More than 70 per cent of foreign companies present in Malta have indicated that Malta may benefit from hitting the brakes on its high rate of economic growth.

Respondents to audit and advisory firm EY’s annual report on Malta’s attractiveness for foreign investment noted that “slowing growth” should be a priority for Malta’s long-term success.

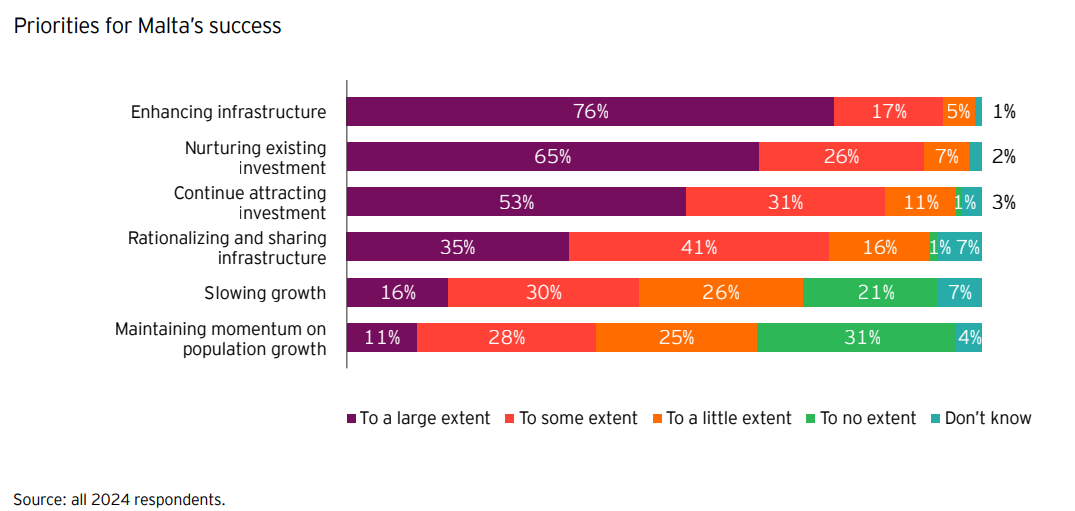

Almost one in six (16 per cent) of the 134 foreign direct investment (FDI) company investors participating in the survey, conducted in July and August 2024, said that Malta’s success can be improved “to a large extent” by slowing growth.

Another 30 per cent said slowing growth should be “to some extent” a priority, while another 26 per cent indicated “to a little extent”.

The three categories indicating that slowing Malta’s economic growth, combined, show that 72 per cent of FDI investors believe the country will benefit from a reduced focus on achieving the high growth figures seen over the last decade.

The figure stands out among the other priorities mentioned, which were broadly in line with conventional economic thinking.

These included enhancing infrastructure (selected as a priority to a great, some, or a small extent by 99 per cent of respondents), nurturing existing investment (98 per cent), continuing to attract investment (95 per cent), rationalising and sharing infrastructure (92 per cent), and maintaining momentum on population growth (64 per cent).

While slowing growth is by no means the top avenue chosen as a priority for Malta’s continued economic success, the high percentage of respondents who feel it should be seriously considered may make the country’s authorities pause for thought.

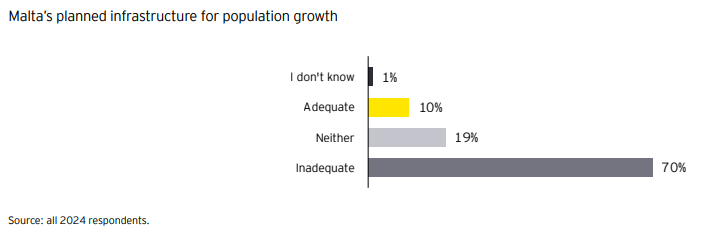

No fewer than 70 per cent of respondents felt that Malta’s infrastructural plans did not adequately prepare for the increase in its population, which increased by some 25 per cent over the last decade.

EY noted that this imbalance “is viewed as a deterrent, with investors calling for immediate action to build and improve infrastructure, particularly in transport and logistics.”

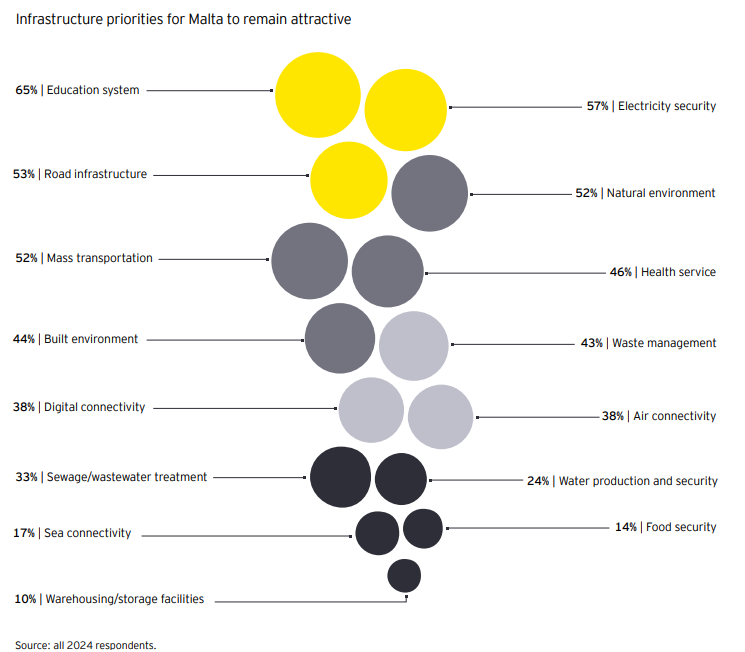

In terms of infrastructure, Malta’s education system was singled out as a key factor affecting Malta’s attractiveness. This was followed by the electrical distribution system, which has suffered from major blowouts over the last summers.

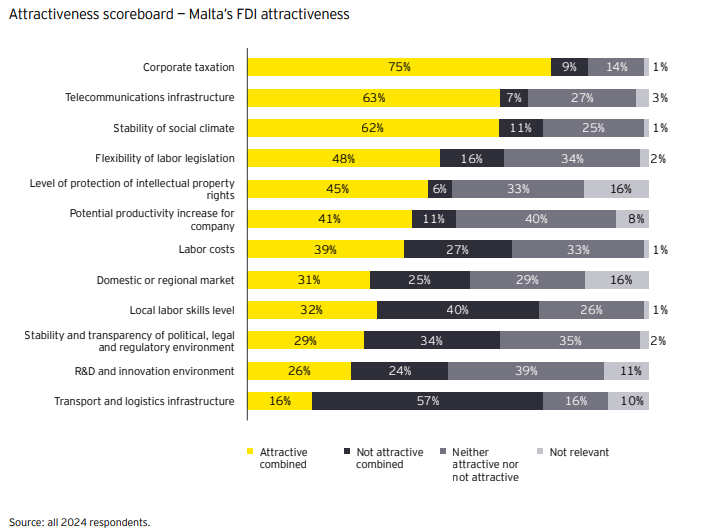

Overall, Malta’s attractive corporate tax regime for companies with a foreign shareholding, its telecommunications infrastrucutre, and the stability of the social climate were the top three factors that make Malta attractive for FDI, said respondents.

When looking at the results over the last decade, some of the country’s historical strengths have waned, noted the report.

“Only 29 per cent of respondents now consider Malta’s political, legal and regulatory environment as attractive, compared with the high of 85 per cent in 2015. Similarly, labour costs and skills availability, once strong selling points, are now seen as growing challenges. Only 32 per cent of respondents view Malta’s labour skills as attractive for FDI in 2024, and this has seen a significant drop over the years.”

Meanwhile, although corporate taxation and telecommunications infrastructure remain stable pillars of attractiveness, the social climate, previously seen as a strong factor, is now viewed less favourably by investors. Although in third place overall, stability of the social environment is attractive for 62 per cent of respondents. This is lower than its previous attractiveness levels, which were as high as 90 per cent in 2015.

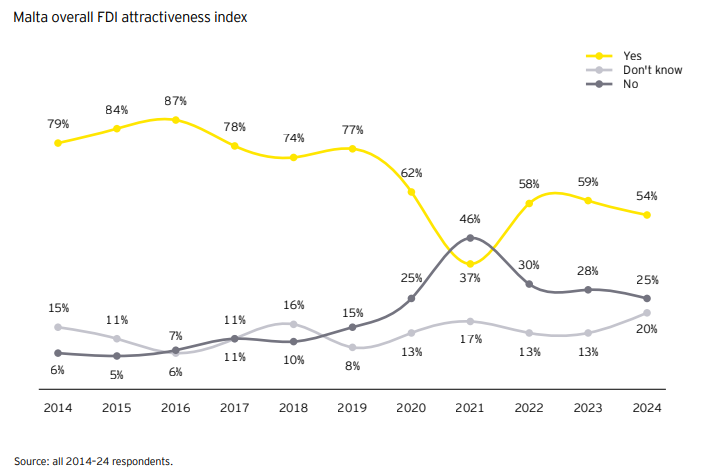

All told, the report will do little to allay concerns about Malta’s economic direction, which has seen its attractiveness plummet over the years. Although the current overall FDI attractiveness index is far above the low registered in 2021, it nonetheless represents the second-worst ranking in the 11 years since 2014.

The upcoming Government Budget for 2025, set to be announced on Monday 28th October, will have a lot to account for.

Passenger traffic between Malta and Gozo grew by nearly 8% in Q2 2025

Vehicle crossings and fast ferry usage also surged

New Malta-backed incubator to fuel Europe’s semiconductor startups

The ChipStart EU program provides a one-year, no-cost incubation opportunity for semiconductor startups in the European Economic Area

Government renews scholarship scheme for tech postgrads

In 2024 the Pathfinder Digital Scholarship issued €125,000 in funding, supporting 13 Master’s and 3 PhD students