Malta’s thirst for physical cash has seen the country repeatedly exceed the amount allocated to it by the European Central Bank (ECB), reveals the Central Bank of Malta (CBM), largely because the formula determining the allocation uses outdated GDP and population figures.

In a recent policy note, CBM staffers Brian Micallef and Tiziana Gauci, a manager and senior economist, respectively, explain that the trend has exacerbated since the outbreak of the COVID-19 pandemic.

The issue is not confined to Malta, with high demand for banknotes also experienced in the euro area in recent years, despite a decrease in the use of cash for retail transactions.

This, the policy note explains, is referred to as the “paradox of banknotes”, and occurs because currency is not only used for daily transactions but also as a store of value, while it is also influenced by demand from citizens outside the euro area.

Cash hoarding could also have increased as the cost of holding cash became very low in an environment until recently characterised by low inflation and low interest rates.

The authors cite a 2021 study suggesting that only around 20 per cent of the value of euro banknotes in circulation are held for transaction purposes. Between 28 per cent and 50 per cent are held as store of value inside the euro area, while 30 per cent to 50 per cent are held outside the euro area.

A CBM policy note from 2020 noted that “although modern payment instruments are highly efficient and convenient, households in Malta still prefer the traditional paper-based payment instruments”.

It posited that this may be due to a variety of reasons, including reluctance to change their habits, lack of knowledge with regards to modern payment instruments, and also suppliers of goods and services not providing payment instrument channels other than cash or cheques.

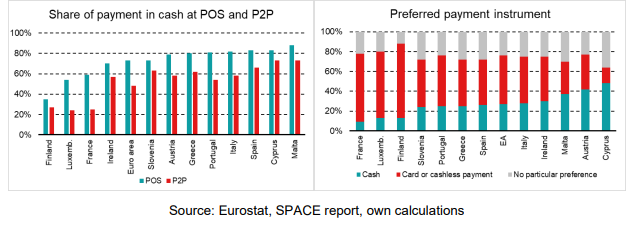

In fact, Malta has one of the higer shares of transactions occurring in cash in the eurozone, although the onset of the COVID-19 pandemic has spurred increased use of digital means of payment.

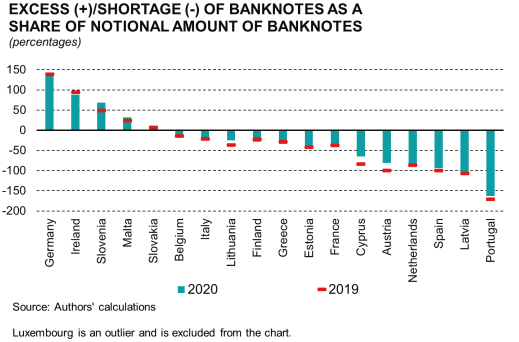

At the end of 2020, Malta was one of six euro area Member States that reported an excess demand for banknotes, while 13 experienced a shortage, with Malta’s excess banknotes amounting to 32 per cent of allocated banknotes.

This means that the CBM has a corresponding net liability within the Eurosystem, which currently has no interest expense since the interest rate on the main refinancing operations rate (MRO) is currently set at 0 per cent per annum.

This excess has been on an upward trajectory. At the end of 2017, excess banknotes amounted to €172 million, or 17 per cent of allocated banknotes, reaching €448 million at the end of 2020 and €614 million at the end of September 2021.

Malta’s is the fifth highest share of excess in the eurozone. The largest excess by far is recorded in Luxembourg, amounting to 2190 per cent higher than their allocation. In the case of Germany, excess banknotes amounted to 136 per cent of allocated banknotes, followed by Ireland (88 per cent) and Slovenia (68 per cent).

The allocation of banknotes depends on the ECB banknote key, which is calculated on the basis of each country’s relative GDP and population size. Figures for GDP refer to average GDP between 2011 and 2015 while population figures refer to 2016.

“Hence,”, the authors write, “these estimates do not reflect the sharp increase in both GDP and population growth registered in Malta since then.”

They point out that since 2016, Malta has experienced the highest population growth amongst all EU countries, with an increase of 49,000 persons, or a rise of 10.8 per cent. Over the period 2015 to 2019, Malta’s average GDP grew by 45 per cent as compared to average GDP for the years 2011 to 2015, the second highest growth after Ireland.

Using more updated figures for GDP and population would push upwards Malta’s banknote allocation, which in turn would lead to a reduction in excess banknotes.

However, structural factors also explain the relatively high demand for banknotes in Malta. These include strong economic activity and population growth that proxies the transaction demand for currency, and a strong preference of consumers towards holding cash.

Local demand for cash is also driven by relatively large underground economic activity, a large tourism industry, and remittances by migrant workers.

“Overall, cross-country evidence concerning the above structural factors is mixed since most of these factors feature both in countries that report excess demand for banknotes and those reporting shortages,” the report states.

“The only exception is the population growth factor, where the only three countries with average growth exceeding 1 per cent per annum over the period 2015-2020 all reported excess demand for banknotes.

“For economic activity, share of migrants in the working-age population and payments habits favouring the use of cash, the evidence is broadly balanced. On the other hand, the evidence for the tourism factor is relatively weak.”

Self-employed, employees and companies contribute €2.1 billion in 2023

Parliamentary data reveals five-year growth trends in fiscal contributions

MFSA concludes review of Crypto-Asset Service Providers following MiCA implementation

The Authority provided clear expectations and guidance to address certain concerns.

Malta Development Bank to launch schemes supporting sustainable development and creative sector

In 2024, the MDB launched the SME Guarantee Scheme and the Guaranteed Co-Lending Scheme