The cryptocurrency exchange Bittrex Inc and its affiliated companies, which included two Malta-registered entities, filed for bankruptcy on 8th May (yesterday) following regulatory crackdown by the US Securities and Exchange Commission (SEC).

The company said that while its US operations shut down at the end of April, its global operations are not impacted.

The bankruptcy occurred three weeks after the SEC sued the company for allegedly violating federal laws by operating an unregistered exchange, broker and clearing agency, according to reports by Bloomberg.

In the bankruptcy petition filed in the U.S Bankruptcy Court for the District of Delaware, it was revealed that the company had up to $1 billion In liabilities.

The US Department of Treasury’s Office of Foreign Assets Control (OFAC) was listed as the largest creditor due to the company owing $24 million from an earlier settlement for failing to prevent customers in Iran, Cuba, and other sanctioned nations from using its platform.

Bittrex’s flirtation with Malta

In 2018, Bittrex launched an international trading platform in Malta which excluded US customers. It was set up to operate within the regulatory framework set by Malta’s Virtual Financial Assets Act (VFA) and was even planning to get licenced by the Malta Financial Services Authority (MFSA) in order to become a regulated exchange.

Bittrex Malta was Bittrex’s first exercise in expanding overseas in 2018. In 2019, it was decided to close down Bittrex Malta and establish an entirely separate entity, which is Bittrex Global. Most customers transferred from Bittrex Malta to Bittrex Global, but a few did not.

— Bittrex Global (@BittrexGlobal) May 9, 2023

However, the company decided to leave Malta in 2019 a few weeks after the MFSA announced plans to monitor crypto exchanges in order to crack down on money laundering.

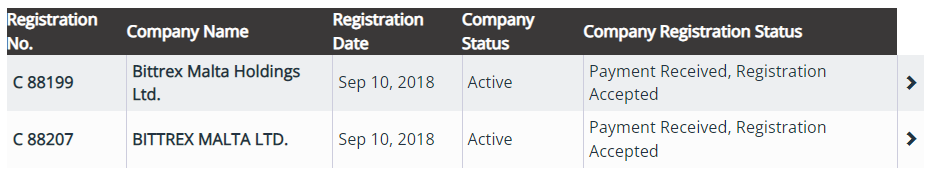

While it moved its operations to Lichtenstein, the company kept it’s Malta-registered companies (Bittrex Malta ltd and Bittrex Malta Holdings ltd) active.

In a statement, the company said, “For those customers who did not withdraw their funds from the platform prior to the end of April, your funds remain safe and secure, and our main priority is to ensure that our customers are made whole. While the Bankruptcy Court will ultimately decide the method by which those funds can be claimed by and distributed to our customers, we intend to ask the court to activate those accounts as soon as possible so that customers meeting the necessary regulatory requirements will be able to withdraw them.”

ĠEMMA launches new podcast series to make financial literacy accessible for all

New episodes will be released every two weeks and will be available across multiple platforms

Malta introduces new 15% tax regime for highly skilled professionals

Qualifying individuals are taxed at a flat 15% rate for an initial five-year period

Malta’s inflation edges up to 2.7% in October as food and services lead price pressures

The October RPI reading indicates some re-acceleration in consumer-facing sectors after a period of summer stabilisation