Following the surge in profitability reported by HSBC Bank Malta plc towards the end of February, it should not have come as a surprise that Bank of Valletta plc also reported a significant hike in profitability last week. The 2023 annual financial statements of BOV show that the BOV Group generated a record level of profits during the year amounting to €251.6 million pre-tax. This is €100 million above the adjusted pre-tax profit figures for 2022 when excluding the effect of the Deiulemar settlement.

In essence, the BOV Group have reported record levels of profits for two consecutive years when one excludes the major litigation settled in 2022. Prior to this, BOV had generated €175 million in pre-tax profits in 2017 but that was for a 15-month period when the bank had changed its financial year from September to December. Meanwhile, in order to place the extent of the level of profits generated by BOV during 2023 in the context of the performance in prior years, it is also worth highlighting that in the past, BOV generated pre-tax profits in excess of €100 million on only six other occasions. Moreover, in each of these 6 years, BOV’s profits never exceeded €150 million. As such, the profits of €251.6 million are well-and-truly reflective of a bumper year largely brought about by the increase in interest rates by the European Central Bank between the second half of 2022 and the third quarter of 2023 as the deposit facility increased from minus 0.5 per cent to 4 per cent.

In fact, the main driver of the surge in profitability is the ‘net interest income’ — the difference between the interest that banks receive from loans, investments and cash at the central bank and the interest that they pay on deposits and other liabilities. BOV’s net interest income jumped to €352.0 million in 2023 from €201.9 million in 2022. An important key financial indicator across the banking sector is the net interest margin (NIM), which is the difference between the rate charged on loans and that paid on deposits, expressed as a percentage of interest-earning assets. BOV’s NIM climbed to 2.8 per cent in Q4 2023 from 1.84 per cent in Q4 2022 reflecting the beneficial impact of the rising interest rate environment.

The largest portion of BOV’s interest income is generated from the loan book at over €200 million followed by the income generated from balances with the central bank and other short-term financial instruments like Treasury Bills which amounted to €85 million in 2023 and the interest income of almost €78 million from the bank’s investment portfolio.

The timing and pace of expected interest rate cuts by the ECB in the months and years ahead will naturally negatively affect the performance of the large majority of eurozone banks including that of BOV once these take place. However, with interest rates potentially unchanged at the four per cent level for most of the first half of 2024, the performance of BOV this year should not be negatively impacted from the interest income aspect.

In order to partially reduce the bank’s dependency on changes to the ECB interest rate to the overall interest income of the bank, BOV is consciously shifting some of its idle liquidity into its investment portfolio composed of bonds. In fact, one of the key highlights within the 2023 annual financial statements is the additional investments of €785 million within the Treasury portfolio with €200 million of these during the last quarter of the year. The investment portfolio has now grown to €5.3 billion compared to the liquidity held at the central bank of €2.35 billion. The shift in these two line items over these past two financial years is rather remarkable as the investment portfolio has increased from €3.6 billion at the end of 2021 to €5.3 billion while the liquidity held at the central bank dropped from €4.6 billion at the end of 2021 to €2.35 billion.

The largest income-generating asset remains the loan book which increased by €1 billion over the past two years to €6 billion.

In fact, it is very positive to note that the loan to deposit ratio has now improved to above the 50 per cent level once again – the highest level since 2014.

Over the last five financial years, BOV hardly distributed any dividends to shareholders. In financial year 2017 and in prior years, regular semi-annual dividends were distributed with the dividend payout ratio ranging between 27.8 per cent in 2017 (a 15-month financial period) and 46.6 per cent in 2013. In more recent years, BOV’s Chairman Dr Gordon Cordina regularly emphasised that the aim of the bank is to distribute sustainable dividends to shareholders. Following the interim dividend paid in December 2023, a final net dividend of €0.0455 per share is being recommended subject to regulatory approval as well as approval by shareholders at the upcoming Annual General Meeting. The total dividend for FY2023 would equate to a dividend payout ratio of 26 per cent of the profits after tax generated by the bank and a net dividend yield of above 5 per cent based on the current share price.

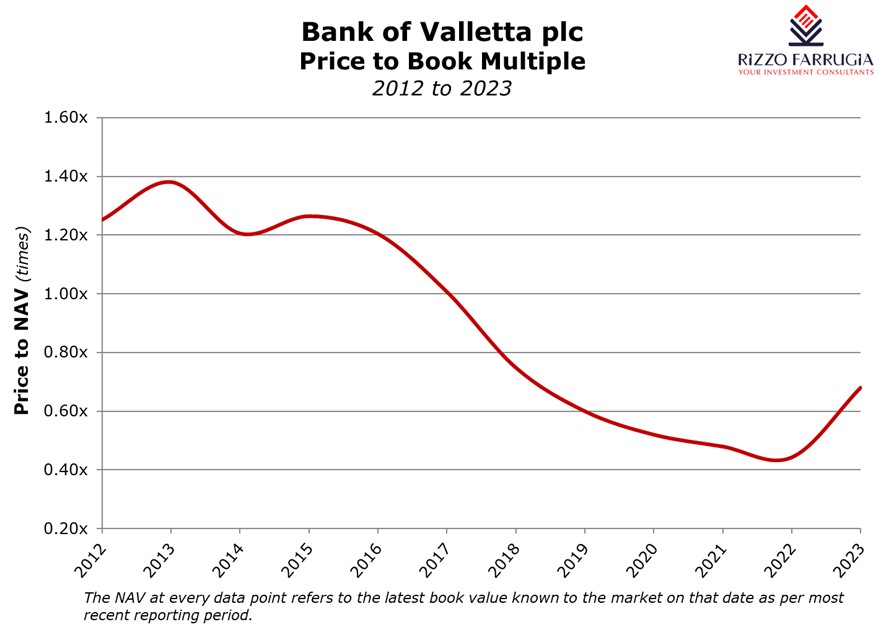

Apart from the weak profitability from 2018 onwards as the return on equity dropped below the 10 per cent level, the lack of dividends has been the other main reason for the subdued share price performance despite the sharp upturn seen in 2023. However, despite the 75 per cent increase in the share price in 2023, this is still well-below the net asset value per share of €2.17 as at December 2023 at a time of surging profits as reflected by the return on equity jumping to 14 per cent in 2023. The price to net asset value or book value is one of the principle pricing multiples used across the international banking sector. BOV’s share price has been trading below its book value ever since 2017 and it is currently at a 34 per cent discount to its historic NAV.

This phenomenon has also been evident in recent years across the eurozone banking sector. In fact, in a very recent article published in the Financial Times, it was reported that European banks have promised to distribute significant returns to shareholders (via cash dividends and also share buybacks) in order to address the valuation gap between European banks and their US peers.

Despite BOV’s ambitions to continue to grow in size and the capital requirements required to do so, the bank ought to replicate the strategies of several other eurozone banks also by embarking on a share buy-back programme given the continued deep discount of the share price compared to the book value. Unfortunately, institutional shareholders and other large investors in Malta do not play an activist role which could instigate companies to bow to shareholder pressure when there are clear indications that this will be beneficial to all shareholders especially in the light of the current circumstances across the capital market.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

Hospitality sector review

With updated FAS now available, investors are turning to credit metrics to assess the financial resilience of Malta’s bond issuers

Mobilising savings into investments

Malta’s equity market needs to grow in size and depth if it is to embrace the EU’s Savings and Investments ...

Reduction in free float

Lowering Malta’s minimum free float requirement to 10% could unlock new opportunities for the local capital market