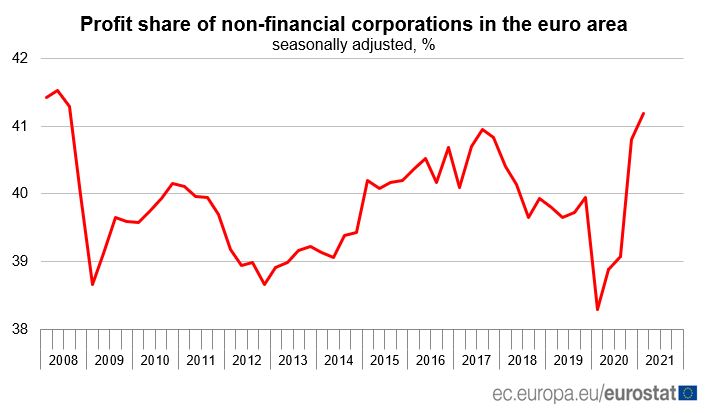

The profit share of non-financial corporations in the euro area has continued its upward trend, rising to 41.2 per cent for the first quarter of 2021, the highest rate seen since the third quarter of 2008, on the eve of the global financial crisis that precipitated the Great Recession.

Eurostat, the European statistics agency publishing the findings, explains that the profit share of non-financial corporations is defined as the gross operating surplus divided by the gross value added.

This indicator shows the share of the value added created during the production process which goes to remunerating capital. It is the complement of the share of wage costs (plus other taxes less other subsidies on production) in value added.

The figure represents a 0.4 percentage point increase over the last quarter of 2020, a sharp slowdown over the remarkable 1.7 per cent increase seen between Q3 and Q4 of last year.

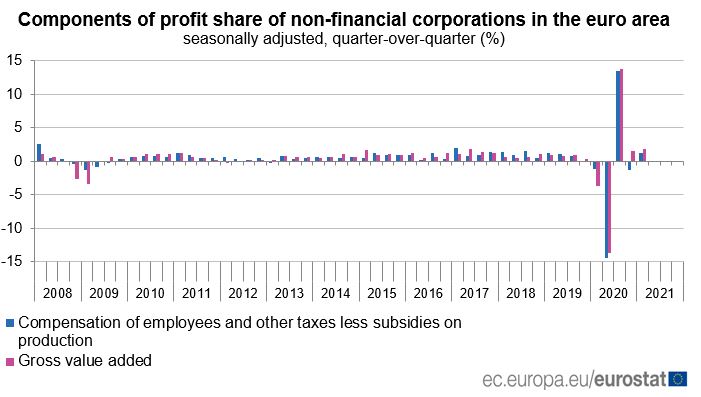

This increase of business profit share in the euro area by 0.4 percentage points is explained by the increase of business gross value added (+1.8 per cent), while compensation of employees (wages and social contributions) plus taxes less subsidies on production increased by 1.2 per cent.

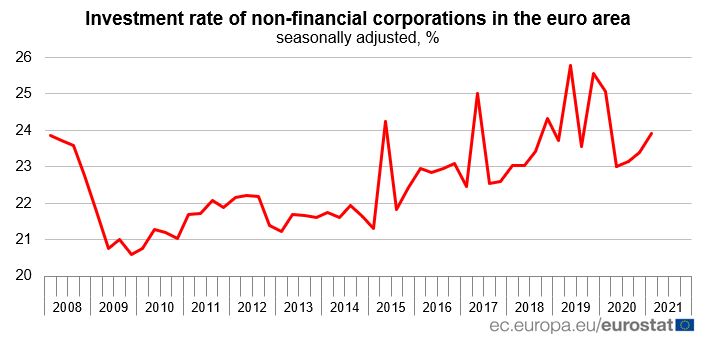

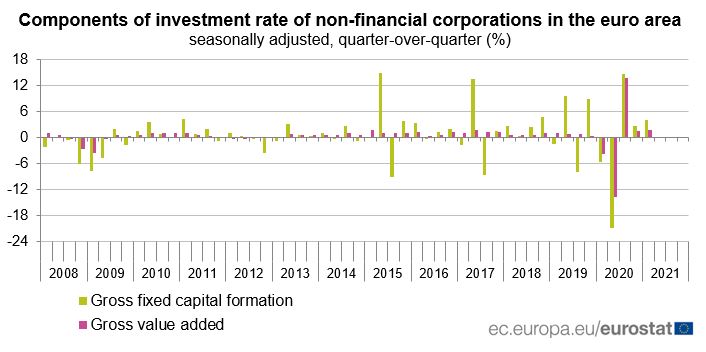

The business investment rate in the euro area increased to 23.9 per cent, compared with 23.4 per cent in the fourth quarter of 2020.

The increase of business investment rate in the euro area by 0.5 percentage points is explained by the increase of business gross fixed capital formation (+4.1 per cent), at a faster rate than the increase of gross value added (+1.8 per cent).

Eurostat notes that the peaks of the investment rate of non-financial corporations observed in 2015Q2, 2017Q2, 2019Q2, 2019Q4 and 2020Q1 are related to large imports of intellectual property products reflecting globalisation effects.

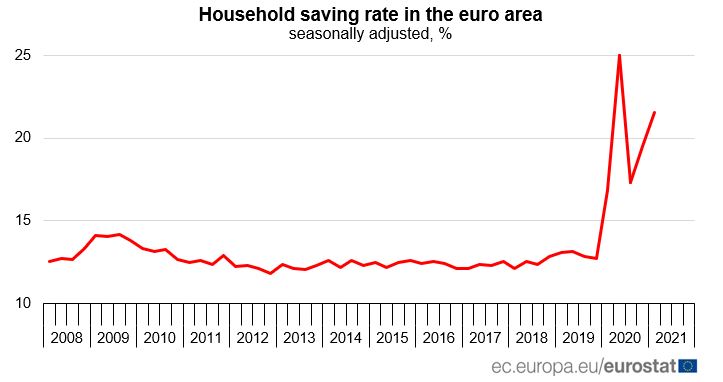

Meanwhile, the household saving rate in the euro area was at 21.5 per cent in the first quarter of 2021, compared with 19.5 per cent in the fourth quarter of 2020.

This is the second highest value since the beginning of the time series in 1999 (the highest was 25 per cent in the second quarter of 2020).

As seen in the chart below, the value has averaged between 12 and 14 per cent since 2008.

This increase in household savings has led to deposits held by locals to increase by over a billion euro since the start of the spread of COVID-19, with local investment firm Curmi & Partners CEO David Curmi calling it “one of the positives” of the pandemic.

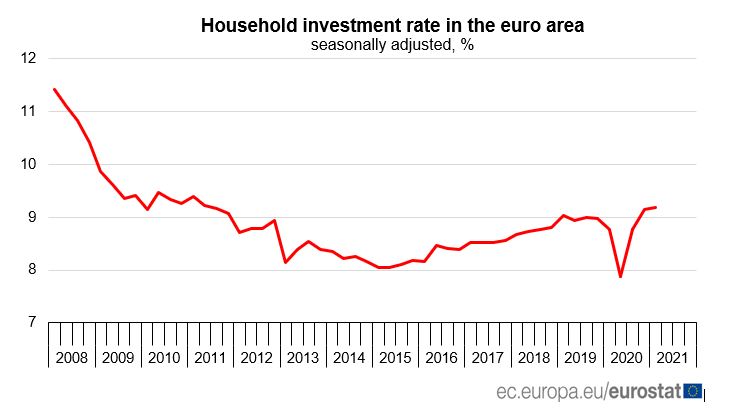

The household investment rate in the euro area has meanwhile increased from 9.1 per cent to 9.2 per cent in the first quarter of 2020, the highest value since 2011.

Government shells out close to €70 million to national bus operator Malta Public Transport in 2023

Buses became free for residents in late 2022, leading to a hefty increase in the public subsidy

Opera Cloud PMS: The cost-effective property management system for any hotel size

Smart Technologies Ltd provides leading hotel PMS system, starting from just €6 per room per month

Inflation rate in Malta drops from 3.7% in January to 2.7% in March, nearing EU average – Government

The Government attributed the decrease in inflation to its initiative ‘Stabbiltà’