The underlying inflation in the euro area likely peaked in the first half of 2023 due to falling prices, especially in energy, according to a release published by the European Central Bank (ECB).

Underlying inflation is a measurement which reflects medium-term inflation developments linked to the business cycle. It’s different from core inflation which refers to the harmonised index of consumer prices (HICP) which excluding energy and food prices.

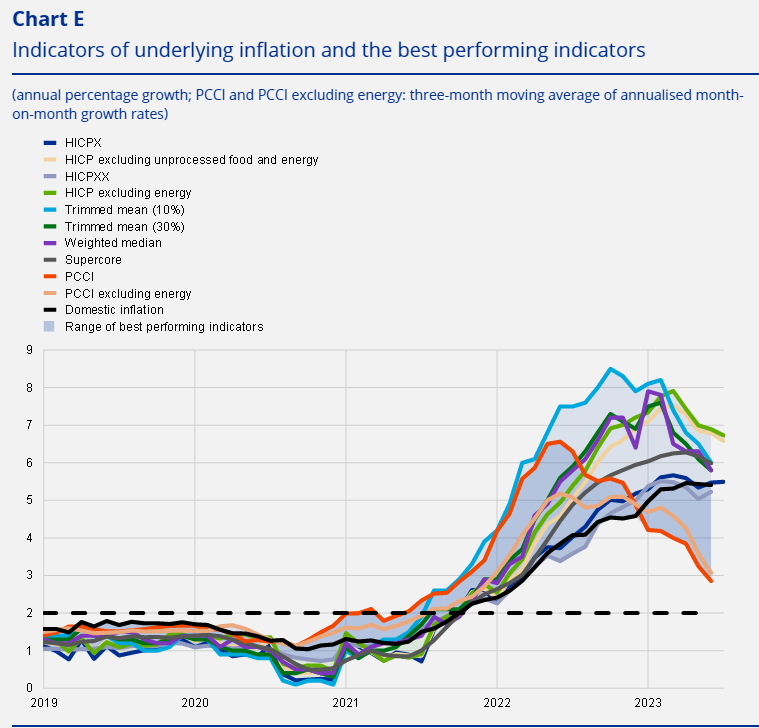

“Median and mean underlying inflation measures suggest that underlying inflation likely peaked in the first half of 2023,” wrote the ECB.

The ECB makes use of 10 different indexes to generate the rate of underlying inflation.

The most optimistic indicator was the persistent and common component of inflation (PCCI) index which is a measurement based on disaggregated information from the HICP. The PCCI registered an inflation rate of 2.9 per cent.

Meanwhile, the most pessimistic index was the HICP excluding energy index, which registered a 6.9 per cent inflation rate in June 2023.

Nevertheless, almost all indicators showed signs of easing.

However, the ECB cautioned, “the range of the underlying inflation measures remains much wider than before 2022, which suggests there is still a high degree of uncertainty as to the level of underlying inflation.”

“At the same time, the easing of underlying inflation comes with an ongoing shift in inflationary forces from external to domestic sources.”

The ECB has been on the warpath with inflation, having raised interest rates nine consecutive times to their highest rate in over 20 years.

The monetary union’s average inflation rate declined to 5.3 per cent in July 2023, well below it’s 2022 peak of 10.6 per cent, however it was still significantly above its target rate of two per cent.

Rising interest rates have helped cool inflation however it has also contributed to a slower economy since it made borrowing money more expensive.

According to reports, it is possible that the ECB may opt to pause hiking interest rates further at the next Governing Council meeting in September.

Self-employed, employees and companies contribute €2.1 billion in 2023

Parliamentary data reveals five-year growth trends in fiscal contributions

MFSA concludes review of Crypto-Asset Service Providers following MiCA implementation

The Authority provided clear expectations and guidance to address certain concerns.

Malta Development Bank to launch schemes supporting sustainable development and creative sector

In 2024, the MDB launched the SME Guarantee Scheme and the Guaranteed Co-Lending Scheme