Malta’s property market continues to run hot, with both the volume of sales and the price of real estate refusing to subside to any significant degree.

Much of the property boom seen in recent years has been driven by the rental market, as a growing foreign population looks for a place to live and enterprising locals look to capitalise on the phenomenon.

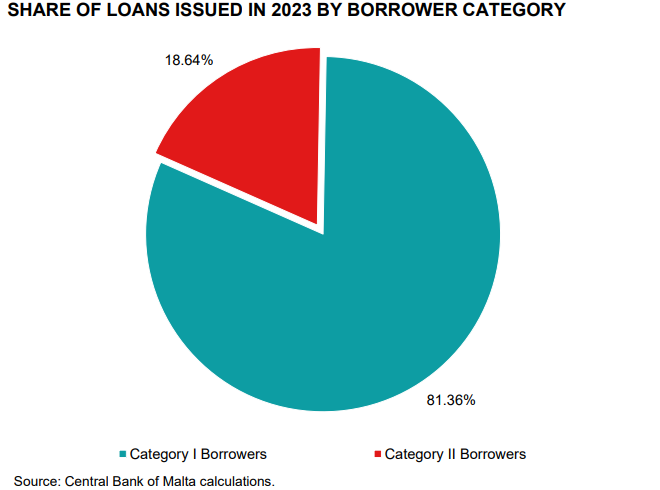

New data released by the Central Bank of Malta shows just how many loans are issued by banks for people to buy a second home – most of these then being used to generate income from rent.

In a recent report, it calculated that 19 per cent of all home loans in 2023 went to property buyers purchasing secondary or buy-to-let residences.

The remaining 81 per cent were issued to buyers of property to be used as their primary residence.

The two categories emerge from a Central Bank directive that sought to limit risk in the banking sector from over-exposure to property by tightening credit terms for anyone buying a second home.

Malta forecast to enter world’s 15 richest countries per capita

Malta is projected to overtake the UK, Germany, Austria, Canada and Sweden in terms of GDP per capita

Malta wins top international tourism award in Italy

Recent initiatives aimed at diversifying tourism flows and strengthening off-peak demand

Welbee’s doubles down on Christmas cheer with ambitious plans for 2026

Head of Marketing Miguel Borg outlines how Welbee’s is closing the year with momentum and what's in store for 2026