered a liability of Central Government, and the 62+ Malta Government Savings Bond, the latter amounting to €329.9 million.

Long-term debt securities increased by €955.6 million, while short-term debt securities decreased by €271.2 million, respectively. In addition, long-term loans increased by €81.3 million. Local Government debt stood at €1.9 million.

General Government guaranteed debt amounted to €1,069.7 million at the end of March 2024, equivalent to 5.4 per cent of GDP1. There was a decrease of €89.0 million when compared to the first quarter of 2023.

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns

‘This is true one-touch implementation designed with SMEs in mind’ – Roderick Farrugia, CIO, Melita Limited

A walk through the primary cybersecurity threats facing today’s SME’s and Melita’s practical solutions to combat them