According to the CBM Business Dialogue, just launched by the Central Bank of Malta (CBM), positivity is building amongst Malta’s companies, with half as many respondents (16 per cent) reporting an uncertain outlook in Q1 2021 as did in Q4 2020.

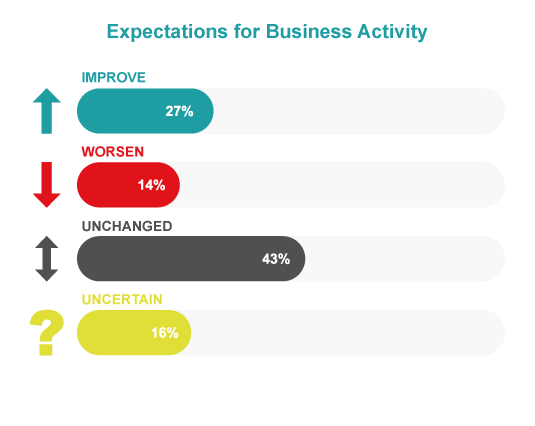

During the survey period, the CBM reveals that 27 per cent of the firms it spoke to expected their business activity to improve shortly, and 43 per cent predicted it would remain the same.

On the other hand, 14 per cent of businesses surveyed predicted some sort of worsening.

In a further optimistic indication, a third of business contacted in the first quarter reported having noticed positive developments – an increase of six per cent on the quarter before – though the other two-thirds assessed business conditions as “weak and well below pre-COVID-19 levels”.

The report found that the vast majority (over 75 per cent) of businesses have seen both input and selling prices remain unchanged in the previous few months.

Around 20 per cent found input costs to have increased, and in response, 17 per cent said they raised their selling prices.

The majority of firms contacted reported that their investment plans remain on track. Indeed, the bank finds, investment plans for 69 per cent of firms contacted have continued as schedules.

13 per cent reported the postponement of their investment plans, and the number of respondents reporting cancellation of investments was small.

The employment situation remained broadly stable among the pool of firms interviewed in the first quarter of 2021, with 81 per cent reporting unchanged employment plans.

According to the ECB survey, most firms continue to benefit from the Government’s Wage Supplement Scheme, which was widely seen as essential for maintaining current staff levels.

The rest were almost evenly divided between those revising up their employment plans and those that had revised them down. In some cases, this reflected voluntary redundancies – as staff moved to sectors perceived to be more resilient and these were not replaced.

The aforementioned findings, part of the CBM Business Dialogue, were compiled by the bank from meetings conducted by the Bank’s economists with top-level representatives of corporations and institutions.

Addressing the release of the new publication, the bank’s Governor Edward Scicluna commented: “This exercise aims to supplement official statistics – which are often published with a lag – with more timely and enhanced insights into the main issues faced by firms.”

“Over the last five years the Bank has maintained regular contact with major non‑financial corporations, authorities, and other institutions in Malta. It did this to obtain useful real-time insights on economic performance, expectations for business activity, employment, and prices. But the information was kept for the Bank’s own use.

“Now we intend to pass on this information – in aggregate form – to the public,” he concluded.

The full document can be found via the bank’s website.

Malta flights to Bergamo suspended following fatal incident

An incident resulted in the cancellation of several other flights, with some flights being redirected to nearby airport

Malta’s business economy grows by 15.6% in 2023

While large enterprises continue to play a leading role, SMEs and micro-businesses remain vital pillars of the economy

MFSA and Central Bank warn of loan and email scams

Both institutions urged the public to report suspicious activity and avoid sharing personal data with unverified sources