The Central Bank of Malta (CBM) on Thursday (today) shared that it has found annual growth in business activity to be slightly below its long-term average in January 2024.

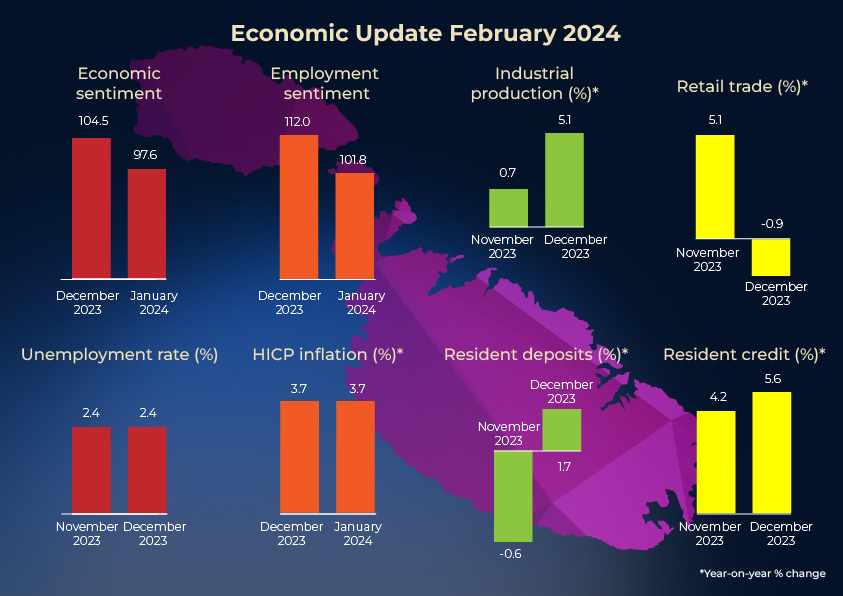

The European Commission’s economic confidence indicator fell in January, and stood lower than its long-term average.

Additionally, employee expectations also decreased when compared to a month earlier.

In the productive sectors, price expectations rose among retailers and in the construction sector, yet experienced a strong decrease in the services sector and in industry.

CBM added that developments in activity indicators were mixed, as industrial production rose at a faster pace on a year earlier, while retail trade contracted in annual terms. In December, labour market conditions remains favourable.

While residential permits were lower, commercial permits issued were higher in December when compared with the level reached a year ago. In January, the number of promise-of-sale agreements rose on a year-on-year basis, while the number of final deeds was broadly unchanged, CBM stated.

During December, Maltese residents’ deposits, forming part of the broad monetary aggregate M3, rose above their level form a year before, following four consecutive year-on-year declines. This rise was primarily driven by balances belonging to households. On the other hand, annual growth in credit to Maltese residents increased at a faster pace when compared to the prior month.

In January, the annual inflation rate based on the Harmonised Index of Consumer Prices (HICP) stood at 3.7 per cent, unchanged from a month earlier. However, CBM added that inflation according to the Retail Price Index (RPI) dropped to 3.2 per cent from 3.6 per cent in December.

The full Economic Update by CBM is available by clicking here.

Employers take umbrage at video promoting public sector’s flexible work arrangements

The video outlines a range of flexibility options available to public sector employees

Malta’s inflation eases to 2.5% in January as food prices remain main driver

While overall inflation continued to moderate at the start of the year, price pressures remain uneven across categories

Final call for food and beverage manufacturers to exhibit at SIAL Paris

SIAL Paris is one of the world’s leading international food and beverage exhibitions