Malta’s largest bank, Bank of Valletta, has confirmed that 85 per cent of moratoria granted on loan repayments since the start of the pandemic in an effort to assist local businesses with cash flow, have expired.

This means that most businesses who applied for a moratorium with the bank are now back on track with their committed repayments.

Speaking during the Quarterly Malta Hotels and Restaurants Association Reports Episode, BOV Chief Business Banking Officer Albert Frendo also confirmed that the remaining 15 per cent of moratoria are those related to businesses operating in tourism and hospitality.

Indeed, this tallies with the experience being felt on the ground by many in tourism and hospitality, struggling with much lower numbers than usual for the summer months. Malta’s decision to limit unvaccinated travel by forcing all those without the COVID jab to quarantine at a designated hotel for two weeks on arrival in Malta hampered expectations that tourism would provide a major boost to the local economy.

In a statement by Malta International Airport on the outlook for 2021, it singled out this travel restriction as having a negative impact on recovery and said that the result is Malta will continue to lag behind Southern European counterparts.

While the economy is nowhere near its 2019 levels, other sectors less dependent on tourism have slowly begun to see more activity and stability. For tourism, however, which continues to be dogged by global travel restrictions and uncertainty, Mr Frendo called for the Government to establish clear short-term and long-term strategies for the industry.

National bank moratorium figures

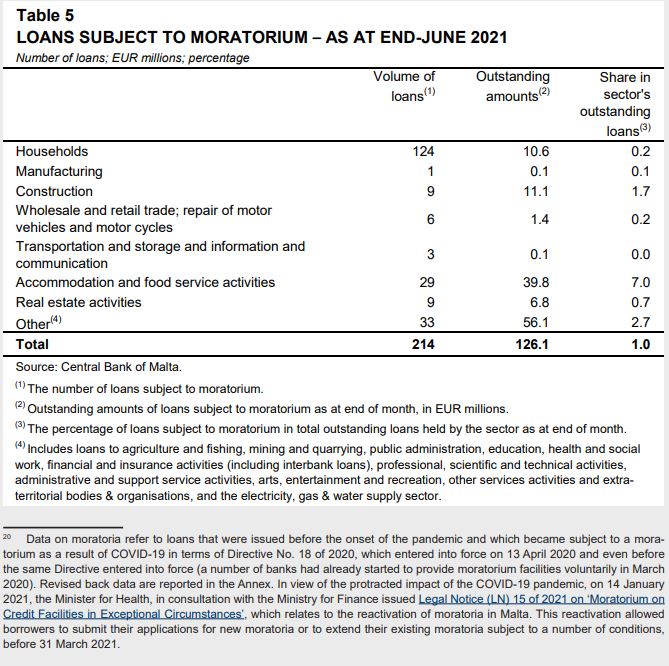

In the Central Bank’s August economic update, it provided figures for bank loan moratoria across the country, which largely reflects the experience shared by BOV’s Albert Frendo.

In June 2021, loans subject to a moratorium continued to decline sharply, as the moratoria period is gradually expiring for many loans, and economic activity is beginning to normalise in most sectors

Indeed, by the end of the month, only 214 loans were subject to a moratorium on repayments compared to 340 loans a month earlier. The value of such loans declined by €29.8 million and stood at €126.1 million, or one per cent of total outstanding loans to Maltese residents. Loans subject to a moratorium have fallen consistently since August 2020.

During June, declines in both value and volume terms were observed across all sectors. However, the largest decreases in value terms were registered in the real estate, wholesale and retail, and the accommodation and food services sectors as well as among households.

The outstanding value of loans subject to a moratorium of Maltese households fell to €10.6 million – equivalent to 8.4 per cent of the total value of loans subject to a moratorium and 0.2 per cent of outstanding household loans. This is down from a peak of €635 million in July 2020.

Meanwhile, the accommodation and food services activities sector held €39.8 million in loans subject to a moratorium. This is the sector most affected by the containment measures and, indeed, seven per cent of the loans held by this sector were subject to a moratorium by the end of June. This contrasts with the end of 2020, when over 40 per cent of outstanding loans of this sector were subject to a moratorium.

The real estate sector held €6.8 million in loans subject to a moratorium, equivalent to 0.7 per cent of the sector’s outstanding loans. Moreover, as at end-June, the construction sector held €11.1 million in loans subject to a moratorium, or 1.7 per cent of loans held by the sector.

These three sectors jointly accounted for almost 46 per cent of all loans covered by moratoria.

The ‘other category’ sector which contains loans subject to a moratorium in agriculture and fishing, education, health, and financial and insurance activities among others, held €56.1 million in loans subject to a moratorium – 44.5 per cent of loans subject to a moratorium – but only 2.7 per cent of the outstanding loans held by the sectors falling under this category.

Malta Development Bank COVID-19 Guarantee Scheme

To further alleviate liquidity challenges, the Government launched the Malta Development Bank (MDB) COVID-19 Guarantee Scheme (CGS) for the purpose of guaranteeing new loans granted by commercial banks for working capital purposes to businesses facing liquidity shortfalls as a result of the pandemic. The scheme enables credit institutions to leverage government guarantees up to a total portfolio volume of €777.8 million.

In terms of the number of facilities, the sector comprising wholesale and retail activities applied for the largest number of facilities and had €95.2 million in sanctioned loans. This was followed by accommodation and food services activities, with 142 facilities or €107.4 million in sanctioned loans.

In value terms, these were followed by the sector comprising transportation, storage, information and communication, and by the construction sector, with €50.3 million and €41.4 million, respectively.

Retail and wholesale investors submit €542.7m in bids for November MGS issuance

Combined retail and wholesale subscriptions reached €542.74 million against an issuance target of €350 million

Remembering George Fenech and his lasting legacy on Tumas Group and Malta

From pioneering hotel ventures to the landmark Portomaso project

Young innovators tackle car-free Malta concept at Startup Festival

Students set out to design forward-looking mobility systems in line with the country’s Vision 2050 goals