The Malta Financial Services Authority (MFSA) has recently published its findings on local bank’s preparedness to the changes in the Capital Requirements Regulation (CRR3).

CRR3 was introduced by the European Commission to enhance the financial stability of banks throughout the European Union, ensuring they have enough capital to handle financial risks. The regulation introduces new rules for how much capital banks must hold, how they manage risks, and how they report their financial activities to ensure they meet these requirements.

The MFSA found that most local banks are on track to comply, with most local banking sector assets belonging to institutions categorised as either highly or reasonably prepared. However, some institutions still need to do more to meet the new requirements.

The MFSA analysis revealed a varied distribution of expected impacts across several areas, although the vast majority (81 per cent) of banks expect CRR3 to affect their Environmental, Social, and Governance (ESG) frameworks.

Other areas anticipated to be impacted include operational risk at 19 per cent, market risk a 13 per cent, credit risk at 9 per cent, credit valuation adjustment (CVA) at eight per cent, and leverage ratio at 6 per cent, while no institutions reported any impact resulting from the introduction of the output floor.

With a view to support CRR3 updates, institutions reported that they are planning on implementing and enhancing their IT systems. It has been observed that over 73 per cent of banks prioritised training on ESG and operational risk. Additionally, 27 per cent of banks attended training on leverage risk and 23 per cent of institutions engaged on credit risk.

The survey findings suggest a varied understanding of the regulatory changes by institutions and the respective impact brought about by CRR3. The MFSA stated that such outcome requires further commitment and focus from those entities that have been deemed partially and not prepared.

Catherine Galea, Head of Banking Supervision at the MFSA, emphasised the importance of these reforms: “The findings show that most banks are well-prepared, but some still need to make further improvements. ESG is, of course, a new risk area which banks need to onboard and embrace into their frameworks. Strengthening these areas will ensure a more resilient and responsible financial system that ultimately benefits consumers.”

From a purely qualitative perspective and based on the reported figures, the MFSA found that local banks’ capital levels seem well placed to absorb the underlying changes which CRR3 will bring.

Final deeds of sale rise 8.4%, promise of sale agreements up 6.8% in November

Malta’s residential property market strengthened again last month

Employment rises 4.8% as labour market continues to expand

66.8% of the population aged 15 and above are employed

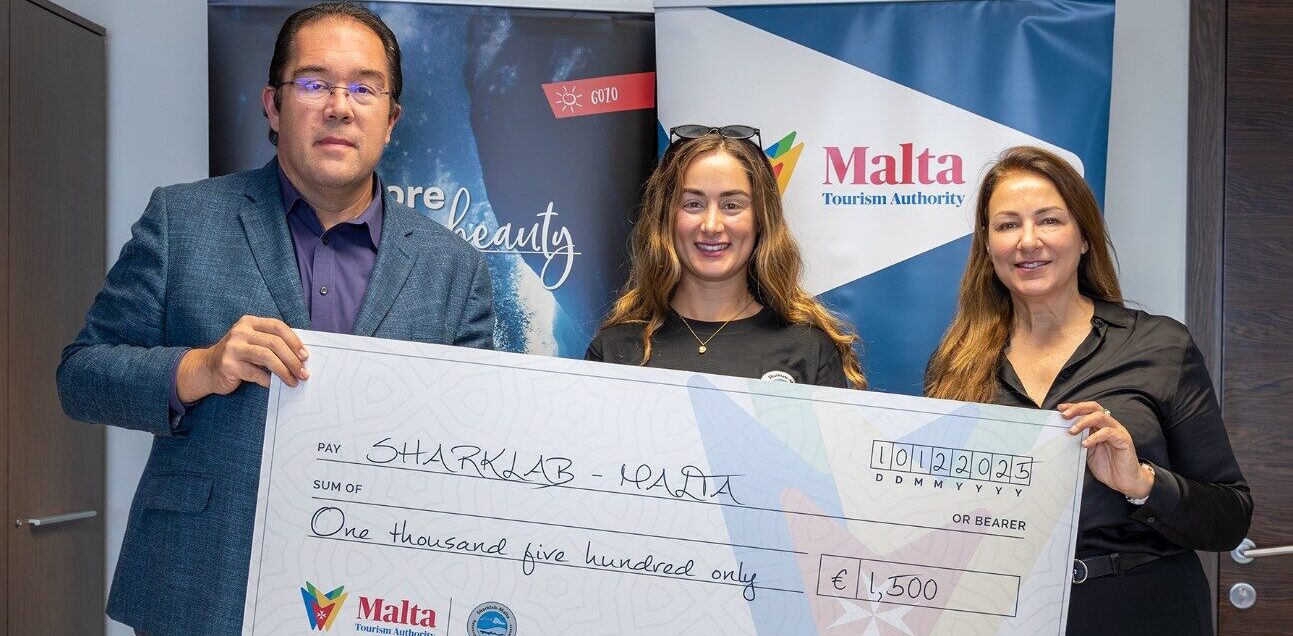

MTA donates €3,000 award to marine conservation NGOs Sharklab Malta and Nature Trust

'Sharklab Malta and Nature Trust have been instrumental in supporting our marine environment'