The Energy Efficiency and Renewable Energy (EERE) Malta Fund has been fully taken up due to “significant demand from the market”, with both the local banks offering credit facilities backed by the fund being forced to take attractive loan products off the shelf, such as loans for the purchase of electric and hybrid cars payable over 10 years at zero per cent interest.

Financed through a €15 million allocation the European Investment Fund, the EERE allowed Bank of Valletta and APS Bank to offer zero per cent interest loans to households and businesses undertaking green investments.

BOV offered three products – the BOV Business Energy Loan, BOV Home Energy Loan and BOV Personal Energy Loan – while APS offered the APS Green Finance Loan.

The total loan portfolio is estimated to have been about €60 million.

Initially intended to support families and businesses invest in PV panels, insulation, and cooling, the purchase of electric vehicles was added as an eligible expense in February 2023, immediately becoming one of the most popular uses of the zero-interest loan.

Speaking to BusinessNow.mt, a BOV representative that “in view of the significant demand from the market the EERE Malta fund was fully taken up in November, requiring the bank to close the three participating products to new applications.”

He added that the bank is in discussions to attract additional EU funds.

An APS representative said much the same, with the EIF notifying the bank in early November that the funding allocated to the instrument had been fully utilised, leading it to move the products off sale and no longer accept any new appointments.

“We continued to service those applications already underway, as well as those customers who already had appointments for the product booked across our network of branches and commercial teams,” said the APS representative.

She added that while the product is no longer available for new applications, the underlying funding continues to be available for customers, who had such facility sanctioned, to utilise until 31st December 2023.

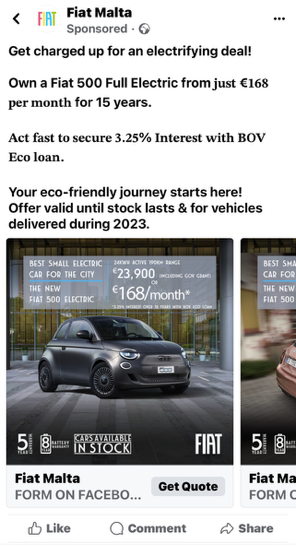

Today, BOV personal loans targeted at green investments, called the BOV ECO Personal Loan, provides for a variable interest rate of 3.25 per cent up to a maximum of 15 years, and covers the purchase of electric and hybrid cars, among other environmentally friendly products.

Meanwhile, APS is offering similar conditions through its APS Eco Loans with a variable interest of 3.25 per cent for unsecured loans.

BNF Bank and Mastercard partner to bring added value to Maltese customers

Collaboration enhances everyday banking through exclusive experiences, rewards, and innovative payment solutions

ĠEMMA launches new podcast series to make financial literacy accessible for all

New episodes will be released every two weeks and will be available across multiple platforms

Malta introduces new 15% tax regime for highly skilled professionals

Qualifying individuals are taxed at a flat 15% rate for an initial five-year period