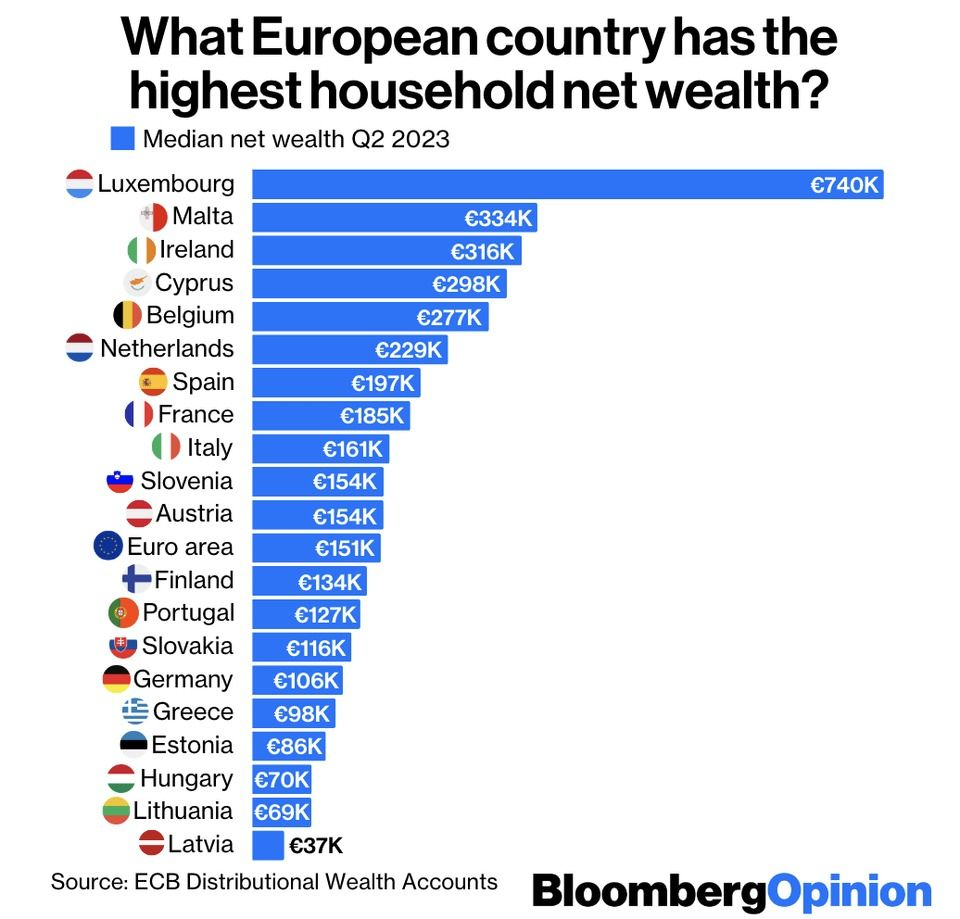

When a Bloomberg Opinion graph showing the median level of household wealth across the European Union started doing the rounds online, many were left nonplussed at Malta’s high position in the table, ranking second just behind the famously wealthy Luxembourg.

“I’ve been to Malta. I don’t think so,” said one commenter replying to a share of the graph by the popular Facebook Page Simon shows you maps.

He was not the only one to express disbelief: “Malta is the surprise,” said another, while yet another perplexed commenter asked: “Why would Malta be so rich?”

It did not take long for people from all over to chime in, many reflecting stereotypes about the country’s economy and the unfortunate reputation Malta has picked up in recent years.

“Heavy corruption and money stashing,” said one commenter bluntly, a not entirely unsurprising reply given the headlines Malta has tended to attract from international media.

Indeed, tax evasion was a common refrain, with many believing that the money saved on taxes by large multinational corporations nominally headquartered in Malta makes its way into Maltese households’ net assets.

“Malta is also popular amongst wealthy globetrotters looking to purchase an EU passport,” said one commenter, referring to Malta’s controversial citizenship-by-investment scheme – a more plausible reason since such wealthy families could skew the average for Malta upwards.

However, a closer look shows that this explanation does not hold water, since the chart measures the median wealth, a measure that is less subject to change from the impact of a few super-rich households.

What Malta’s high median household wealth almost certainly boils down to, ultimately, is the high level of homeownership coupled with soaring property prices.

In fact, that accounts for many of the ‘surprises’ in the ranking, with Germany, the EU’s largest economy where, however, only around 40 per cent own their own homes, ranking lower than Portugal for example – a considerably less wealthy country, but one where the rate of homeownership is similar to that of Malta.

“In Germany it’s very common to rent and not to buy,” pointed out one commenter, with another concurring: “There is a common saying: ‘Germany is a wealthy country full of poor people.’”

In fact, while Germany is indeed an economic powerhouse, much of its wealth is held in corporations rather than in families.

Meanwhile, in France, property prices are kept relatively low, both due to considerable new builds as well as the economy’s concentration around Paris, which results in cheap real estate everywhere else.

As one person pointed out: “This shows more whether it’s common to have an own house/flat or not,” pointing out that “in Hungary, many people live in theoretically expensive flats in literal poverty” and arguing that “wealth is not the best indicator if you don’t exclude the main living real estate.”

A look at the European Central Bank’s own explanation reveals that household wealth was calculated by adding the total bank deposits, debt securities (like bonds) equity (like company shares), life insurance, housing wealth (namely real estate) and non-financial business wealth, and then subtracting liabilities, mainly comprising loans received.

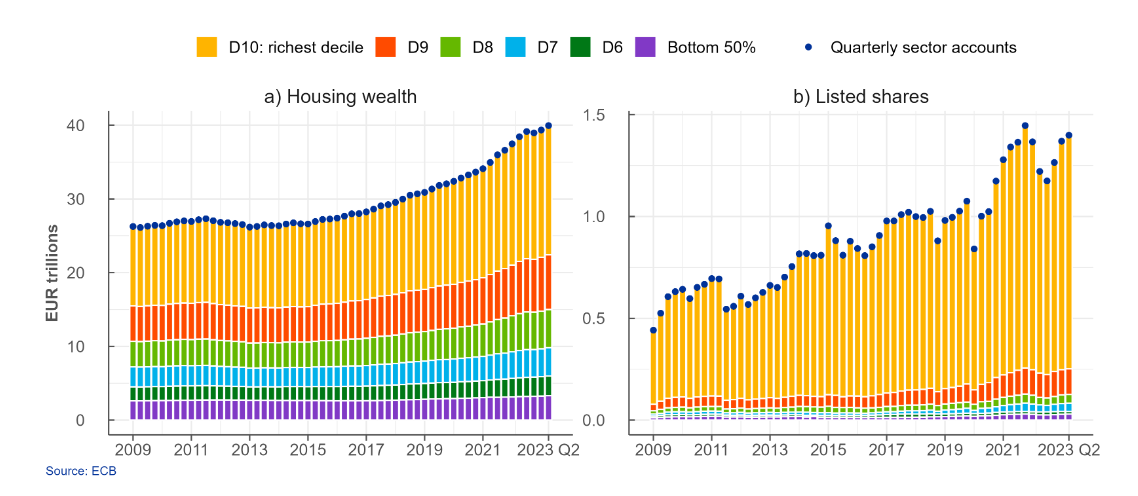

“Through these data, it is possible to analyse the effects of, for example, growing housing wealth and the rising value of listed shares on the distribution of household wealth. The results show that the increase in housing wealth in recent years has been more equally distributed than the increase in the value of listed shares.”

In fact, the graphs below show that housing wealth increased somewhat proportionally for all income segments.

Wealth held in company shares, on the other hand, primarily increased for those in the richest and second-richest deciles, with the increase being much less visible for those further down – a phenomenon largely attributable to the far larger share of total wealth that shares make up for these wealthy segment. In other words, the rich are more likely to have financial investments in the stock market, and stock market increases therefore impact this segment most.

General fear of travelling doesn’t justify free holiday cancellation, MCCAA warns

Malta Competition and Consumer Affairs Authority clarifies rights for travellers amidst concern over the Middle East war

Malta to host first Mediterranean forum on accessible hospitality

One panel will examine Malta’s potential role as a regional focal point for promoting accessibility in the hospitality sector

Merchant Shipping Directorate ‘providing full support’ to Malta-flagged vessels in Middle East

Malta committed to ensuring that its flag continues to represent safety and stability ‘even in challenging circumstances’