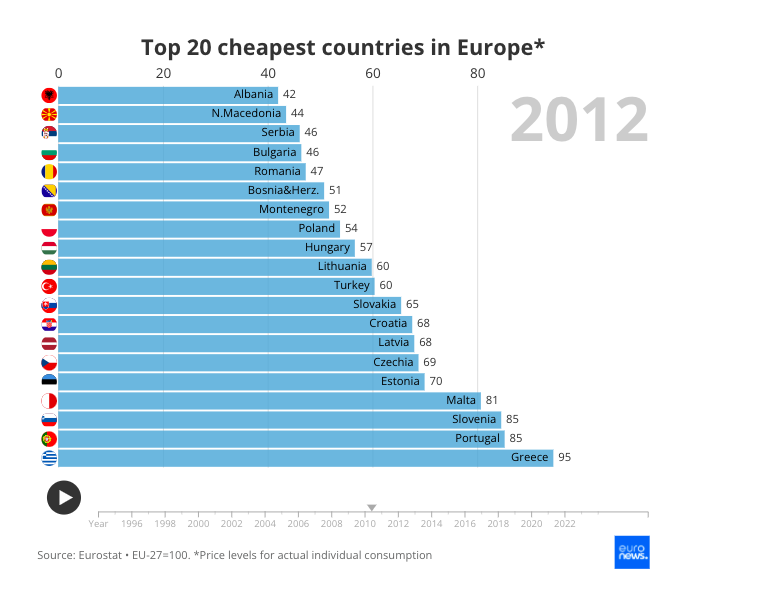

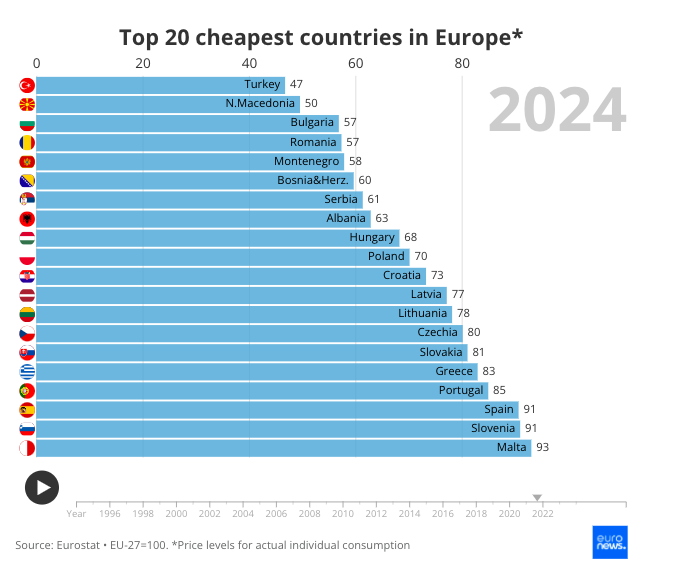

Malta has experienced one of Europe’s most dramatic cost of living increases over the past decade, with price levels rising from 81 per cent in 2012 to 93 per cent of the EU average in 2022 according to Eurostat’s latest Purchasing Power Parity (PPP) data.

This near-double digit climb has occurred alongside stagnant wage growth, creating significant financial pressures for Maltese households. The island now finds itself at the bottom of a ranking of Europe’s 20 least expensive countries, having lost much of its former cost advantage.

It’s important to note that these figures, based on Actual Individual Consumption (AIC), don’t include housing purchase prices – a critical omission for Malta where property values and rents have skyrocketed in recent years.

Independent studies show Maltese housing costs have increased by over 70 per cent since 2015, far outpacing the general price increases captured in the AIC index. This means the true cost of living pressure on Maltese residents is significantly higher than the official 93 per cent figure suggests.

Last year, in the last quarter, housing prices increased by according to fresh data released by the National Statistics Office (NSO) showing that its Residential Property Price Index RPPI rose by 6.9 per cent.

The decade-long price surge reflects multiple converging factors. Tourism growth has driven up costs in hospitality and retail sectors, while Malta’s import dependency leaves it vulnerable to global supply chain fluctuations. The property market boom, fuelled by foreign investment and limited housing supply, has particularly impacted living costs in ways not fully reflected in the AIC measurements.

When examining Europe’s price extremes, Malta’s position becomes clearer.

Switzerland remains the continent’s most expensive destination at 184 per cent of the EU average, while Turkey sits at the opposite end at just 47 per cent. Within the EU, Bulgaria and Romania maintain their position as the most affordable members at 57 per cent of the average, while Luxembourg leads at 151 per cent. Malta now finds itself uncomfortably close to Italy (98 per cent) and Spain (91 per cent) in terms of general prices.

The AIC-based figures, while useful for international comparison, present an incomplete picture of Malta’s cost of living reality. The exclusion of housing purchase prices particularly distorts the situation for Maltese residents, as property costs represent one of their largest financial burdens. Furthermore, while Malta’s price index sits at 93 per cent of the EU average, disposable incomes remain substantially below Western European levels, meaning essentials consume a larger portion of household budgets than a decade ago.

Looking ahead, Malta faces significant challenges in rebalancing its cost of living equation. Policymakers must address the growing disconnect between prices and wages, particularly in the housing market where supply constraints continue to drive costs upward. Strategic interventions may be needed to mitigate import inflation and ensure Malta retains its quality of life advantages even as its economy continues to develop and converge with EU averages. The island’s ability to manage these competing pressures will determine whether it can maintain its appeal as an affordable Mediterranean destination in the coming years.

Source: Eurostat 2024 data, PPP-based price level indices using Actual Individual Consumption (AIC) metrics. Housing cost data from Malta’s National Statistics Office.

Ryanair cuts Malta link to Serbia’s Niš

The low-cost airline is slashing some major routes in Germany, Spain, Belgium, Portugal and Malta

Event tourism is the standout travel trend for 2026 – How will Malta fare?

The global tourism market is booming, and events are leading the way

EU Parliament agrees on common system to calculate corporations’ taxable income

The reform is designed to replace today’s patchwork of national tax rule