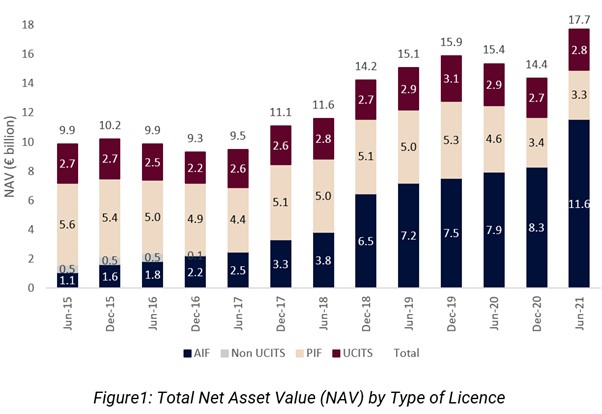

Malta’s investment fund industry seems to have shrugged off the uncertainty surrounding the country’s greylisting, growing by almost a quarter in the first half of 2021 to reach a total value of €17.7 billion to register the largest growth in Europe.

In fact, the aggregate net asset value (NAV) of investment funds domiciled in the Malta rose by €3.3 billion at the end of June 2021, representing growth of 23.4 per cent when compared to the end of December 2020.

This growth is represented exclusively in the Alternative Investment Fund space, indicating that the investors are likely to be foreign institutional and/or professional investors looking for the comfort of their investment funds being regulated under the AIFMD regime.

During the first half of 2021 the Maltese financial jurisdiction was subject to significant uncertainty as national authorities did their utmost to beef up anti-money laundering and couter financing of terrorism (AML/CFT) legislation and enforcement to pass the Moneyval assessment.

Despite receiving a passing grade by the Council of Europe’s Moneyval in May 2021, the global Financial Action Task Force, which takes into account but is not bound by the regional organisation’s assessment, nonetheless placed Malta on its list of jurisdictions subject to enhanced monitoring, better known as the grey list, on 23rd June 2021.

Amidst this precarious situation, foreigners pumped billions into local investment funds, according to figures emerging from the Malta Financial Services Authority’s latest statistical analysis of Collective Investment Schemes (CIS).

This report gives an in-depth overview of the collective investment scheme industry in Malta, setting out key figures and trends covering the period up to 30th June 2021 and illustrating how this industry is evolving.

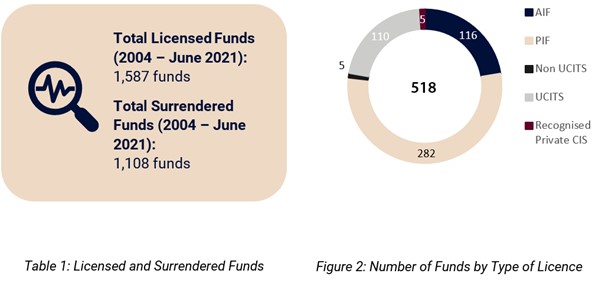

At the cutoff date, the number of licensed funds domiciled in Malta stood at 518, a marginal reduction of seven net licences compared to 31st December 2020. Notified AIFs continued in their upward trend, with a net increase of 13 notifications from 31st December 2020, to stand at a total of 78 notifications as at 30th June 2021.

“This shows that the evolution of this product is strong, as the asset management industry is attracted by its features, not least of which is the short time to market,” the MFSA said.

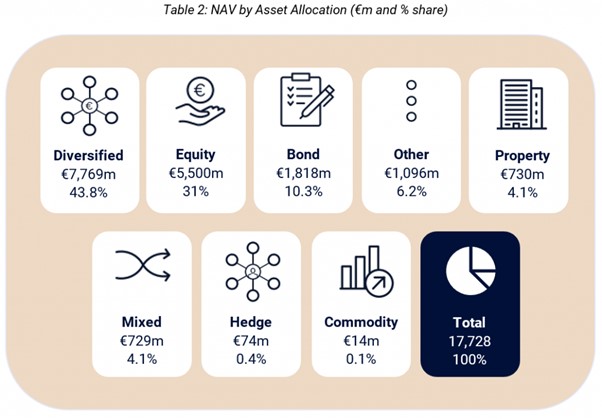

Diversified funds account for the largest share of the June 2021 NAV, followed by equity funds and bond funds.

“This indicates that investors seem to be attracted by the diversification in asset classes within Collective Investment Schemes. That said, investment in equity share class and bond share class is also robust and other investors achieve diversification through holding different investment funds. Investment in alternative share classes is lower when compared to equity and bond investment funds,” read the statement.

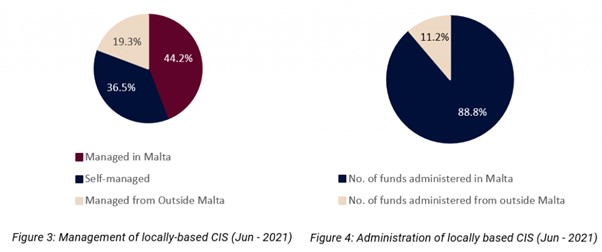

As at 30th June 2021, 80.7 per cent of the funds were managed in Malta, of which 44.2 per cent were managed by a Maltese third-party fund manager. The remainder are self-managed investment funds with the investment management being conducted from Malta. The balance of 19.3 per cent of the funds were managed from outside Malta.

Domestic fund administrators administered 88.8 per cent of the Malta-domiciled funds. Furthermore, Maltese fund administrators service a total of 218 non-Malta domiciled funds, with an aggregate net asset value of €5.3 billion.

At an international level, the number of registered worldwide, regulated, open-ended funds reached 144,410 as at the end of June 2021: an increase of 1.5 per cent from end 2020.

Net assets increased by 12.3 per cent, from €55.2 trillion as at December 2020 to €62 trillion in June 2021. Net inflows amounted to €1.8 trillion in the first half of 2021, compared to €1.4 trillion in the first half of 2020.

At a European level, the total number of registered funds stood at 64,484 as at June 2021, up by 0.8 per cent from end 2020. Net assets increased by 8.8 per cent, from €18.8 trillion as at December 2020 to €20.4 trillion as at June 2021.

“In conclusion, the Malta funds industry reported double-digit growth in the aggregate net asset value in the first half of 2021,” the MFSA said. “This placed Malta in the highest rank in terms of percentage growth compared to other European jurisdictions in the period under review.

“While there was a marginal decline in the number of licensed funds, the Notified AIF segment continued to show signs of attractiveness in the funds industry recording a net increase of 20 per cent. Indeed, the recent recorded positive trend in the Maltese Collective Investment Scheme industry is encouraging, especially when one considers the more subdued growth seen at a European level.”

Malta’s public debt ‘very much in line’ with Eurozone rules – BOV Chair

The chairperson of Malta’s largest bank shrugged off the doubling in Maltese Government debt since 2019

Malta’s public debt tops €11 billion

The debt-to-GDP ratio remains well within EU limits

New EIB and BOV partnership channels ‘fresh financing to Maltese businesses’

The banks say this initiative is designed to enhance the working capital and investment capacity of Maltese mid-sized firms