Bank of Valletta has informed its business banking clients that the administration fee it charges is set to triple as from next February, rising from €10 to €30 a month. This has led to uproar among small businesses, with Chamber of SMEs CEO Abigail Agius Mamo sardonically describing it as “BOV’s way of saying Merry Christmas”.

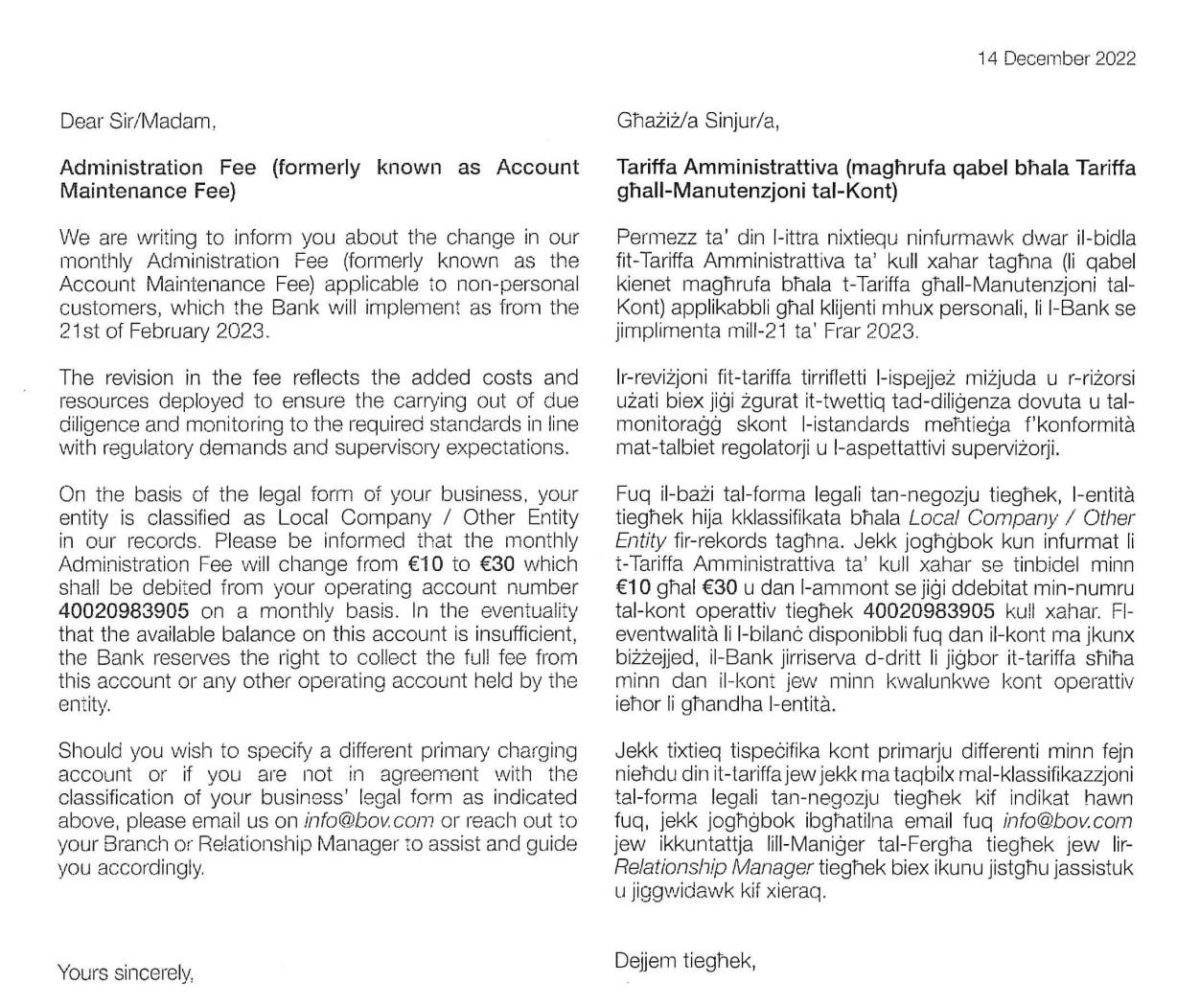

In a letter sent out this week, Malta’s largest bank informed clients that the administration fee – previously known as the account maintenance fee – will be increasing due to added costs related to regulatory checks and balances.

With this increase, businesses will now need to pay €360 a year to maintain their banking relationship with BOV.

Meanwhile, accounts used for international trading will see their administration fee jump from €25 to €60 per month.

While large businesses should easily absorb this, small and micro enterprises are seeing this as deeply unwelcome news, especially coming days before Christmas in a year characterised by sky-high price hikes and economic uncertainty.

Taking to Facebook, the Chamber of SMEs said: “2022 shall surely be marked as the year of BOV fees imposed by the dominant player in the market,” and called on regulators to intervene.

“Just a week before Christmas we are flooded with calls, emails and messages from SMEs who are angered and feel abused by BOV’s recent announcement of yet another fee increase.”

The organisation had previously protested the introduction of the original €10 fee too. It had also spoken out against HSBC for doing the same in 2019.

The SME Chamber has long been vociferous in its calls for banking reforms that make it easier and cheaper for small businesses, and has criticised BOV and HSBC for “abusing” their dominant market position to take unilateral actions that harm the wider business community.

BOV meanwhile stated that it levies the fee on all non-personal accounts other than those for voluntary organisations.

BOV is Malta’s largest bank and provides services to 365,000 clients. Of those, 20,000 are business clients.

In its letter dated 14th December, BOV stated that the revision in the fee “reflects the added costs and resources deployed to ensure the carrying out of due diligence and monitoring to the required standards in line with regulatory requirements and supervisory expectations.”

HSBC had provided a similar justification when it increased its fees in 2019.

BOV says charges essential to support the fight against financial crime

Responding to media coverage of the news, Bank of Valletta issued a statement clarifying its position about the revised administration fee for business customers.

It said: “The Bank has informed its business customers that the monthly administration fee had to be increased to reflect the additional costs being incurred to carry out its Anti-Financial Crime (AFC) obligations. AFC regulations and expected processes and controls have become more rigorous and onerous in recent years. Such requirements are reflected in the country’s legal framework, where a main priority at a national level is that of combatting financial crime, money laundering and related unlawful activities.

“The Bank’s AFC practices as reflected in the Bank’s Compliance and Regulatory framework, had to be markedly enhanced over the last few years to keep it in line with the evolving regulatory demands and supervisory expectations. This essentially entails substantial and continuous investment both from a human resources and technological perspective.

“Such investment is deemed to be of critical importance not only for the Bank, but also for the financial stability of the country and for the customers in general, in a way that it fosters the right environment for investment and future growth.

“The introduction of this fee, which will be applicable as from February 2023, follows lengthy discussions with the Malta Financial Services Authority and carries their no objection. This fee, which will cost each company no more than €360 per annum is in line with similar fee structures applied by other banks in Malta and is proportionate to the services being received by our business clients.

“The charges applied by Bank of Valletta are moderate when compared to other banks locally and internationally and deemed to be essential to enable investments to sustain the delivery of our services.

“Whilst AFC regulations are applicable to all types of customers having an active account with the Bank, the fee has only been applied to non-personal customers where the level of KYC and Due Diligence reviews and ongoing assessment requirements are more demanding. It is important to point out that personal customers and sole-traders have been excluded from the application of this fee.

“On a final note, the Bank strives to seek a balance between its endeavour to serve the business community to the best possible levels whilst at the same times ensures that it observes regulation and combats financial crime in a proactive manner. The Bank does appreciate that incremental costs for the business entities do create their own challenges. The Bank is however similarly cognisant that investing in a robust a wide and encompassing AFC framework does further assist in the achievement of a sustainable and forward-looking economic environment earmarked to support the generation of further investment and economic growth.”

ICT sector makes up 10.3% of Malta’s economy, most in EU

Malta was also in the top spots for value added from ICT services and ICT manufacturing

Building and Construction Authority CEO resigns days after fatal construction incident

Jesmond Muscat quits after less than two years in the role

Government launches portal for temping agencies to apply for a licence, following regulations

New regulations, aimed at regulating the sector and diminishing abuse, came into force on 1st April