Malta’s investment industry is one of the largest within the broader financial services sector, and is growing rapidly, registering the largest percentage increase in assets under management in Europe in 2021.

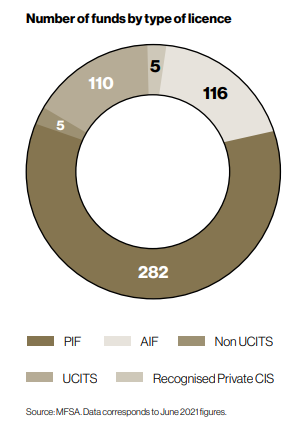

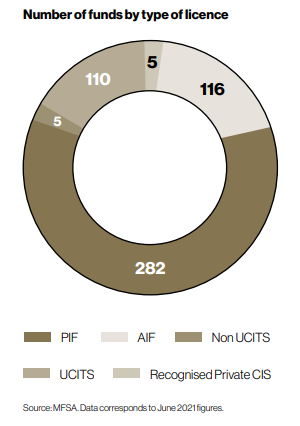

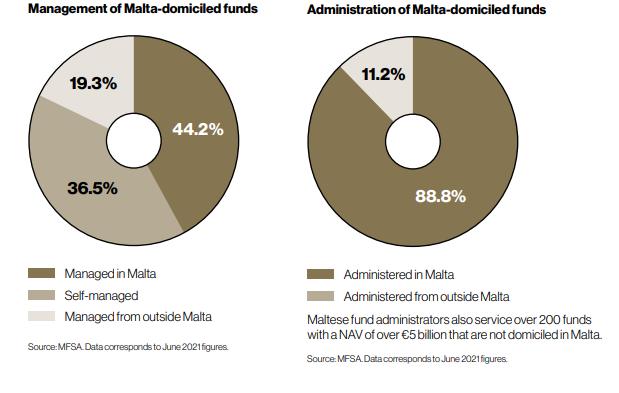

Over 500 investment funds with a total aggregate value of almost €18 billion are licensed in Malta, attracted by the country’s positioning as the home of fund managers and administrators, while providing an environment that is welcoming to smaller funds and start-ups.

A key pillar of this attractiveness is the ability to benefit from a wide range of innovative and flexible investment vehicles and services at relatively low cost while remaining fully onshore within a regulated and constantly evolving EU jurisdiction.

The country’s success in establishing itself as a preferred jurisdiction for investment funds is due to a number of factors, including:

- Easy access to European markets.

- A dynamic and approachable regulator with a high standard of compliance, yet open to innovation.

- A time-sensitive approach to the processing of licence applications.

- Highly efficient re-domiciliation procedures for funds from other financial centres.

- Service provider flexibility, with local fund administrators not generally required.

- Possibility of adopting a self-managed structure.

- Protected cell company legislation allowing for the creation of ring-fenced holdings within a legal entity.

Malta’s comprehensive framework provides fund promoters with a wide choice of potential set-ups catering for a broad range of investment strategies to suit the needs of every type of investor. The nature, structure, and operation of each fund will depend on the purpose and objectives of that specific fund, including the classification of the investor, the type and duration of investment, and the level of risk incurred.

Before diving into the vast array of options available to anyone wishing to establish a collective investment scheme in Malta, it is important to note that the local industry is not limited to the establishment of collective schemes, but extends also to the outsourcing of fund administration, compliance, regulatory reporting, and entire back and middle office services.

Thanks to the wealth of international expertise developed over the last decades, Malta’s asset management and servicing providers are known for their sophistication and commitment, presenting a cost-competitive solution for fund administration.

Taxation of Funds

Thoughtfully constructed collective investment schemes registered in Malta offer significant opportunities for tax optimisation. Provisions in the legislation allow for a multiplicity of options depending on the legal structure used, the sources of income, and the domicile of the scheme, its underlying assets, and its shareholders.

For tax purposes, funds or sub-funds of a locally licensed collective investment scheme are classed as prescribed or non-prescribed funds. The former must be incorporated in Malta and make a written declaration to the Commissioner of Inland Revenue that at least 85 per cent of the value of their underlying assets are or will be held in Malta.

All other set-ups, from Maltese funds having over 15 per cent of their assets situated outside the country to funds registered in an overseas scheme, are non-prescribed.

Whereas non-prescribed funds are exempt from all tax except for income generated by immovable property in Malta, prescribed funds are subject to and can benefit from the advantages afforded by Malta’s tax code.

Prescribed funds are subject to tax at source, or withholding tax, on local bank interest (15 per cent) and investment income arising from certain Maltese securities, such as bonds issued by the Maltese government or local companies (10 per cent), and on local real estate income, but all other income, including income from foreign sources and dividends or capital gains derived from other investment vehicles, is tax exempt.

Malta does not levy tax on any scheme’s net asset value, nor is there stamp duty or VAT on share and unit issues or transfers by licensed funds or their investors. Fund management and administration services are also exempt from VAT.

The attraction Malta holds as an investment fund jurisdiction is further apparent when considering taxation at the level of fund investors. Non-residents are exempt from tax on dividends and capital gains from the transfer of units in any fund, while residents are subject to a 15 per cent withholding tax on dividends from any fund’s foreign sourced income, and when fund profits are not taxed at fund level, these are taxed at the same rate.

When profits are taxed at fund level (at the standard 35 per cent corporate income tax), however, the full imputation system and the tax refund system come into play, allowing for an effective tax rate of 5 per cent, which can be further reduced by applying a Notional Interest Deduction.

Taken in combination with the country’s extensive list of double taxation agreements and its unilateral tax relief system, Malta emerges as a uniquely enticing domicile for funds of all kinds.

This feature was first carried in the Malta Invest 2023 edition. Malta Invest is the first-ever comprehensive international investment guide focusing on Malta as a destination. It is produced by Content House Group.

Featured Image:

User32212 / Pixabay

Government introduces mandatory physical inspection for vintage vehicle classification

From 1st September 2025, vehicles seeking vintage status must undergo a physical inspection by the official classification committee

Local filmmakers paid just €250 to screen at Mediterrane Film

The figure stands in stark contrast to the estimated €5 million total spend

Malta International Airport closes in on one million passengers in June

Meanwhile, aircraft traffic movement rose by 4.5 per cent year on year