The implementation of a national payments strategy could foster a unified seamless system across payment solution providers, Government authorities and banks, facilitating the day-to-day needs of individuals and businesses.

The manner in which people spend their money has changed tremendously in recent years, with the digitalisation of everyday transactions having accelerated during the COVID-19 pandemic. This has led to calls by financial services stakeholders for the development of a national payments strategy.

Cashless payments through the use of bank cards, online payment portals, and app-based and contactless solutions have become the preferred method for an ever-growing number of people.

JP Fabri, CEO of Insignia Cards, and co-founder of Seed told this newsroom, “the Maltese economy requires a national payments strategy and supporting architecture to ensure that Malta can be an innovative hub and ecosystem which is further enabled by the presence of other strong sectors such as insurance, remote gaming, and technology.”

What could a national payments strategy do?

“With the appropriate permissions, customers will be able to centralise their account information and payment options into one unified mobile application, enabling them to conduct day-to-day banking on the platform of their choice, provided by their bank or an innovative [fintech firm],” explained Mr Fabri.

“The obvious threat for banks is one of disintermediation, with fintech firms potentially owning the customer relationship, while traditional banks simply maintaining the infrastructural architecture.”

“Although banks may choose to treat PSD2 as a mere compliance exercise, I strongly believe that they should turn the regulation into a competitive advantage by becoming the customer’s trusted integrator and service provider.”

Payment Services Directive Two, better known as PSD2, refers to EU legislation that was introduced to regulate new market players known as Third Party Providers (TPPs) to make payments safe and encourage innovation and competition.

It requires strong consumer authentication for electronic payments by requiring at least two or more authentication factors (such as a password, a code, fingerprint etc).

It also prohibits surcharging on electronic payments. This means that merchants can’t charge customers extra for opting to pay electronically instead of by cash.

“The local market is ripe for innovation and the challenges that many companies are facing can be addressed through such developments”

“The Maltese economy requires a national payments strategy and supporting architecture to ensure that Malta can be an innovative hub and ecosystem which is further enabled by the presence of other strong sectors such as insurance, remote gaming, and technology.

“This should provide a cluster in payment services excellence which will be supported by the required infrastructure and regulatory sandboxes.”

Regulatory sandboxes are tools allowing businesses to explore and experiment with innovative products for a specified amount of time within the market under prescribed conditions.

Malta has regularly made use of regulatory sandboxes to facilitate innovation related to financial services, and at the moment the Malta Financial Services Authority (MFSA) is operating fintech regulatory sandbox.

One of Malta’s challenges is that it faces a highly fragmented ecosystem.

“It is precisely for this reason that a national payments strategy needs to be launched. Having a digitally based payments infrastructure will also help and support other key sectors and services such as digital identity, unified KYC across financial institutions and Government authorities, easier client on-boarding, possibility of offering innovative services and products to local consumers and companies and much more.”

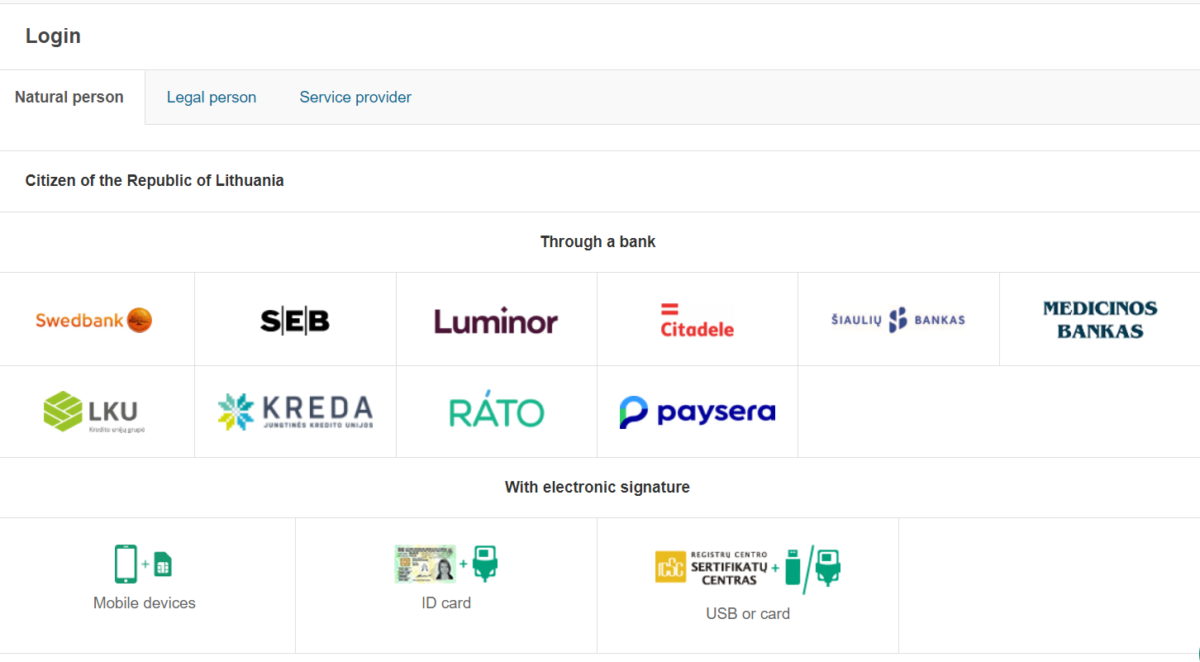

A country which has a unified KYC across several financial institutions and state authorities is Lithuania, where citizens and businesses are able to log-in to their e-ID through their bank account, both through a computer or via an app.

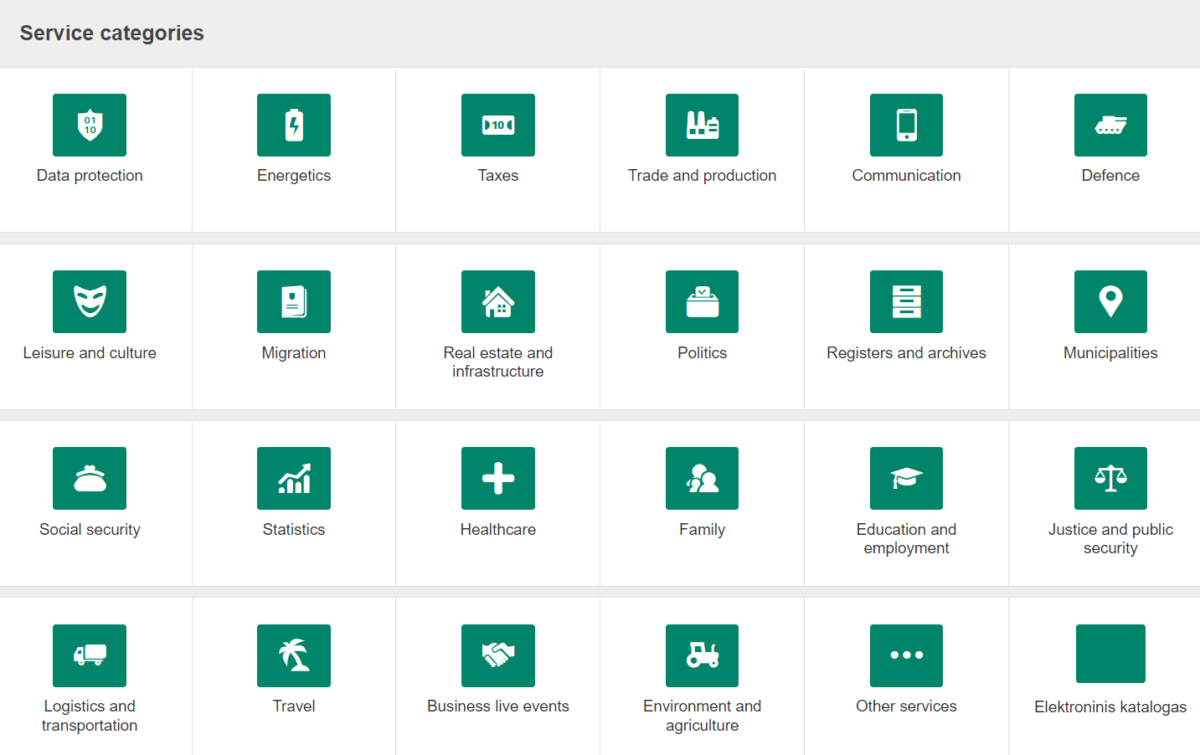

Once logged-in they’re able to access any and all Government services they may need.

This deep level of integration has helped Lithuania become the largest fintech hub in the EU in terms of licensed companies, hosting companies such as Revolut and Curve.

“The interplay of all these elements culminates in increased levels of national competitiveness and attractiveness, whilst supporting the development of other key sectors,” explained Mr Fabri.

Moving toward a cashless society

The experience of the COVID-19 pandemic and the consumer behaviour it encouraged has led industry analysts to believe that the world is moving toward a cashless society.

In addition to going cashless, Mr Fabri described another four drivers accelerating the move toward a cashless society and increased adoption of alternative payment methods:

- Engagement: as payments and mobility become more integrated, the importance of payment transactions as a potential customer interaction point will increase for merchants and financial institutions alike

- Data-driven: with greater adoption of electronic payments, more data will be accumulated from payment transactions, allowing financial institutions, service providers and merchants to gain a greater understanding of customers and businesses

- Increased access to loans – as more payments are processed through electronic rails, financial institutions’ visibility into individuals’ and businesses’ cashflow and spending patterns will increase, improving their ability to extend loans to customers previously less understood

- Reduced costs – since innovative solutions build on the existing infrastructure, which has very low variable costs, the cost of making electronic transactions will fall as electronic payments gain more volume.

“These forces, together with regulatory and technology innovations, will usher in a new era of customer empowerment.”

In addition to pull factors there are also push factors which increasingly scrutinise the use of cash as a payment solution when in 2021 the Government introduced a €10,000 limit on cash purchases as part of its anti-money laundering rules.

A national payments strategy could foster synergy between the Malta Gaming Authority, MFSA, Central Bank of Malta among other authorities with financial institutions operating in the country.

“Malta can and should be a leader in this area – our young population has shown itself to be a very fast adopter of new technology. However, I believe the task of transforming Malta into a leader in payment services will be a very challenging one as it depends on numerous factors including a well-functioning ecosystem.”

MFSA concludes review of Crypto-Asset Service Providers following MiCA implementation

The Authority provided clear expectations and guidance to address certain concerns.

Malta Development Bank to launch schemes supporting sustainable development and creative sector

In 2024, the MDB launched the SME Guarantee Scheme and the Guaranteed Co-Lending Scheme

Euro surges as Trump slaps 20% tariff on Europe, EU vows to retaliate

The sweeping reciprocal tariffs has sparked fears of an all-out global trade war