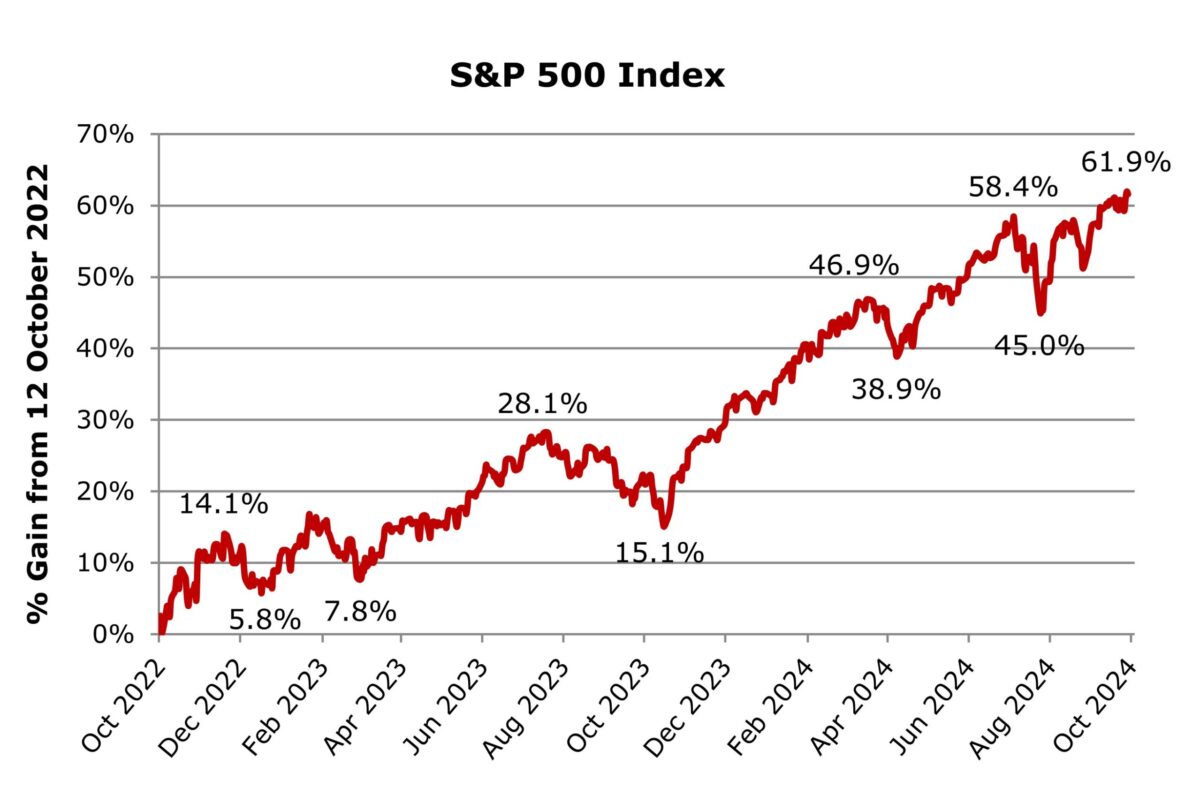

The S&P 500 and Dow Jones Industrial Average ended at fresh all-time highs last week after stronger-than-expected profits from two of the major banks during the start of the Q3 earnings season reinforced optimism that the US economy will achieve a soft landing. The S&P 500 index climbed for a fifth straight week, closing above 5,800 points for the first time ever and reaching a market cap of over USD50 trillion. Incidentally, this fresh milestone for the S&P 500 coincides with the 2nd anniversary of the current bull market.

The index had hit a bear-market bottom of 3,577.032 points exactly two years ago on 12th October 2022. The S&P 500 has soared by over 60 per cent during the past two years. The US equity market entered a bull market (+20 per cent from its October 2022 low) in June 2023. Towards the end of January 2024, the S&P 500 index surpassed its previous record level that it had reached on 3rd January 2022.

The bear market had lasted 282 days between 3rd January 2022 and 12th October 2022 and during this period, the S&P 500 index shed 25.4 per cent. At the time, there were widespread fears of a recession caused by the tightening of monetary policy. The Federal Reserve had started hiking interest rates in March 2022 as inflation spiked. Statistics indicate that this ranked as the longest bear market since 1948. Nonetheless, it was a relatively mild downturn given the fact that the average bear market since 1929 resulted in a decline of almost 40 per cent.

The S&P 500 is now up over 22 per cent during 2024, marking the best year-to-date performance in 24 years and touching 45 fresh all-time highs this year. In recent months, however, there were three notable drawdowns (5.5 per cent ending in April, 8.5 per cent ending in August and 4.3 per cent in September). The flash-crash in early August grabbed the media headlines with a comparison to the stock market crash in 1987. On Monday 5th August 2024, Japan’s Nikkei 225 index plunged by 12.4 per cent for its worst day since the Black Monday crash in 1987 (and its second-worst daily decline in history) and the S&P 500 index suffered its biggest daily decline in about two years sending the index down 8 per cent below its previous record high in mid-July.

When looking at the movements since October 2022, one notes that all the sectors within the S&P 500 are showing double-digit gains with the IT sector by far outperforming with an upturn of over 110 per cent followed by Communication Services (+90 per cent) and Industrials (+60 per cent).

When reviewing the performance of individual equities over the past two years, it comes as no surprise that Nvidia is the strongest performer with a rally of over 1,000 per cent. On the other hand, it is rather surprising that Meta Platforms is the only other member of the ‘Magnificent 7’ that features among the 20-best performing equities during the current two-year bull market. The other star performers are Super Micro Computer Inc, Vistra Corp, Palantir Technologies and Royal Caribbean Cruises. Meanwhile, the worst performers are Walgreens Boots Alliance, Dollar General and Enphase Energy. It is worth highlighting that two of the pharmaceutical companies that made the headlines some years ago as a result of the successful roll-out of the COVID-19 vaccines, namely Moderna Inc and Pfizer Inc, also rank among the worst performers over the past two years.

Bull markets have historically lasted much longer than bear markets. The average length of a bull market is about five years with an average cumulative total return of over 175 per cent.

Meanwhile, the average bear market lasted only one-and-half years with an average cumulative loss of almost 40 per cent.

With the current bull market only two years old, several market commentators and investment banks have recently hiked their year-end forecasts for the S&P 500 index on account of strong profitability growth and a steady macroeconomic outlook including a sharp reduction in inflation. There are now two banks anticipating that the S&P 500 index will continue to edge higher to end the year at 6,000 points while the most upbeat target is a continued rally to a level of 6,200 points.

Meanwhile, an increasingly larger number of commentators and investment banks are arguing in favour of a major ‘melt-up’ in share prices over the coming years by comparing current market conditions to those seen in the mid-to-late 1990’s. The combination of innovation, a strong economy and lower interest rates created a boom in the stock market with a major upturn in the S&P 500 between 1995 and 2000.

The major technological advancements that are reshaping the global economy nowadays related to artificial intelligence (AI), automation, renewable energy, and biotechnology coupled with the continued strength of the US economy and the potential for lower interest rates are creating the conditions that could similarly lead to a rapid rise in share prices in the years ahead.

On the other hand, despite the strong economic performance that has boosted investor confidence and helped the market move to fresh highs, some commentators continue to highlight the uncertainty surrounding the outcome of the US Presidential election and escalating geopolitical risks in the Middle East and elsewhere.

Moreover, there are also some economists who are increasingly concerned of the debt dynamics of the US. They anticipate that this will be a key focal point for the market following the US Presidential election with the resultant effect of a significant rise in bond yields which is a headwind for the equity market.

While there are a number of headwinds that could derail stock market returns, the performance of the equity market has historically been more correlated to earnings growth than it has to other factors. As such, the outcome of the current earnings season could prove to be more important than the identity of the new US President and the fluid geopolitical developments.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Share buybacks and safe harbour

A share buyback is one of the initiatives that could help improve trading activity on the secondary market

The end of an era: What Valletta’s changing face means for its soul

The Wembley Store was a meeting point, a backdrop to history, and a piece of Valletta’s identity

Europe is at a crossroads: Mario Draghi’s wake-up call can’t be ignored

Economist JP Fabri unpacks the former Italian PM's 'clear and uncomfortable' message