The European hotel industry is facing a challenging year ahead, with rising costs, labour shortages, and high interest rates being the primary risks threatening its growth in 2025, according to Deloitte UK’s European Hospitality Industry and Investment Survey 2024.

This data comes as Malta recorded a record-breaking 3.56 million inbound tourists, marking a 19.5 per cent increase compared to 2023, revealed NSO data, in the survey.

The fourth quarter alone saw 811,000 arrivals, up by 17.5 per cent from the same period in the previous year. The total number of guest nights stood at 5.1 million for Q4 2024, reflecting a 14.1 per cent rise from Q4 2023. For the full year, guest nights amounted to 23 million, a 13.8 per cent increase compared to 2023.

Primary concerns for European hotels

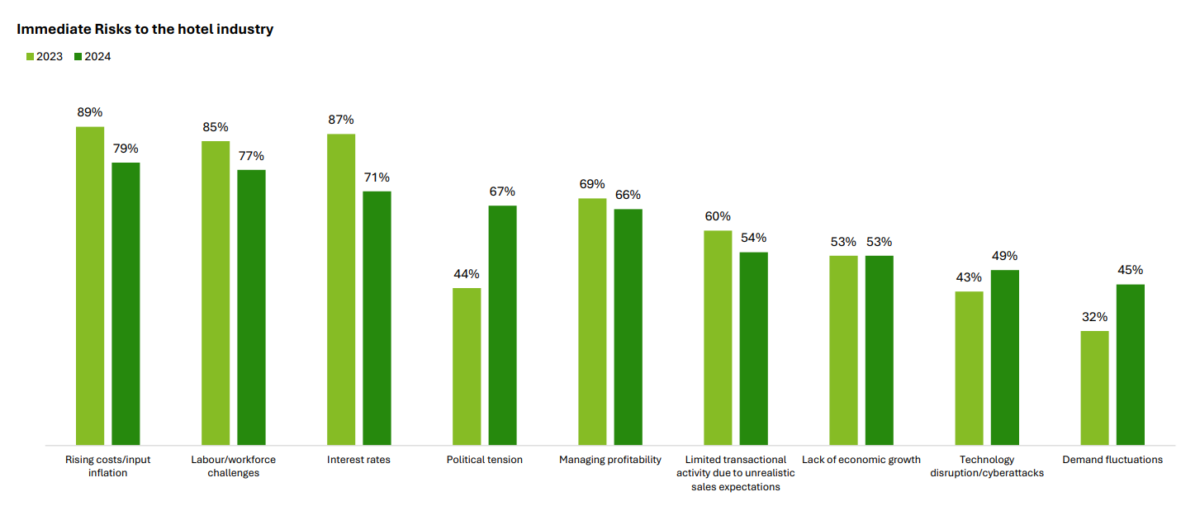

According to a European Hotel Industry and Investment Survey 2024 carried out between August and September 2024 by Deloitte UK, rising costs and input inflation remain a primary concern for European hotels.

However the percentage of industry stakeholders citing this as a major risk has decreased from 89 per cent in 2023 to 79 per cent in 2024.

Similarly, concerns over labour and workforce challenges, as well as interest rates, have declined, albeit still remaining high at 77 per cent and 71 per cent, respectively. Notably, political tension has seen a significant surge as a perceived risk, jumping from 44 per cent in 2023 to 67 per cent in 2024, suggesting increasing instability and uncertainty in the sector.

Managing profitability remains a pressing issue, though it has slightly decreased from 69 per cent to 66 per cent.

Concerns over limited transactional activity due to unrealistic sales expectations and lack of economic growth have seen slight declines.

However, the perception of technology disruption and cyberattacks has risen from 43 per cent to 49 per cent, while demand fluctuations have also increased as a concern, moving from 32 per cent in 2023 to 45 per cent in 2024.

These trends indicate a shift in focus from economic and financial concerns toward political uncertainty, technological threats, and demand variability, reshaping the industry’s risk landscape for the coming year.

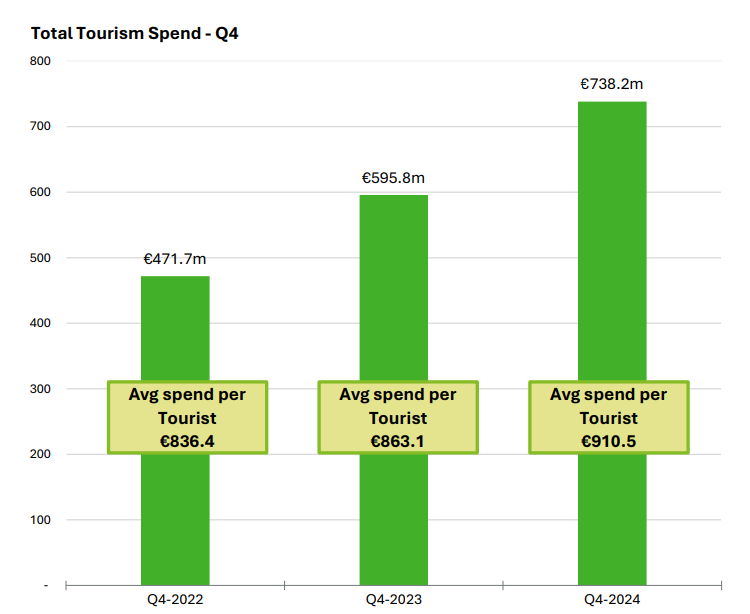

Tourism spend continues to climb

In Malta, total tourism expenditure in Q4 2024 reached €738.2 million, a 23.9 per cent increase from the €595.8 million recorded in Q4 2023. For the entire year, tourist spending totalled €3.3 billion, an impressive 23.5 per cent increase from the €2.67 billion spent in 2023.

The average spend per tourist also grew, with a 5.5 per cent increase at the quarterly level and a 2.7 per cent increase on a year-to-date basis.

Hotel occupancy remains stable across categories

The Deloitte Malta Hotel performance survey carried out on behalf of MHRA showed that occupancy levels for five-star hotels in Malta experienced a slight increase of 1.7 per cent in Q4 and 2.1 per cent year-to-date.

However, four-star hotels faced a decline of 2.6 per cent in Q4 and a 0.8 per cent drop year-to-date.

Three-star hotels, on the other hand, showed a strong recovery, recording a 5.8 per cent increase in occupancy.

Regionally, five-star hotels in Sliema and St Julian’s had the highest occupancy rates, with a median of 69.9 per cent, while those outside the area had a slightly lower median of 67.3 per cent.

For four-star hotels, however, those located outside Sliema and St Julian’s outperformed those within, achieving a median occupancy rate of 85.5 per cent compared to 72.4 per cent.

Average daily rates (ADR) and revenue per available room (RevPAR) rise

ADR increased across all categories, contributing to higher revenues. Five-star hotels in Malta saw an 8.1 per cent increase in ADR in Q4 and a 3.7 per cent rise year-to-date.

Four-star hotels experienced even stronger growth, with ADR rising by 11.8 per cent in Q4 and 8.4 per cent year-to-date. The most significant rise was seen in three-star hotels, which recorded a 7.5 per cent increase.

The increase in ADR translated into higher total revenue per available room (RevPAR). Five-star hotels recorded an 8.3 per cent increase in Q4 and 6.9 per cent year-to-date, while four-star hotels saw a 9.4 per cent increase in Q4 and 7.4 per cent over the year. Three-star hotels experienced a notable 14.0 per cent increase in RevPAR.

Payroll costs and direct expenses continue to rise in Malta

Labour costs remain a major concern, with payroll costs increasing across the board. Five-star hotels in Malta saw a 4.4 per cent increase in Q4 and 7.5 per cent rise year-to-date.

Four-star hotels, however, managed to control costs better, recording only a 0.5 per cent increase in Q4 and 4.5 per cent year-to-date.

Meanwhile, direct costs and overheads surged for four-star hotels, rising by 16.0 per cent in Q4 and 17.9 per cent year-to-date. In contrast, five-star hotels were able to manage their expenses more effectively, with direct costs declining by 3.9 per cent in Q4, although they still increased by 7.0 per cent over the year.

Booking pace and market outlook for Maltese hotels

Confirmed bookings for Q1 2025 follow similar trends to previous years.

However, about half of the respondents expect to maintain at least the same average daily rates (ADR) as achieved in Q1 2024, indicating a strong pricing environment.

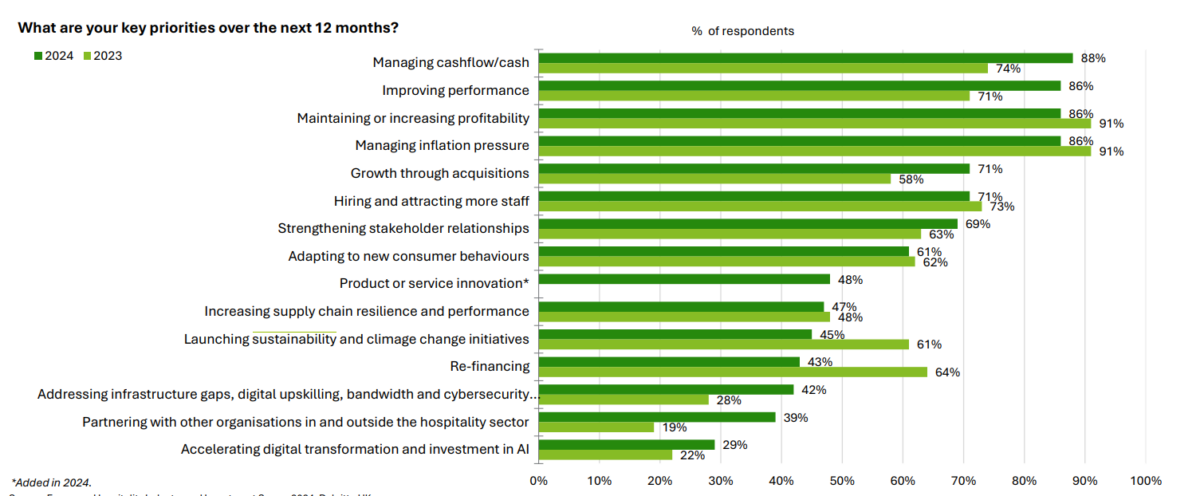

The Deloitte UK’s European Hospitality Industry and Investment survey also highlights long-term risks such as limited pricing flexibility, the disruptive impact of generative AI, and climate-related challenges for hotels.

As the survey noted, with over-tourism, political uncertainty, and cybersecurity threats on the rise, Europe’s hotel industry must adopt strategic risk management measures to ensure sustainable growth.

Despite these challenges, opportunities remain.

Sustainability is a growing priority in the European hospitality sector, and Maltese hotels could gain a competitive advantage by enhancing their environmental initiatives. Additionally, the increasing trend towards strategic alliances could see local operators collaborating with international players to strengthen their market positioning.

Technology adoption remains another key opportunity. While AI implementation in the hospitality sector is still in its early stages, investment in digital transformation could enhance guest services and operational efficiency.

Labour shortages, meanwhile, continue to pose a challenge in Europe, and the sector may need to explore improved working conditions and training programmes to attract and retain staff.

Investors across Europe are showing particular interest in luxury and economy segments, with 24 per cent and 22 per cent favouring upscale hotels, while 17 per cent focus on economy hotels. Maltese operators could align with these preferences by enhancing premium services.

Employers take umbrage at video promoting public sector’s flexible work arrangements

The video outlines a range of flexibility options available to public sector employees

Malta’s inflation eases to 2.5% in January as food prices remain main driver

While overall inflation continued to moderate at the start of the year, price pressures remain uneven across categories

Final call for food and beverage manufacturers to exhibit at SIAL Paris

SIAL Paris is one of the world’s leading international food and beverage exhibitions